Taxes

Latest Taxes News

How To Distinguish Between Willful And Non-Willful FBAR Penalties

The Bank Secrecy Act requires U.S. taxpayers to file annual reports with the government if their foreign accounts exceed $10,000…

Can Trump Eliminate The Income Tax? Maybe With An 85% Tariff

The idea of eliminating the income tax is an attractive one to anyone that has ever had to cut a…

Justice Department Returns Millions To Malaysia As Work Continues On 1MDB Scandal

The Justice Department has announced that it has turned over an additional $156 million in misappropriated 1Malaysia Development Berhad (1MDB)…

Dear IRS: This May Look Like My Income, But It Belongs To Someone Else

Have you ever received something that wasn’t entirely yours? Probably. Say you receive $100 but have to hand over half…

TikTok And Other Social Media Posts Are Wrong About Charity At The Checkout

A few days ago, I saw a post on social media from a taxpayer concerned about what exactly goes on…

IRS Seeks In-Person Interviews For Failure To File A 2011 Form 5471

Taxpayers with foreign assets often have international information return filing requirements. And the failure to timely file these returns can…

Supreme Court May Hear Philadelphia Case Focused On State And Local Taxes

The Supreme Court Justices may want to brush up on their tax law this summer. It seems that more tax…

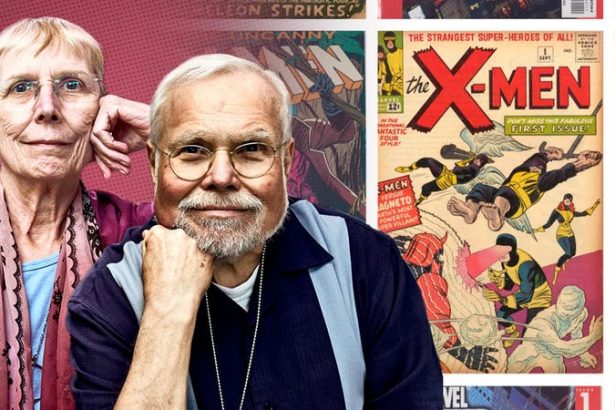

How To Give Away A $500,000 Comic Book Collection

Seven decades after he became addicted to Superman, Gary Prebula?s collection of graphic novels and comics has a permanent home…

Summer Vacation And Your Estate Plan

As we all prep for our summer travel plans and vacations, one of the typical last minute stressors to many…

Analyzing The EITC’s Role In Poverty Reduction

Susan Lanham, Amanda Thompson-Abbott, and Tom Norton of Marshall University discuss their research on the earned income tax credit’s effectiveness…