Taxes

Latest Taxes News

As Summer Begins, The Tax World Shows No Signs Of Cooling Off

This is a published version of our weekly Forbes Tax Breaks newsletter. You can sign-up to get Tax Breaks in…

Partnership Beats IRS In Tax Court: BBA Election Held Valid

In tax cases, sometimes procedure alone wins the day. In SN Worthington Holdings LLC v. Comm’r, 162 T.C. No. 10…

What’s Next For ERC Refund Claims Pending With The IRS?

The latest IRS data shows that it had 1,057,000 unprocessed Forms 941-X as of December 9, 2023. Most of those…

IRS Extends Free File Program Through 2029, While Direct File Future Remains Uncertain

The IRS will extend the Free File program through October 2029, following an agreement to continue making free private-sector tax…

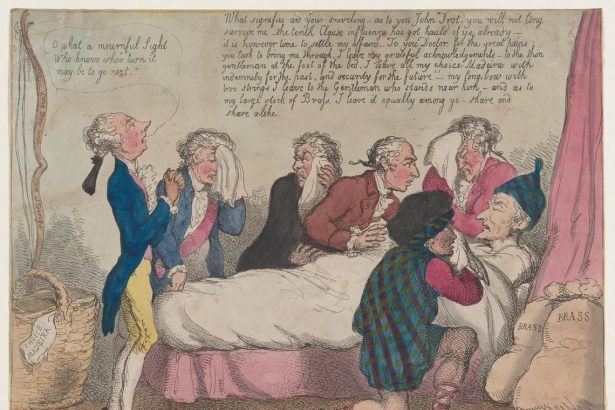

In Terrorem Clauses In Estate Planning

Disinheriting a child or family member from one’s estate plan can be one of the most difficult and often heartbreaking…

Copilot+ PCs Could Be A Privacy Nightmare For Professionals

On a May 20th event on Microsoft’s Microsoft campus, the Redmond, Washington company introduced Windows PCs designed specifically for AI—dubbed…

Biden’s Tariffs Conflict With His Environmental Goals

Slowing climate change has been a signature issue for President Biden. But Biden also has been an ardent booster of…

Don’t Roll Over RMDs To Other Retirement Accounts

Some retirees continue to make a key mistake with required minimum distributions, and that could cost them a lot of…

How To Avoid Faulty Advice On IRS Form 706 And The Portability Election

There is an onerous issue plaguing the tax community. Some tax professionals have been advising their clients that filing the…

Treasury Secretary Yellen Indicates U.S. Will Not Support Global Billionaire Tax

The world’s ultra-rich should pay more in taxes. That’s the crux of a proposal by some members of the G20—and…