The entry of a judgment means the beginning of post-judgment enforcement proceedings by the creditor against the debtor and, more specifically, against the debtor’s assets. But not all of the debtor’s assets, since certain assets are off-limits to creditors. These assets are known as exempt assets because the assets in this category have been designated by law to be exempt from judgment enforcement. The reason these exemptions exist is so that by leaving debtors with a minimum of assets, debtors are not put out on the street and thus become a public burden — whether the exemptions accomplish this in a particular jurisdiction will be left to others to discuss.

Note that even if a person has no creditors at all, the topic of exemptions may be important if that person engages in asset protection planning, since there usually is no need to include exempt assets in the asset protection plan since those assets are protected anyway. There may be estate planning reasons to do something with those assets, but not for asset protection planning purposes. As an aside, there is an old joke about why asset protection plans are so elaborate in exemption-friendly states like Florida and Texas, which is that there is no money in exemption planning.

Before we examine the various laws that provide for these exemptions, commonly known as creditor exemptions, it is also important to understand an important bit of the civil procedure that relates to exempt assets. When a creditor attempts to enforce the judgment against a particular asset, meaning to execute against that asset, the local sheriff will serve a writ or court order on either the debtor or a third-party holding assets or income of the debtor. When that happens, exempt assets are then parsed into two categories depending on whether the debtor is required to make a claim of exemption and thereby request a hearing by the court to determine if the asset is indeed exempt. If an asset is exempt without making a claim, then the debtor doesn’t have to do anything to claim the exemption which is applied automatically to the asset by statute. However, some assets require that a debtor make a timely claim of exemption and thus trigger a hearing by the court to determine if the exemption is appropriate. If the debtor fails to make a timely claim of exemption, then the exemption is deemed to be waived.

We must further understand that there is nothing like a uniform law of exemptions. Each state has different exemptions, and often there are radically different exemptions between two neighboring states. Some exemptions are found in the state constitution, while other exemptions are statutory creations of the local state legislature. There are federal bankruptcy exemptions, but these exemptions only and exclusively apply if a debtor is actually in bankruptcy; otherwise, they have no effect whatsoever.

Finally, the law of exemptions which is applicable to a particular debtor is that of the law of the state wherein that debtor is domiciled (lives in with an intent to remain) at the time that the creditor attempts to execute against a particular asset. If the creditor relocates to a different state, the exemptions that were available in the first state evaporate and those of the new state will apply. Thus, a person can gain or lose exemptions of particular assets if they move from one stateto another — this is exactly why “debt birds” who have gotten into financial trouble will flock to Texas, Florida and a few other debtor-friendly states that have generous exemptions.

State Exemptions Generally

As mentioned, state exemptions are creatures of either the state constitution or state statute. It is not a distinction without a difference. If an exemption is provided by the state constitution, then the exemption may in some circumstances survive certain of the creditor remedies that are provided by statute and which might otherwise reach the asset. Also, assets that are exempt by the state constitution are almost always exempt without the necessity of a debtor making a claim of exemption.

Note that exemptions are not absolute, but frequently have exceptions. For instance, a debtor’s homestead may be exempt under the state exemption law, but things like property taxes and HOA fees and fines may be allowed nonetheless. There may also be exceptions to the exemption for certain types of claims, such as spousal or child support. It is here that we must especially remember The General Rule, which is that general rules are generally inapplicable.

Homestead

The exemption for homestead protects the debtor’s equity in the debtor’s personal residence. Usually, the exemption applies to only one home, so second homes are not protected. The debtor must actually reside in the home to claim the homestead exemption, such that if the debtor owns a house in which the debtor’s mother lives but the debtor does not, the homestead exemption will likely not apply.

Most homestead exemptions are usually restricted by the amount of equity that the debtor has in the property. From state to state, these amounts are all over the board from very little to quite a bit. Some states now cap their homestead exemption at the mean property value for all residences in the county where the home is located, which keeps the legislature from having to increase the homestead every time that property values jump up.

A few states (most notably Florida and Texas but there are others) have unlimited homestead which means that there is no limit on the value of the property that is protected or the amount of equity that the debtor has in that property. In these states, however, there are usually restrictions on the physical size of the home, with one value for urban property and one for rural property, both measured in acres or a portion thereof.

Personality

Creditor exemptions also protect certain categories of personalty, meaning property that is not real estate. The exemptions for personalty protect such common things as clothing, one automobile, pets, cooking utensils, furniture, and the like. The personalty exemptions also protect things for historical reasons, such as the family Bible that in past days was often used by families to record their genealogical history, or one cow to provide the debtor’s children with their daily milk. These exemptions also will usually protect a debtor’s means to earn a living, most commonly the debtor’s tools of the trade and so many head of cattle.

The personalty exemptions are almost always limited in value, meaning that a debtor can only protect so many dollars of particular property or so many dollars of all the debtor’s personality. Because the legislatures have not kept these exemptions current with the times, they are usually low such as $5,000 for the equity in a debtor’s automobile. Thus, if a debtor attempts to claim an exemption for the family Bible which just happens to be a Gutenberg Bible worth $30 million, the debtor may be limited to maybe a couple of thousand dollars after it is auctioned away in a judicial sale.

Personal property exemptions are dangerous for debtors because some categories are exempt without making a claim while other categories require that the debtor timely file an exemption claim. These differences vary widely from state-to-state and within a particular state’s laws these differences often make little sense.

Wages

In most states, a creditor can enforce a judgment by having the sheriff serve a garnishment summons on the debtor’s employer which directs the employer to pay a portion of the debtor’s wages to the sheriff (who then remits to the creditor). There are restrictions on this, however, under both state and federal law.

The Federal Wage Garnishment Law (FWGL) generally limits a creditor’s garnishment to only 25% of the debtor’s income after withholdings, and the debtor is allowed a bare minimum which is 30 times the federal minimum hourly wage calculated weekly. The FWGL trumps any contrary state law if it is less protective of debtors. Many states have adopted legislation which effectively conforms their exemptions for a debtor’s wages to the FWGL. Some states provide greater protection than the FWGL, however, and a few states such as Texas prohibit any wage garnishment.

Typically, even when the wages are deposited into a bank account, they are protected by state law from execution so long as the wages are not comingled with other non-exempt funds. Thus, it is common for debtors to set up a wage account to which they deposit their paychecks and nothing else so that there is no confusion that the account is exempt.

Retirement Accounts

From an exemption viewpoint, the state exemptions vary so widely that it is almost impossible to state how they are treated. Then, even within a particular state, different types of retirement plans can have different exemptions or not, even when they are functionally similar. It is a confusing mess.

Take IRAs for example. Some states protect IRAs completely, some protect them only partially, and some states do not protect them at all. There may also be differences between traditional IRAs and Roth IRAs.

If there is any good news in this area, it is that federal law protects retirement assets in ERISA plans through what is known as the ERISA anti-alienation provision so long as the account assets are held within the ERISA plan. When an ERISA plan pays out to the debtor, however, then we’re back to state law as to whether those moneys are protected, if at all, and if so then in what amounts.

Annuities And Life Insurance

Even more difficult to figure out the exemption for retirement accounts are the protections for annuities and life insurance. Life retirement accounts, some states protect them entirely, some not at all, some protect life insurance but not annuities or vice-versa, and many limit the amount that may be protected. However, the biggest problem here is that usually the state exemption laws for life insurance and annuities are antiquated and were often drafted some decades ago before there was even such a thing as cash-value annuities or cash-value life insurance. There are thus exemption statutes that are not clear on who is protected between the policy owner and the beneficiary. The upshot is that when applying these ancient statutes to try to figure out exemptions as to modern annuity and life insurance policies, one can tear their hair out quite quickly and there often is little or nothing in the way of court opinions for guidance.

Bankruptcy Exemptions

The Bankruptcy Exemptions found at 11 USC sec. 522 are available to a debtor only if the debtor is in bankruptcy. The Bankruptcy Code has its own lengthy list of exempt property, and in some circumstances the debtor may also claim an exemption under applicable state law.

There is a potential catch, however. The Bankruptcy Code allows a state to opt-out of the list of things which are exempt under bankruptcy law and instead require the debtor to use state exemptions instead. These states may then also have an alternative list of exemptions that are different than their own normal non-bankruptcy exemptions. For example, California has opted-out of the bankruptcy exemptions, but the normal California creditor exemptions are not available to the debtor. Instead, a California debtor in bankruptcy is restricted to a special list of state exemptions that are only applicable in bankruptcy. Why California has this special list instead of just making its normal exemptions available to creditors is beyond peradventure.

Exemptions Contrasted With Anti-Alienation Provisions

One thing that confuses a lot of folks is that there are protections for assets that are not exemptions. Generally, these protections are known as anti-alienation provisions (or sometimes anti-assignment provisions) that prevent a person from assigning their rights to an asset to somebody else. Examples of this include the aforementioned ERISA protection, but they also include prohibitions in LLC and partnership provisions that restrict the assignment of a debtor-member’s interest. While such provisions have the effect of protecting assets in a fashion similar to exemptions, they are decidedly not the same and can have radically different consequences in certain situations.

Summary

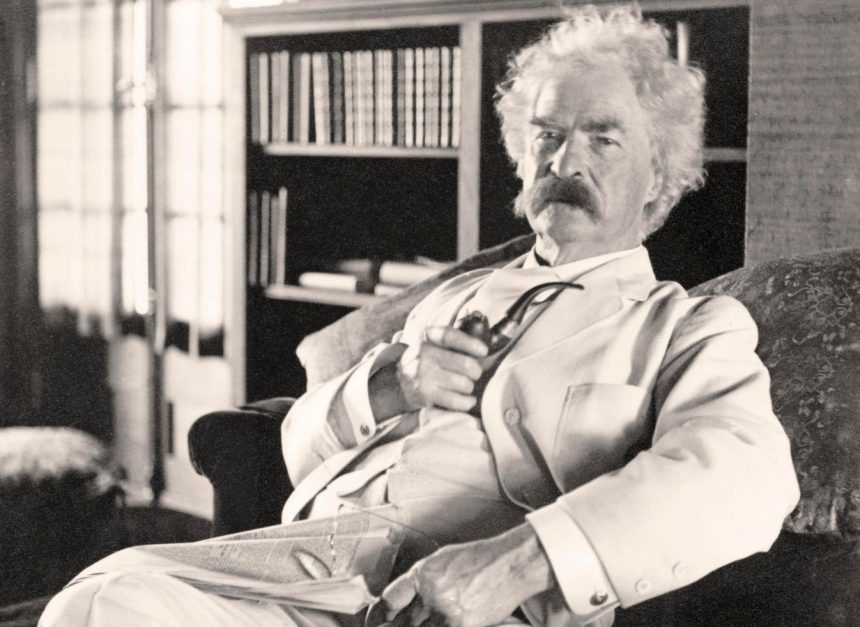

Mark Twain once famously wrote that “It ain’t what you don’t know that gets you into trouble. It’s what you know for sure that just ain’t so.” This applies with great effect to exemptions where a little knowledge can be extremely dangerous. Many attorneys of all types, including debtor attorneys, creditor rights attorneys, bankruptcy attorneys and asset protection attorneys think that they have a good understanding of exemptions when in fact such is often not the case when it comes to specific assets in particular circumstances. To the contrary, exemptions can often be very hard to figure out and require a great deal of analysis and legal research to get to anything like a solid answer.

Read the full article here