The pain of loss has an impact on us that is at least twice as powerful as the joy of gain. This potent observation from Daniel Kahneman has implications in nearly every area of our lives, but especially in our finances, where losses and gains are so clearly illuminated numerically.

We’ve discussed how financial planning is inherently an exercise in mistake management, but the question is still begged, “How do we recover from our mistakes?” Here’s a one-step process for getting back on track:

1. Do the next right thing.

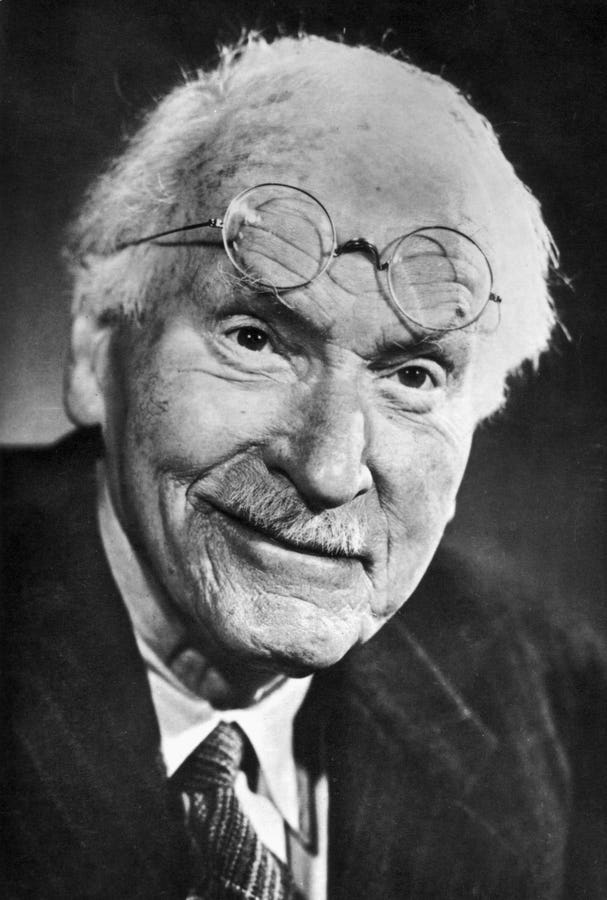

While the recovery movement has mastered this simple maxim, its origin predates Alcoholics Anonymous, I just learned, even as its source was almost anonymous. Would you believe that the eminent psychiatrist Carl Jung responded to letters from random strugglers with life-changing guidance that cost nothing more than a postage stamp?

Indeed, in 1933, Jung responds to Frau V., struggling to find direction in life:

“There is no single, definite way for the individual which is prescribed for him or would be the proper one,” Jung writes.

We need to pause here because within this single statement lies a truth that we, as a community of financial guidance (in which I place the whole of the financial industry and all the self-styled financial gurus out there) have failed to acknowledge:

There is no one way to do financial planning.

It’s not your bank, brokerage firm, or insurance company’s way. It’s not Dave Ramsey or Suze Orman’s way. It’s not even your personal advisor’s way because the optimally positioned advisor acts as a guide, not a dictator.

The whole benefit and point of financial planning isn’t to arrive at a number, but to discern and discover what’s most important to you in life—then, and only then, to enlist your host of financial and other resources to pursue those aims. But I digress.

Jung continues, “But if you want to go your individual way, it is the way you make for yourself, which is never prescribed, which you do not know in advance, and which simply comes into being of itself when you put one foot in front of the other.”

This reminds me of the BAT Success Triangle—Behavior, Attitude, and Technique—that while we too often spin our wheels hunting for the perfect technique or waiting for the epiphany that will right our attitude, it is the simple choice to act (or not), to put one foot in front of the other—that is the foremost requirement for any successful pursuit.

So, how do we know if the step we’re taking is the right one—the perfect one? “And then you know, too, that you cannot know it,” Jung reminds, “but quietly do the next and most necessary thing.”

The implication here is that we know what that “next and most necessary thing” is. And indeed, while the margins of wealth management can get extremely complicated, most of the financial screw-ups that get us in trouble have self-evident solutions. Most of the time, it’s about doing what we know more than knowing what to do.

The reward for doing the next right thing is also often self-evident because “…if you do with conviction the next and most necessary thing, you are always doing something meaningful,” according to Jung.

And don’t we know this to be true? The first day of a new diet, a new gym routine, a new job, a new relationship, or a new financial resolution, always feels right. So, while I have and will continue to unpack the myriad of financial planning possibilities in this column, there will always be steps two through however many, while the first step remains:

Do the next right thing.

Read the full article here