Taxes

Latest Taxes News

Scammers Aren’t Taking A Break This Summer

This is a published version of our weekly Forbes Tax Breaks newsletter. You can sign-up to get Tax Breaks in…

Federal Judge Temporarily Halts Ban On Noncompete Agreements

A federal court has ruled in favor of Ryan, a global tax services and software provider, and against the U.S.…

Defense Contractor Charged With Evading Tax On $350 Million In Personal Income

Former U.S. defense contractor Douglas Edelman, 72, and his French wife, Delphine Le Dain, 58, have been charged in a…

Protests Continue In Kenya Despite Ruto’s Change Of Heart On Tax Bill

Protests are continuing in Kenya over a finance bill that included significant tax hikes despite President William Ruto pulling the…

Less Is Moore: The Supreme Court’s Ruling In Moore V. United States

Tax Notes managing legal reporter Andrew Velarde breaks down the Supreme Court's decision in Moore v. United States and its…

4 Tax Benefits of Using an LLC for Your Rental Property

Forming a limited liability company (LLC) can offer significant tax advantages for real estate investors, including pass-through taxation and a…

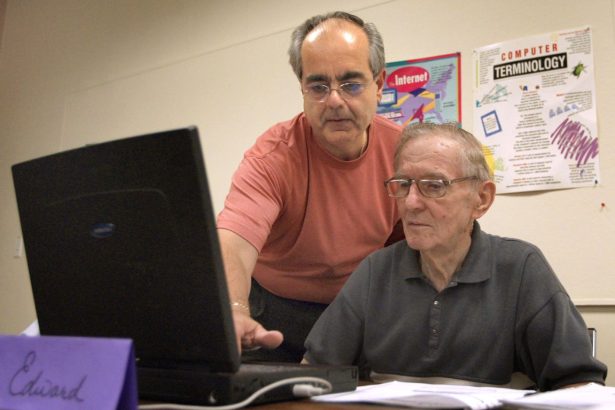

3 Ways To Safeguard Finances Of The Vulnerable, Yet Navigate U.S. Tax

The rise of AI has made scams increasingly sophisticated and more convincing to potential victims. When combined with cognitive issues…

Judge Absolves All 28 Accused, Including Mossack Fonseca Lawyers, In Panama Papers Case

Absolved. That was the decision handed down by Judge Baloisa Marquínez in cases focused on the "Panama Papers" and the…

IRS Issues Final Regulations For Tax On Corporate Stock Buybacks

The IRS has issued final regulations that provide taxpayers and tax professionals with guidance on how to report and pay…

Proposed Rule Would Allow IRS To Accept Tax Payments By Credit Or Debit Cards

If you've ever tried to make payment to the IRS using credit cards or debit cards, you know that it…