Key takeaways

- Redeem points or miles any time you can get the average redemption value or better.

- While booking economy airfare with miles can help you get a good redemption value, you have the potential to get outsized value for your rewards if you’re booking airfare in a premium cabin.

- Some loyalty programs offer award sales and promotions that make it easier to achieve stellar value for redemptions.

- If your rewards are about to expire, making a redemption can extend the life of your rewards.

- If you’re not interested in earning elite status, you may want to opt for redeeming rewards instead of paying cash.

While points and miles can pave the way to traveling for “free,” most travel rewards enthusiasts use their rewards to supplement their travel budget. For instance, it’s not uncommon for families to book airfare with points or miles but pay cash for their hotel, or vice versa. There are also scenarios where it can make sense to save your points and miles and pay cash for travel instead. If you find an incredible cash fare for a flight you want to book, for example, you would likely want to take advantage and save your rewards for another trip.

That said, there are several scenarios where it makes more sense than not to use rewards to book travel instead of paying with cash.

How to calculate the value of points and miles

Before we get into the scenarios, you’ll want to know how to calculate the value of your travel credit card rewards to understand when it’s best to pay with miles or cash. To see how much your points or miles are worth, divide the cash price by how much it would cost in points or miles. Not sure what that looks like? Here’s a quick example:

The flight for your next vacation costs $415 or 41,500 miles. That means the miles are valued at 1 cent per point ($415 / 41,500 = $.01). If you find the same flight for $350 for the same amount of miles, they would be valued at about 0.8 cents per mile ($350 / 41,500 = .008). In that case, you may want to pay cash since the miles redemption is below average. Find out if exchanging your miles is a good deal by comparing your calculations to our airline valuation chart.

1. You’re getting a good value for each point you redeem

Generally speaking, you’ll want to redeem points or miles when you can get the average redemption value or better. You’ll have to do some basic math to know if you’re getting a good deal, but our recent valuations of airline and hotel loyalty programs can do the heavy lifting for you.

For example, let’s say you want to book a flight with American Airlines. The flight you’re interested in has a cash price of $400, and that same flight would set you back 35,000 American AAdvantage miles plus $6 in airline taxes and fees. To do the math here, you would subtract the airline taxes from the cash price to get a cost of $394 and divide that figure by the number of miles you would need for a redemption ($394 / 35,000 miles = 1.12 cents per mile).

Our valuations show that American AAdvantage miles are worth 1.0 cents each on average. That 1.12 cents per mile is better than the average value for American miles, so you can book this award without any regrets.

That said, the math looks totally different if the flight price drops to $300 but still costs 35,000 miles plus $6 in taxes ($294 / 35,000 miles = 0.0084 dollars, or 0.84 cents, per mile). In this scenario, you’d be getting less than the average value and should probably pay cash for the flight and save your miles for another day.

2. You want to book airfare in a premium cabin

While booking economy airfare with miles can help you get a good redemption value, you have the potential to get outsized value for your rewards if you’re booking airfare in a premium cabin. This is especially true if you’re flexible with your travel dates, willing to consider multiple programs and planning an international trip.

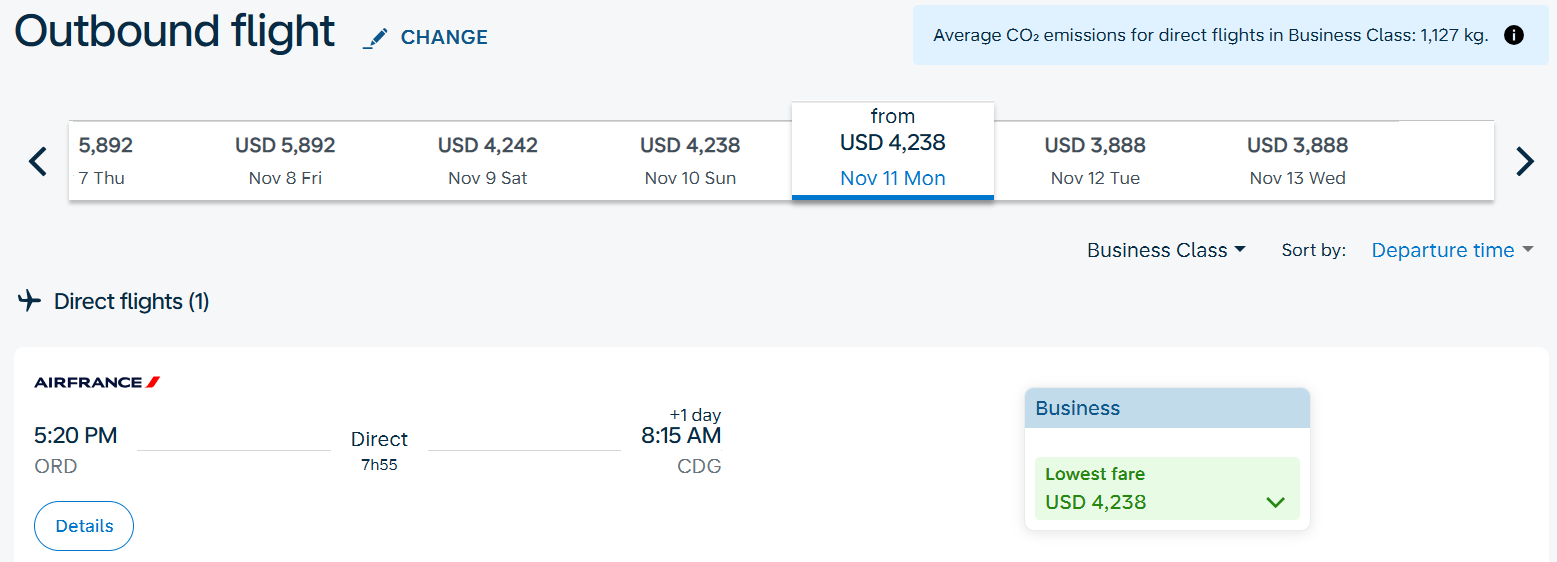

Take this example below, which is from the Air France / Flying Blue program. As you can see, you may be able to find a business-class flight from Chicago to Paris on an Air France Airbus A350-900 for 126,000 Flying Blue miles, plus $209.80 in taxes and fees.

EXPAND

Yes, that’s a lot of miles, but you would get to travel in a pod-style, lie-flat business-class seat with premium dining. Plus, the cash fare for this one-way itinerary works out to $4,238.

EXPAND

If you subtract the $229.80 in airline taxes and fees from the cash price, you’ll get $4,008.20. This means that, ultimately, you could redeem 126,000 miles for about 3.2 cents each — much more than our average value of Air France / Flying Blue miles of 1.0 cents each.

Plus, since the Air France / Flying Blue program is partnered with American Express Membership Rewards, Chase Ultimate Rewards and Capital One miles, Air France / Flying Blue miles are some of the easiest to accrue.

3. Cheap awards are available

While you can always do the math to see if an award lets you get the average value or better for your points and miles, some frequent flyer programs offer award “sales” that make it easier to achieve stellar value. For example, Delta Air Lines has SkyMiles Deals and the Air France / Flying Blue program has its Promo rewards.

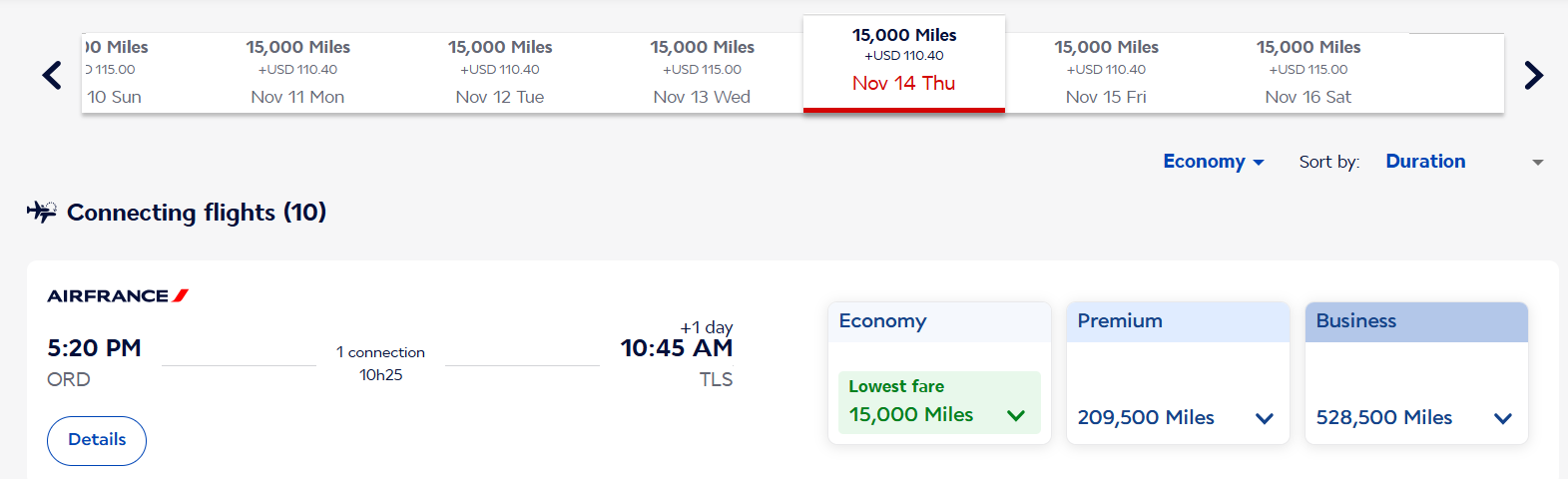

As an example, we found an Air France / Flying Blue Promo rewards deal for a one-way economy flight from Chicago to Toulouse, France in November 2024 for just 15,000 miles plus $110.40 in airline taxes and fees.

EXPAND

In the meantime, the cash price for this one-way economy flight works out to $488. When you subtract the $110.40 in airline taxes and fees from the cash price, you’ll get $377.60. Divide that by 15,000 miles and you’ll get about 2.5 cents per mile in value. In this case, the value of the rewards isn’t huge (though still better than average), but the amount of rewards needed is minimal and could still be worth it.

Airlines and some hotels also occasionally run mileage or points sales where you can purchase rewards directly from the airline as a way to prepay for travel. These sales can snag you up to a 50 percent discount on points or miles in some cases.

4. Your rewards are about to expire

While some airline rewards never expire, the majority of programs will let your rewards lapse completely if you don’t “earn or burn” some of your rewards every 12 to 24 months (on average).

Remember, you can always “restart the clock” on your rewards haul by —

- making an eligible rewards portal purchase.

- redeeming points/miles for a seat upgrade.

- using an eligible credit card to earn rewards on regular spending.

Making a redemption can extend the life of your rewards, so even if the award you’re booking is subpar, redeeming some of your points or miles is much better than watching them disappear.

5. Earning status isn’t a big priority

Finally, remember that redeeming points or miles for a flight or hotel stay typically will not get you any closer to earning elite status. So, while you’ll get to enjoy any elite status benefits you already have when you use an award, you won’t be spending any money that will help you earn qualification miles or hotel loyalty points for the next year’s status qualification requirements.

Ultimately, this is just another reason it can make sense to pay cash for some travel and save your rewards for the rest. The benefits of elite status are worth pursuing since you can enjoy perks like free checked bags and priority check-in with airlines, along with room upgrades and free breakfast with hotel loyalty programs. However, you’ll usually have to spend money with your favorite programs to retain status for the long haul.

The bottom line

While you have the right to redeem your rewards for whatever you want, you can stretch your points and miles further if you take a judicious approach when trying to decide whether to pay with cash or use your points or miles. Redeeming points or miles with one of the best rewards credit cards can make travel more affordable, comfortable and convenient, but being thoughtful about how you redeem your rewards can help you get optimal value.

Read the full article here