Personal Finance

Latest Personal Finance News

Taxable Income vs. AGI: Key Differences and Examples

While taxable income and adjusted gross income (AGI) might sound similar, they refer to different stages of your income after…

Can You Convert an Inherited IRA to a Roth? Rules and Taxes

Roth IRAs are known for tax-free growth and distributions in retirement. However, inherited IRAs come with their own rules and…

I’m 78 With $735k in my 401(k). How Should I Handle My RMDs?

The IRS mandates withdrawals from pre-tax retirement accounts once you reach a certain age. These are referred to as required…

Capital Gains Exemption for Primary Residence: Tax Rules

Selling your home can have tax consequences if its value has gone up. The IRS offers an exemption that lets…

I’m 58 With $680k in My 401(k). Does It Make Sense to Pivot to Roth Contributions?

Roth IRAs can be appealing because they allow tax-free withdrawals and have no required minimum distributions (RMDs). For younger savers,…

Deferred Compensation Plan vs. 401(k): Key Differences

Planning for retirement can feel overwhelming, but fortunately, there are several savings tools available to help take the sting out…

As Kids Go Back To School, Get Educated On Scams That Target Students

This month, many students—including my own kids—are heading back to school. Most of them have a cell phone (or wearable…

Fintechs Consider Raising Prices Due To JPMorgan’s Looming Fees

The big new fees JPMorgan Chase is planning to charge some financial technology companies may well trickle down to consumers,…

Sky-High 14.4% California Taxes Often Trigger Out-Of-State Moves

California has wildfires, high crime rates and plenty of government regulations. All prompt complaints from residents, but in some circles,…

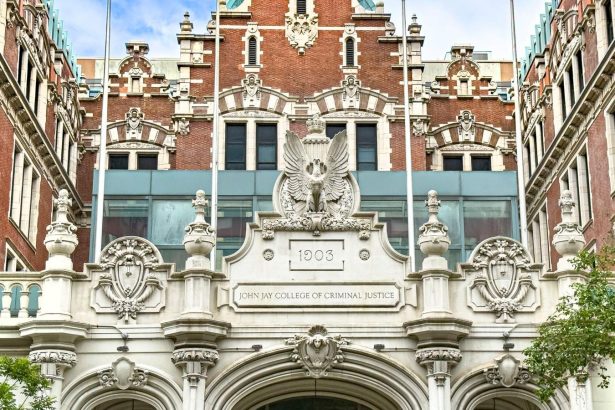

The 25 Colleges With The Highest Payoff

With artificial intelligence beginning to eat away at many white-collar entry-level jobs, and the unemployment rate for recent college graduates…