Despite AI disruption concerns, the company’s strong fundamentals, diversified revenue streams and attractive valuation make it appealing

By Kenio Fontes

Summary

- The stock looks attractive after the recent dip, especially with its double-digit growth prospects and the lowest forward price-earnings ratio among big tech players.

- Concerns abound about AI disrupting Google’s search business, but the company’s diversified revenue streams, including YouTube and Google Cloud, provide stability and growth potential.

- With a robust cash position, high profitability and significant capex investments, Alphabet’s fundamentals remain solid.

When it comes to the Magnificent Seven and big tech stocks, one of the ones I like the least is Alphabet Inc. (GOOGL, Financial) as I find its business model less appealing and a little more fragile when compared to Apple Inc. (AAPL, Financial), Amazon.com Inc. (AMZN, Financial) and Microsoft Corp. (MSFT, Financial).

Even so, it is undeniable that the Google parent company has its moats and an excellent operational track record.

As the company is far from bad, I believe this recent dip makes the stock even more attractive, which, if it maintains its prospects of growing by double digits a year, is very cheap.

Is the business model threatened?

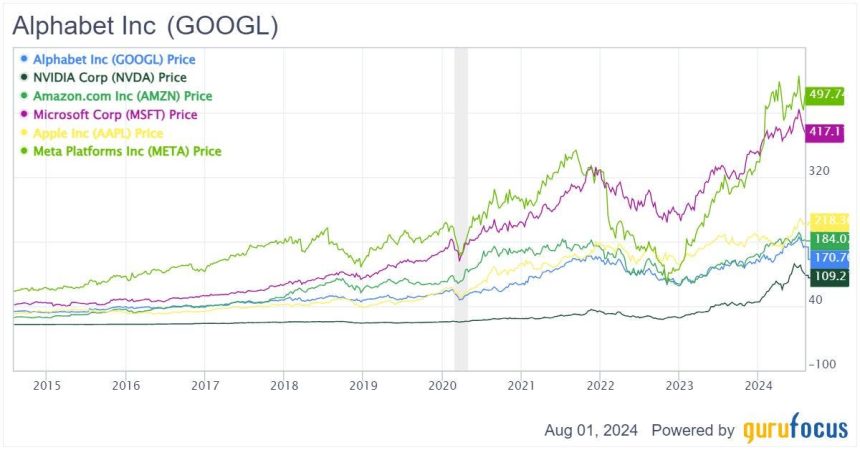

Looking at the forward price-earnings of the main Magnificent Seven companies, it is clear Alphabet stands out as the one with the lowest indicator. While the search machine is trading at 21 times its next 12 months’ earnings, companies like Microsoft and Apple are already over 30, not to mention Amazon and Nvidia (NVDA, Financial), which add further distortion to this comparison. Even Meta (META, Financial), which in recent history had the lowest multiples, has overtaken the tech giant.

Note that although Alphabet has never stood out as a company that is traded with a rich multiple, in many periods it was much closer to the other companies, and only in recent months has this gap opened up.

GOOGL Data by GuruFocus

Of course, there is a reason for this. Even though the market often acts in a dysfunctional way, this would hardly happen without a plausible justification, especially for one of the world’s largest companies. The main reason for the stock trading at this level, while maintaining an expectation of double-digit sales growth, is the threat to its main business, Google Search.

In the second quarter, the search tool accounted for 57% of the group’s revenue, while other initiatives such as YouTube, Google Play and Google Cloud were closer to 10% each. Even with this dependence, credit must be given to Alphabet, which over the years has built up a complete and diversified business model.

Source: App Economy Insights

According to some bears, Google’s search model could be disrupted or slowed down by large language models. Today, the most common thing when you want to go to a restaurant or have a question is to go to the search engine and type it in. One of the narratives suggests this could easily be replaced by a question to your chatbot, be it GPT Chat, Alexa or Siri. If, instead of searching, many people start using these other methods, search becomes less relevant and directly impacts the company’s revenue.

My take tends toward skepticism. However long it takes for this narrative to materialize, instead of completely disrupting Google Search, it may only be something that will add obstacles, reducing growth rather than bringing about a stagnation or decrease in this line of revenue in the short and medium term. Artificial intelliegence will gradually become more popular, but to reach a considerable mass of the population that adopts it in their daily lives and replaces their habits of using Google search as a tool could take years.

As Alphabet is one of the most innovative companies in the world, even if this happens gradually, the company will be able to balance it with growth at other ends, whether in the cloud, through YouTube or a new line of revenue with Gemini. There is a range of options that bring an interesting vision and can help sustain this growth in the long run.

Stick with the fundamentals

In many cases, investors tend to turn something simple into something complex. While this can sometimes be necessary, especially in technology segments that are very dynamic and the outlook changes all the time, overcomplicating something and getting carried away with the narrative is a very common mistake.

Trying to look at it pragmatically, in a “stick with the fundamentals” analysis, Alphabet is still an excellent company. In the breakdown of revenue, you can see that search revenue and Google Play advanced by 14% year over year, YouTube by 13% and Google Cloud by 29%. Alphabet is far from a dying business. Even with this growth, the miss in YouTube ad revenue disappointed the market, which together with the higher capital expenditures, caused the stock to fall post-earnings.

But it does not stop there. As well as having a growth rank of 10 on the GF Score, its profitability rank is also solid at 10. Its financial strength is also very good with cash on hand of over $100 billion. In terms of profitability, it is worth highlighting a net margin of 26.70% as well as a return on invested capital of 32.50%, which shows a cash cow business model and assertive capital allocation.

How about the future?

Alphabet’s capital allocation is very good as it has robust cash on hand, which could eventually turn into another successful acquisition like YouTube, or reinvestment in the business that is transformed to at least remain relevant in industries like search, AI and cloud. In the second quarter, the company made capital expenditures of more than $13 billion to cope with a robust infrastructure that supports the advancement of Google Cloud, Google Search and other businesses through data centers, but it put pressure on free cash flow.

Furthermore, although there is a risk that search will be affected, this is not a trend that seems likely to occur in the medium term. As already mentioned, this depends on the mass replacement and adoption of a new tool by the population. In the short and medium term, this technological evolution could bring greater assertiveness to ads and searches, boosting this market as a positive trend.

When it comes to competition, although Google has recently lost ground to Bing (Microsoft’s search engine), Alphabet still has a virtual monopoly, with more than 80% of the search market according to Statista.

Source: Statista

In this way, the future for search is partly cloudy, but it does not seem so uncertain that it can be labeled a dying business.

Everything has a price

In addition to the multiples, which became even more attractive after the recent dip, other methods reinforce that Alphabet’s stock is at a level that will remunerate shareholders well. If we run a reverse discounted cash flow model using earnings per share, projecting growth of 15% per year for the next 10 years and 10% for the following decade, we find the current share price by discounting at a rate of 12%. In other words, if the company manages to achieve greater growth than this, the annual return for the shareholder would be above 12%, making the stock a real compounder.

This becomes even more interesting when we look at the last five years, where the earnings per share compound annual growth rate has been 25.90%. Although the company does not need to maintain this level consistently, it is possible that positive surprises could happen along the way so that EPS growth could exceed the projected 10% to 15% per year.

If we use more reasonable assumptions to try to find a fair price, it is still possible to find an interesting upside. With 18% in the first 10 years and 8% in the last 10, discounting by 11% (still a high and restrictive figure for a company of such quality), we would have a fair value of $212 per share, equivalent to an upside of 21%. I used EPS instead of free cash flow because of the recent history of high capex, which would negatively bias the reverse DCF model.

According to the GF Value Line, the stock should be worth around $155, which currently qualifies it as fairly valued, showing that although Alphabet is much cheaper than its tech peers, it’s still not a huge bargain.

Final thoughts

Alphabet still has relevant moats and is not a dying business. For this reason, even though there is a certain cloudiness to some parts of its business model, the discrepancy between the premium for companies like Apple and Microsoft seems to have become very large, while there is a discount on the Google parent’s shares that makes it more attractive, especially after this dip.

Disclosures

I/we have no positions in any stocks mentioned, and have no plans to buy any new positions in the stocks mentioned within the next 72 hours.

Read the full article here