Key takeaways

- The American Express Mobile App has a high customer satisfaction rate among users.

- It offers useful features such as transferring funds, tracking purchases and redeeming rewards.

- The app lacks the option to link checking accounts and has reportedly experienced glitches with fingerprint login.

If you’re an American Express cardmember, or are considering becoming one, you’re in good hands when it comes to the issuer’s mobile app. The Amex mobile app boasts an excellent customer satisfaction rate among users — scoring the top spot in J.D. Power’s 2025 U.S. Credit Card Mobile App Satisfaction Study with 704 out of 1,000 possible points.

At the end of the day, the American Express app has many features that can save you time, hassle and stress. Our Amex mobile app review will unpack this app’s most popular features, how to use it and where it falls short of apps offered by other top credit card issuers.

American Express mobile app features

The Amex credit card app lets you track your credit card purchases, rewards and payments in real-time using your mobile device.

You can also use the app to redeem your Amex credit card rewards, whether you racked up cash back or American Express Membership Rewards points. Let’s break down some of the most notable app features below.

Amex Offers

Amex Offers are special bonus offers that let you earn more cash back or points on eligible purchases. The Amex App lets you browse Amex Offers and add them to your card however often you like. This perk is free, but you’ll have to add each offer to your eligible card for it to apply.

Keep in mind:

Amex Offers change frequently, so you’ll want to check offers in the app regularly so you don’t miss out.

EXPAND

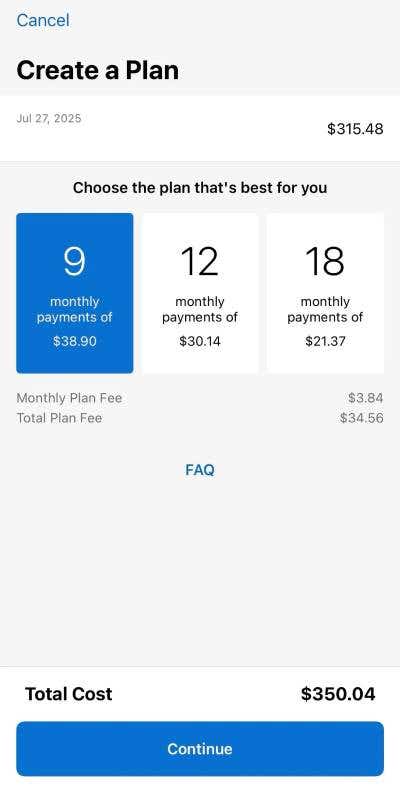

Pay It®, Plan It®

Amex Pay It, Plan It is an American Express credit card feature that lets you pay off smaller purchases (less than $100) quickly or create a payment plan for larger purchases over $100. You can then pay your “Plans” off in fixed monthly payments with no interest, but with a fixed fee. The Amex mobile app enables you to seamlessly use this feature on the go, and you can have up to 10 Plans at a time.

EXPAND

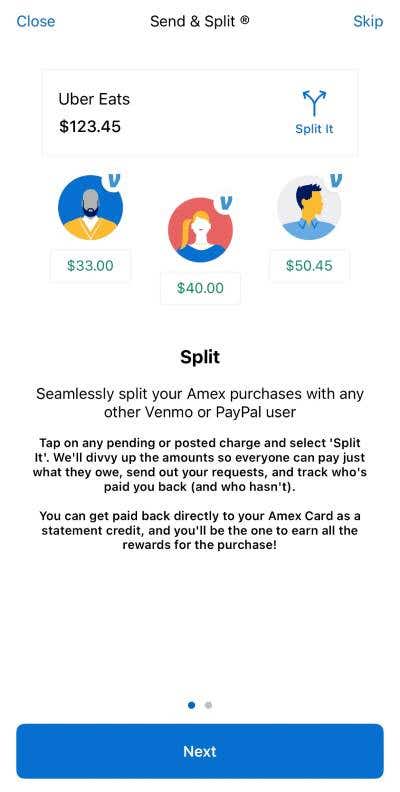

Send & Split

This feature on the Amex App lets you split purchases with other Venmo and PayPal users, making it easy to split the bill when you go out to dinner with friends or make a group purchase.

EXPAND

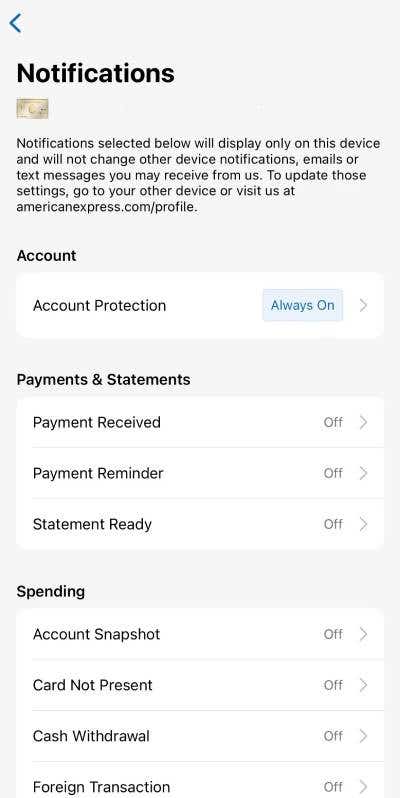

Account alerts

You can also set up account alerts that notify you when a purchase is made, payment is due or suspicious activity is noted. You can get these notifications throughout the day on your mobile device once you download the Amex App and set them up.

EXPAND

Mobile chat option

Gone are the days of having to call into credit card customer service hotlines. The American Express mobile app lets you chat with a live Amex customer service agent using your mobile device.

How to navigate the American Express mobile app

The American Express mobile app is easy to navigate and use, and you can get started as soon as you download the mobile app to your favorite device.

- Connect the app with your Amex account by logging in with your credentials.

- Once you log into the app, the main page shows you information like your credit card accounts and any savings accounts you have with the bank.

- If you scroll down from there, you can see recent transactions made on your accounts. This includes any purchases you’ve recently made with connected Amex credit cards, as well as recent payments and credits.

EXPAND

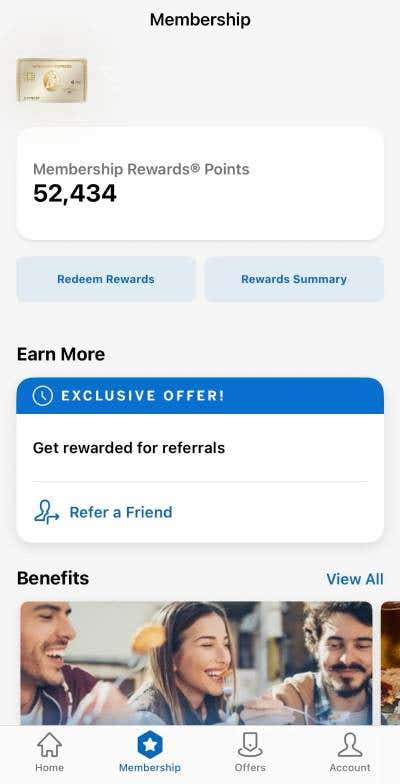

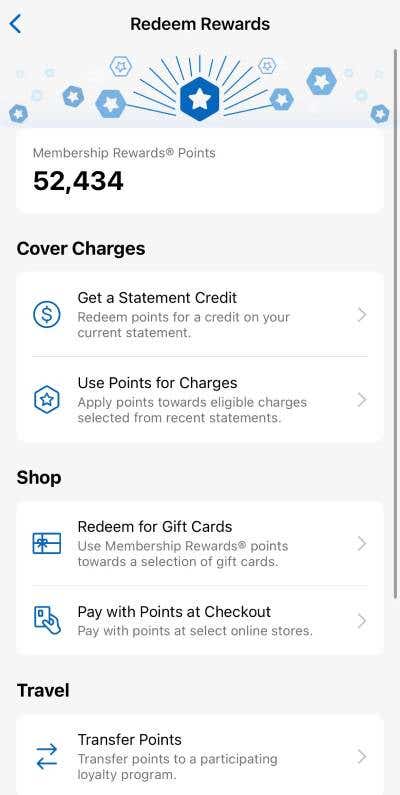

The Amex mobile app also makes it easy to monitor, track and even redeem rewards. You can navigate to the rewards section of the app by clicking on “Membership” at the bottom of the main page. This brings you to the rewards and benefits section of the app, where you can see an overview of the cardholder benefits available with your card, as well as the available redemption options for your rewards.

Depending on the Amex credit card you have, you may be able to redeem rewards for statement credits, merchandise or even point transfers to Amex airline and hotel partners.

EXPAND

The good news is that the Amex app is available for all American Express credit cards issued in the United States and is set up for ease and convenience. The intuitive interface makes it easy to perform various tasks, from checking your rewards balance to setting up notifications for purchases.

American Express mobile app security

Once you log into the mobile app, you’ll notice that the Amex app comes with plenty of security features. These include purchase alerts that can notify you each time your Amex credit card is used, instant fraud alerts that notify you of suspicious activity and reminders that let you know when a payment is due. You can also use the app to freeze your card instantly if it’s lost or stolen.

Bankrate’s take:

One of the safest ways to secure your account is with a fingerprint or FaceID login.

Bankrate’s take: Pros and cons of the American Express mobile app

Amex mobile app strengths

- Lets you monitor your purchases and payments on the go

- Offers advanced security features to help you protect your account

- Makes it easy to utilize Amex Offers to earn more cash back or other rewards

- Gives you easy access to your rewards balance and redemption options

- Lets you use Amex Pay It, Plan It to quickly make a payment or to set up a fixed payment plan with no interest

- Offers account alerts that can help you track your spending and purchases or identify fraud right away

- Enables live chat with a customer service agent using the app

Amex mobile app weaknesses

- Some users complain about glitches that occur with the app’s fingerprint login

- Some users have mentioned the app is harder to use for other accounts such as CDs or high-yield savings accounts

- Some users have reported difficulties redeeming their Amex Membership points for gift cards

The bottom line

The American Express mobile app can make keeping track of credit card purchases and payments a whole lot easier. Fortunately, the app is entirely free to use, so you can give it a try without a big commitment.

Of course, you’ll need an American Express credit card before you can put the app to the test. If you’re not an American Express customer, or if you’re looking for a new Amex credit card to try, make sure to compare all the top options before you decide.

Why we ask for feedback

Your feedback helps us improve our content and services. It takes less than a minute to

complete.

Your responses are anonymous and will only be used for improving our website.

Help us improve our content

Read the full article here