THIS POST MAY CONTAIN AFFILIATE LINKS. PLEASE SEE MY DISCLOSURES. FOR MORE INFORMATION.

Are you looking for ways to build wealth but feel overwhelmed and confused by all the complex investment tactics and budgeting tips available?

Most people dream of living a financially secure, comfortable life, but building wealth in today’s economy can seem overwhelming.

However, building wealth doesn’t have to be an out-of-reach dream that only a few can obtain.

In this article, we will examine a few simple small changes in your daily habits and thinking that can put you on the path to long-term wealth and a financially secure future.

Whether you’re starting your journey towards saving money or are already well on your way, these 24 simple tips will help you take the steps needed to build the wealth you have always wanted.

We have chosen these 24 things because they will help you build your wealth in the simplest way possible.

So get ready to take control of your finances and build the wealth that will let you live the life you deserve!

1. Pay Off Debt

The first step to building wealth is to get rid of debt, especially high-interest debts.

Whether you have credit card debt, student loans, car payments, or any other type of debt, start paying them off as soon as possible.

2. Don’t Use Credit Cards

Another simple but very important thing you can do to start building wealth is to stop using credit cards.

Credit cards often have high interest rates, which can lead to overspending and more debt because they are so convenient to use.

3. Make a Plan

Whatever your goals are, it is always essential to plan to achieve them, especially when trying to build wealth.

Start by creating a budget, setting goals for savings and debt payoffs, and tracking your monthly expenses.

4. Automate Savings

Saving money is much easier if you set your savings to be automatically deducted from your paycheck or bank account.

Start by saving at least 10% of your income and gradually increase it as you gain wealth.

5. Create Passive Income

While you may have a steady income from your job, imagine how much you could save if you had an additional source of income.

Consider buying a rental property or something that interests you to generate passive income.

6. Spend Mindfully

If you want to build wealth, it is important to spend your money wisely.

This means being mindful of where you spend your money and not making impulsive purchases.

7. Invest in Index Funds

Investing in a wide range of companies rather than just one individual stock is a safer and more stable way to grow your money.

You can do this by investing in index funds, which track the performance of a group of stocks.

8. Keep the Change

A simple yet effective way to save money is by keeping the change.

Instead of using a debit card, make purchases with cash, save the change, and add it to your savings at the end of the month.

You will be surprised at how quickly it adds up.

9. Find a Side Hustle

If you have some extra time, consider starting a side hustle to earn extra cash that you can invest or contribute to your savings.

Choose a side hustle that you have skills for, such as freelancing, pet-sitting, or making and selling items online.

10. Take a Risk

While having a diverse and stable investment portfolio is important, occasionally taking some risks can lead to higher returns.

So take the time to research and consider investing in a promising new company or industry.

Just make sure only to invest what you can afford to lose.

11. Stop Overspending

If you want to build wealth, it makes sense that you need to stop spending unnecessarily.

Look for areas where you are wasting money, such as streaming services or eating out too often, and cut back on those expenses.

12. Start a Business

Sometimes, you need to spend money to make money, and starting your own business can be a great investment.

Even if you have to start small, with hard work and dedication, your business can grow and become a significant source of income.

13. Educate Yourself About Investing

If you really want to make the most of your investments, you need to know what you are doing.

So take the time to educate yourself about investing, whether it’s through books, online courses, or talking to a financial advisor.

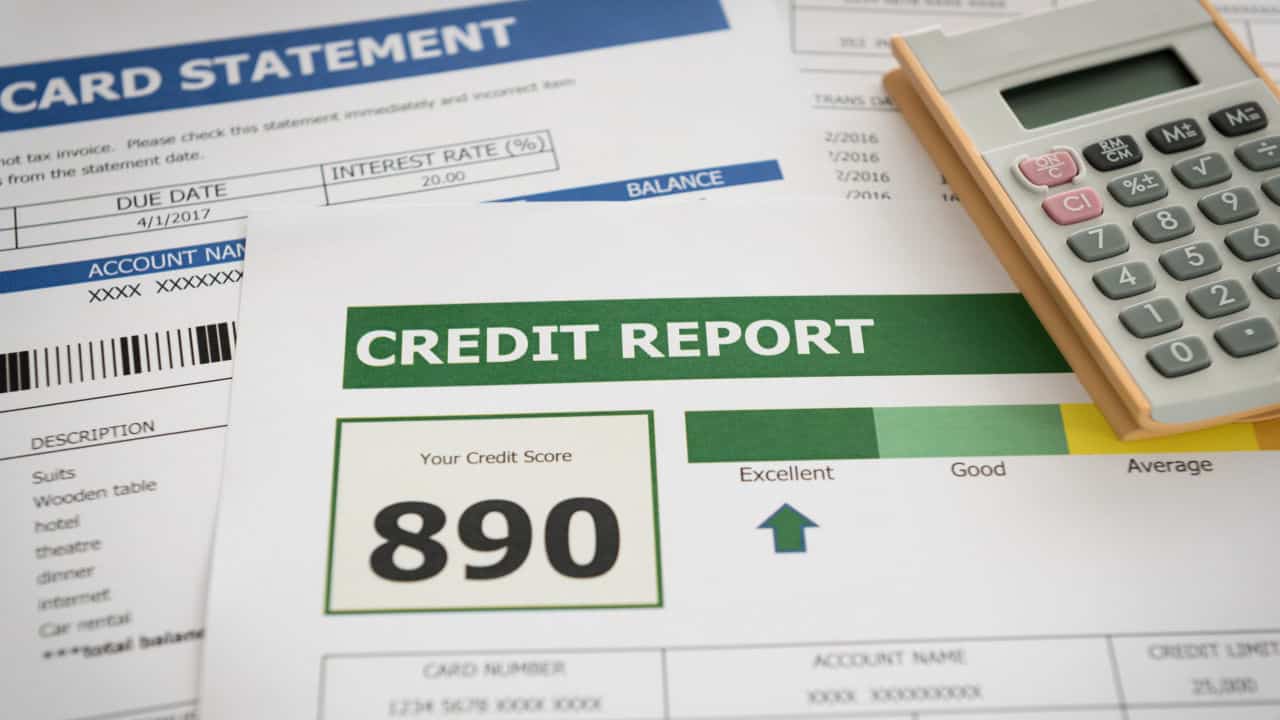

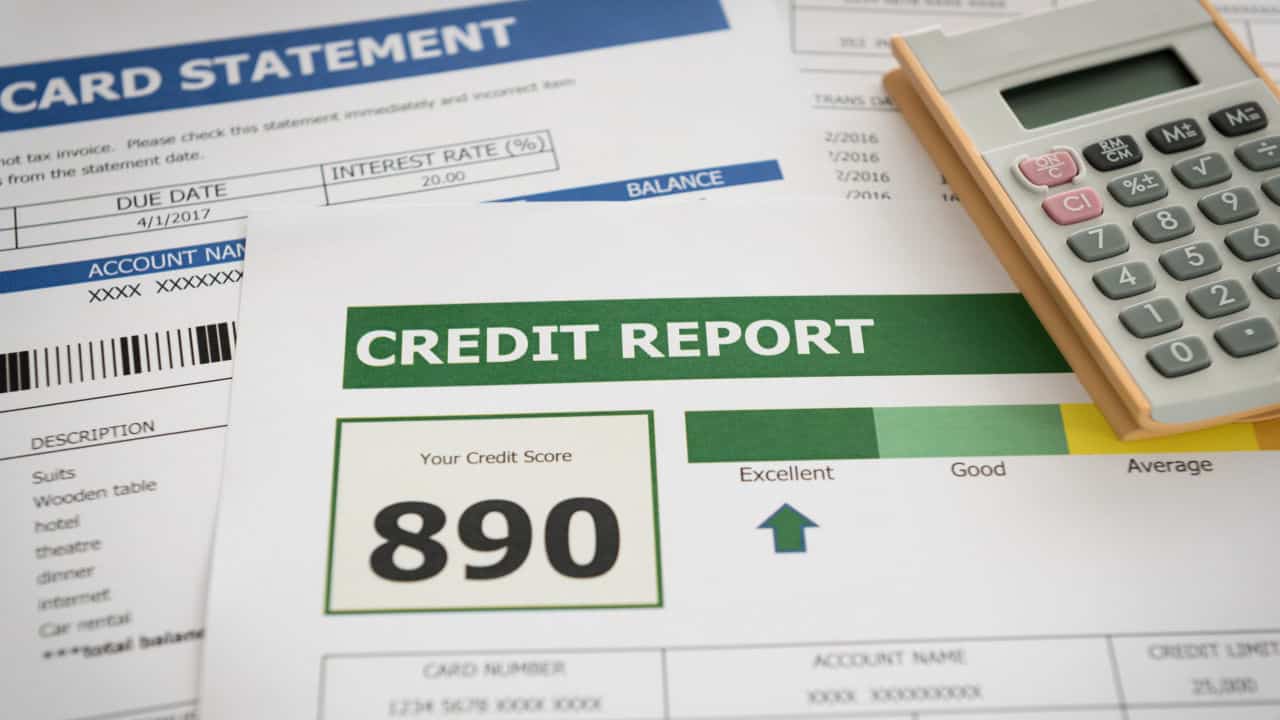

14. Raise Your Credit Score

One of the easiest and simplest ways to save thousands of dollars is by improving your credit score.

A higher credit score means lower interest rates and better loan offers, saving you significant money in the long run.

15. Start an Emergency Fund

One of the quickest ways to wipe out your savings is by unexpected emergencies.

Start building an emergency fund so you won’t have to rely on credit cards or high interest loans when something unexpected happens.

16. Ask For a Raise

You can make an immediate difference in your income by asking for a raise.

This will boost your income and set you up for higher future earnings.

17. Find a New Job

If your job does not offer a 401 K matching program, consider finding a new one.

This is free money that goes towards your retirement savings and can make a big difference in building your wealth over time.

18. Open a High Yield Savings Account

Having a savings account is great, but it’s even more important to make all your money work for you, so don’t let your savings sit in a low-interest account.

Switch to a high-yield savings account that will earn you more money over time.

19. Build Your Skills

One of the best ways to increase your income is to improve your skills, take classes, or get certifications in your field.

This will not only make you a more valuable employee, but it can also open up opportunities for higher-paying jobs.

20. Consolidate Debt

If you have multiple credit cards or loans with high interest rates, consolidating them into one lower-interest loan can get you out of debt faster.

If you have a good credit score, you can apply for a credit card with a 0% introductory APR and transfer your balances to save on interest while you pay off your debt quickly.

21. Use Lump Sums of Money

If you receive a work bonus, a tax refund, or a family inheritance, you should use these lump sums of money to grow your wealth.

Consider paying off debt, investing in stocks, opening a high-yield savings account, or starting a side business.

22. Downsize Your Life

An immediate way to increase your savings is to downsize your living expenses.

Moving to a smaller, more affordable home or apartment, or selling your expensive car and buying a cheaper one, is a great way to reduce your monthly expenses.

23. Live Below Your Means

We all want to look like we are doing well financially, but living beyond our means is not the best path to building wealth.

Instead, try to live below your means, save for your future, and patiently wait until you can afford luxuries.

24. Buy Insurance

Insurance may seem unnecessary, but it can be crucial in protecting your wealth.

Whether it’s health, home, renters, or car insurance, it is important to have coverage to prevent the loss of all your savings and assets, which you have worked so hard to accumulate.

21 Habits Of Wealthy People

Do you what separates the wealthy from everyone else? It’s their habits.

The good news is learning their habits is simple which means with a little effort, you too can become wealthy.

21 HABITS OF WEALTHY PEOPLE

How To Become Financially Independent

Being financially independent means not having to worry about money ever again.

You can choose to work if you want to, and spend money as you wish. But how do you get there? Here are the steps you need to take.

HOW TO BECOME FINANCIALLY INDEPENDENT

I have over 15 years experience in the financial services industry and 20 years investing in the stock market. I have both my undergrad and graduate degrees in Finance, and am FINRA Series 65 licensed and have a Certificate in Financial Planning.

Visit my About Me page to learn more about me and why I am your trusted personal finance expert.

Read the full article here