Taxes

Latest Taxes News

Understanding IRS Form 56: A Guide For Taxpayers And Fiduciaries

IRS Form 56 is a pivotal document in tax and financial regulations. Officially titled, “Notice Concerning Fiduciary Relationship,” the form…

U.S. Tax – How Long Does The IRS Have To Catch Me?

It might be longer than you think! The Internal Revenue Service (IRS) has a very long arm that can grab…

Irish Tax Appeals Court Botches First Transfer Pricing Decision

Like many other judicial attempts to apply the arm’s-length principle to employee stock options, the Irish Tax Appeals Commission’s decision…

The Art Of Donating What You Love And Getting A Tax Deduction

This is a published version of our weekly Forbes Tax Breaks newsletter. You can sign-up to get Tax Breaks in…

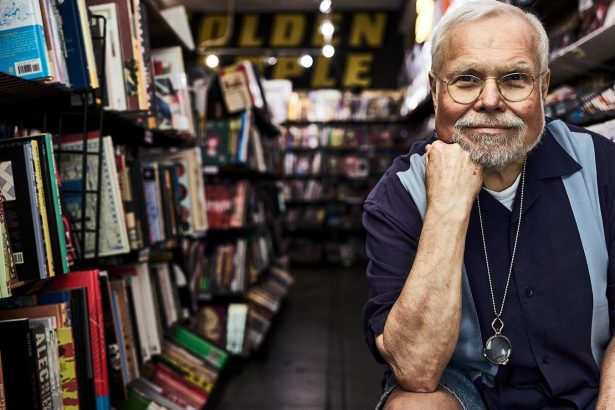

How To Donate 80,000 Comic Books—And Get A Marvelous Tax Break

Seven decades after he became addicted to Superman, Gary Prebula’s collection of graphic novels and comics has a permanent home…

Record-Breaking Accomplishments On Jobs And Unemployment Under Biden

The May jobs and unemployment report is out today, and it shows a continuing strong economy. The Biden Administration’s robust…

Stronger Ties With Top HBCU

Law firm mergers and acquisitions often bring opportunities to grow law firms—but typically not the profession. A recent pairing in…

UK VAT Partial Exemption- Avoiding Unexpected Costs

The UK VAT rules applicable to VAT exempt supplies continue to be a frequent area of dispute with the UK…

IRS Document Upload Tool Hits One Million Submissions As Team In Charge Gets Award Nod

The IRS has accepted its one millionth taxpayer submission using the Document Upload Tool. The tool gives taxpayers and tax…

NYC Congestion Pricing Is Seemingly Dead—In Favor Of Payroll Taxes

In a surprise reversal, Gov. Kathy Hochul announced that planned congestion pricing in Manhattans Congestion Relief Zone will be shelved…