As a major domestic airline with plenty of partner brands, United Airlines can be a solid choice for your upcoming travels. When you fly with the airline itself or with one of United Airlines partner airlines, you can earn United MileagePlus miles. Those miles are redeemable for flights with United or its vast network of Star Alliance partner airlines as well as additional worldwide partners in the travel and hospitality spaces.

In this guide, we will dive into United’s partners and how to earn and use United miles.

United Star Alliance partners

United Airlines is a member of the Star Alliance, a global network of 20-plus airlines. These airlines offer flights to nearly every destination in the world. By flying on airlines within the same alliance, you can accrue miles and status more quickly, which can provide additional benefits and miles to redeem for award flights across the alliance.

-

- Aegean

- Air Canada

- Air China

- Air India

- Air New Zealand

- All Nippon Airways (ANA)

- Asiana Airlines

- Austrian

- Avianca

- Brussels Airlines

- Copa Airlines

- Croatia Airlines

- EgyptAir

- Ethiopian Airlines

- EVA Airways

- LOT Polish Airlines

- Lufthansa

- Scandinavian Airlines (SAS). Note that SAS will be departing the Star Alliance in August 2024 to join SkyTeam, another global airline alliance.

- Shenzhen Airlines

- Singapore Airlines

- South African Airways

- SWISS

- TAP Air Portugal

- Thai Airways International

- Turkish Airlines

Benefits of Star Alliance Gold status

When you meet United’s Premier Gold requirements, you will automatically receive Star Alliance Gold status. This status entitles you to benefits that apply across all airlines within the alliance. Benefits of this status include priority airport check-in, priority baggage handling, access to airport lounges within the alliance network, priority boarding and more. These benefits can be quite helpful and make your next trip a breeze if you fly on airlines within the network.

In fact, meeting status with any of the Star Alliance partner airlines could qualify you for some level of Star Alliance status. You can check whether your airline status qualifies on the Star Alliance website.

EXPAND

Other United airlines partners

United has several partner airlines outside of Star Alliance. While benefits vary by airline, expect the option to accrue United miles on each airline as well as access flights to destinations not served by United nor its Star Alliance partners. For example, through its partnership with Virgin Australia, you can access cities such as Hobart on a single itinerary sold by United and accrue miles for the journey. Keep in mind, since these are not Star Alliance partners, some services such as mobile boarding passes, priority customer service or cabin options may not be available on these airlines.

-

- Aer Lingus

- Air Dolomiti

- Airlink

- Azul

- Boutique Air

- Cape Air

- Discover Airlines (formerly known as Eurowings Discover)

- Edelweiss

- Emirates

- Eurowings

- Flydubai

- Hawaiian Airlines

- JSX

- Olympic Air

- Silver Airways

- Virgin Australia

- Vistara

United hotel partners

United partners with several hotel chains providing yet another way to accrue miles. These partners operate more than 15,000 hotels worldwide so they likely offer a location near most destinations you could imagine. Benefits can vary by hotel brand and chain.

Partner hotels include:

How to earn miles with United partners

Earn with Star Alliance flights

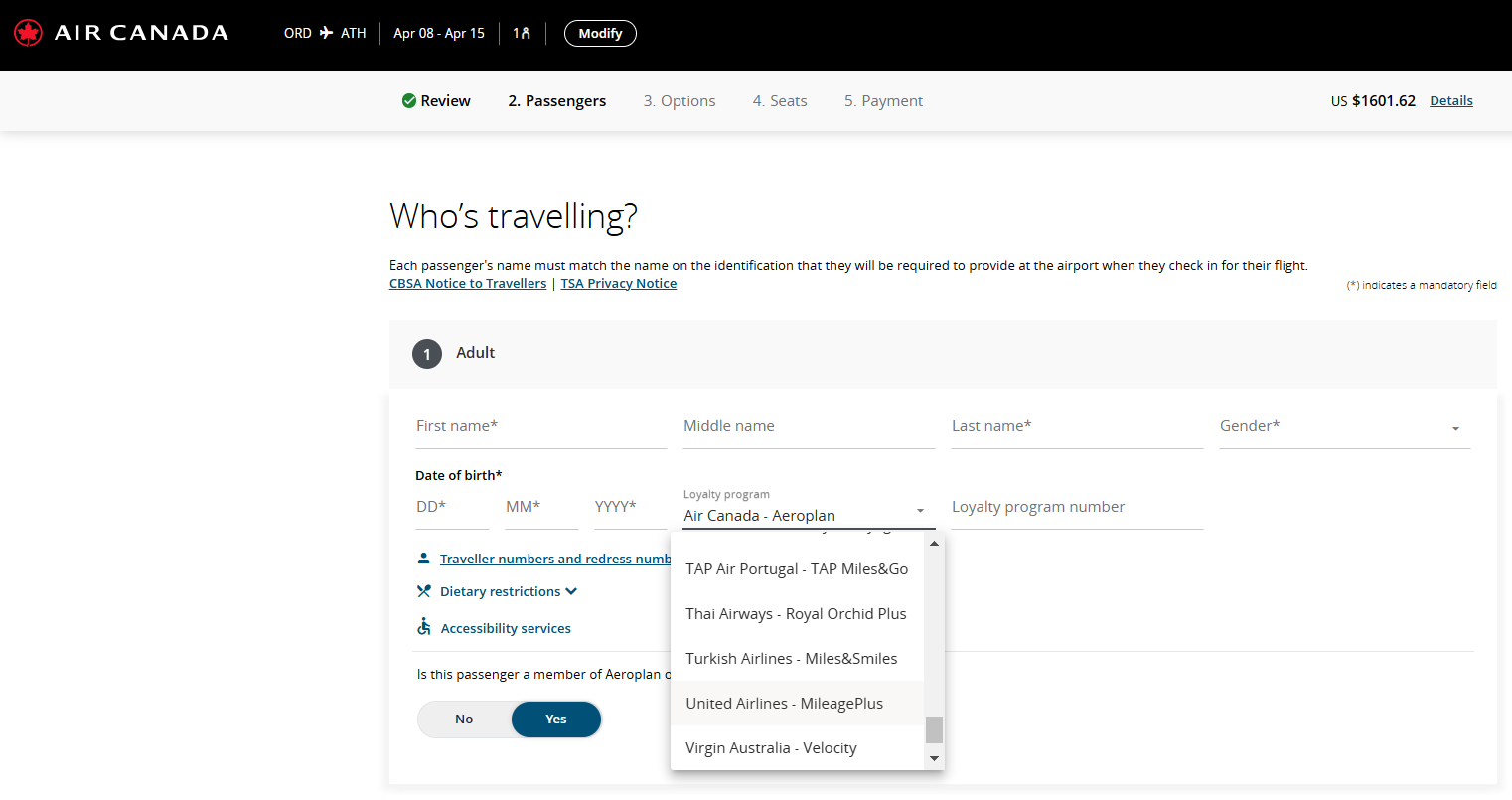

You can earn miles by flying with United partner airlines within the Star Alliance. When you fly with one of United’s airline partners, you can earn United miles simply by adding your MileagePlus number when you book your tickets. This option can often be found in the booking flow as you fill out the passenger information section, as it is for the Air Canada flight example.

EXPAND

Keep in mind that the amount of miles you earn can vary depending on how you booked the partner flight. If you bought your tickets directly from United, you’ll earn miles based on the fare and your MileagePlus status level. When you book a flight through a partner airline, you’ll earn miles according to the distance of your flight and your fare class.

If you’re seeking Premier status with United, Premier-qualifying credits can vary, and not all partner tickets are eligible for Premier-qualifying points. For a full rundown of Premier-qualifying credits with partners, you can visit this page on United’s website.

Lastly, each Star Alliance airline has its own rewards program and points are not exchangeable. If you have points on Lufthansa for example, you can not redeem those for United MileagePlus miles.

Earn with other partner flights

On top of the Star Alliance, United partners with additional worldwide airlines, so you’ll have even more options to earn MileagePlus miles. The ease of crediting these flights to United MileagePlus can vary by partner airline so be sure to check at booking or contact the partner airline to ensure it is credited correctly.

Earn with hotel partners

You can earn miles from hotel partners by connecting your MileagePlus account or by booking via United’s travel portal. The amount of points you can earn will vary depending on hotel partner, amount spent or length of stay. For example, for a stay at a Hyatt hotel, you can earn 500 miles per stay while a stay at a JW Marriott would earn 2 miles per $1 spent. Be sure to review the benefits by hotel to determine the best hotel choice for yourself if you want to maximize earning miles.

Earn miles with United credit cards

When it comes to earning United miles, credit cards can be a great option. United’s co-branded credit cards offer a way to earn miles directly from your purchases. In addition, you can use a flexible travel credit card, such as those in the Chase Ultimate Rewards program, that allows you to transfer those points at a 1:1 ratio to United MileagePlus. These are great opportunities to maximize your MileagePlus miles earning, plus take advantage of other card perks like no foreign transaction fees or travel protections. Here are a few credit card options you might want to consider:

United Explorer Card

The United℠ Explorer Card* offers entry-level loyalists an easy way to earn rewards on United purchases, for a reasonable $95 annual fee (waived the first year).

To start, the Explorer Card offers a 50,000-mile welcome bonus after spending $3,000 in the first three months. Plus you’ll receive 2X total miles on United purchases, 2X miles on dining and hotel stays booked directly with the hotels, as well as 1X miles on all other purchases.

A few additional perks of this airline credit card include your first checked bag free, up to $100 in credits toward your Global Entry or TSA PreCheck application fee, priority boarding and two one-time-use United Club passes at approval and each year after your account anniversary.

United Club Infinite Card

You’ll pay a hefty annual fee ($525) to own the United Club℠ Infinite Card*, but if you fly often enough with the airline and can take advantage of the card’s many perks, it can be worth it.

To start, you’ll earn 80,000 bonus miles after spending $5,000 in your first three months, as well as 4X miles on United flight purchases, 2X miles on all other travel, dining and eligible delivery services and 1X miles on everything else.

Premium perks of the Club Infinite Card include automatic United Club lounge membership, United Premier Access (meaning priority check-in, boarding and more), two free checked bags each for you and one companion, a few travel credits to expedite the airport security process and more.

United Business Card

If you’re a small business owner and frequently fly with United, the United℠ Business Card is a solid option to consider. For a $99 annual fee (waived the first year), you’ll earn 2X miles on United Airlines purchases, dining, gas station purchases and on office supplies, local transit and commuting (plus 1X miles on all non-category purchases).

The card offers a 75,000-mile welcome bonus after you spend $5,000 in the first three months, plus a variety of additional benefits: First checked bag free for you and a companion, $100 United travel credit after marking at least seven United purchases and more.

Chase Sapphire Preferred Card

Chase Ultimate Rewards points transfer at a 1:1 ratio to United MileagePlus, making the Chase Sapphire Preferred® Card a good option for traveling with United.

With the Sapphire Preferred, you’ll earn 5X points on travel through Chase Ultimate Rewards and 2X points on general travel, as well as 3X points on dining, select streaming services and online grocery purchases and 5X points on Lyft rides (through March 31, 2025). All other purchases earn 1X points.

There’s a $95 annual fee, but you’ll have the chance to earn a limited time 75,000-point welcome bonus after spending $4,000 on purchases in the first three months and can enjoy a wealth of travel protections. Other benefits include an annual $50 hotel credit and a 10 percent anniversary point bonus.

Chase Sapphire Reserve

The Chase Sapphire Reserve® is a great choice if you’re looking for a more premium travel card with access to the same Chase transfer partner perks.

To start, you’ll earn 5X points on travel purchased through Chase Travel and 3X points on general travel (after first earning your $300 travel credit). The card also offers 3X points on restaurant purchases, 10X points on Lyft purchases (through March 2025), 10X points on Chase Dining purchases and 10X points on hotel stays and car rentals through Chase Travel (plus 1X points on everything else).

The card charges a steep $550 annual fee, but you’ll get Priority Pass Select lounge membership, a $300 annual travel credit (as noted), a Global Entry or TSA PreCheck credit, various travel protections and more. There’s also a limited time 75,000-point welcome bonus after spending $4,000 in your first three months.

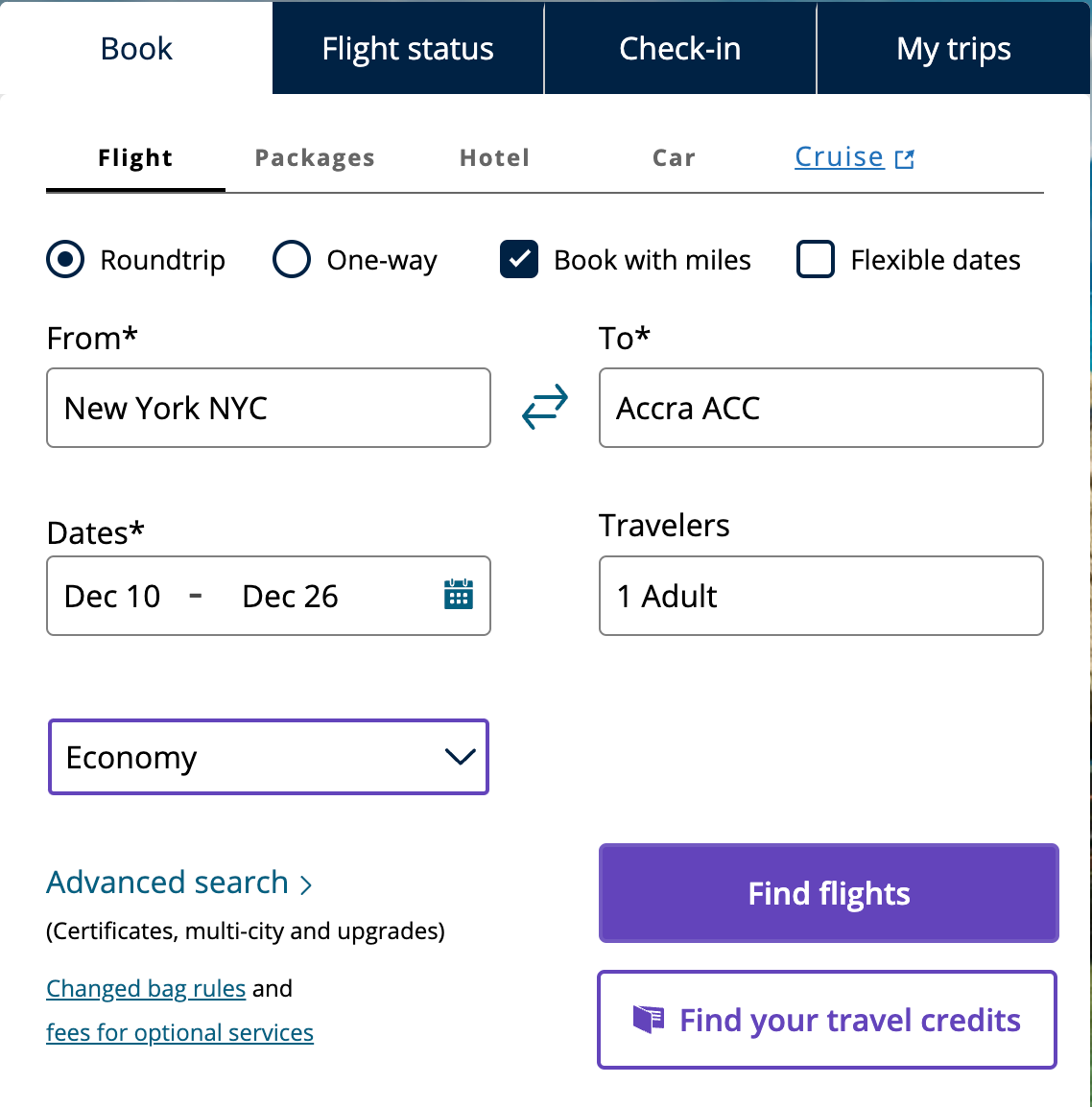

How to redeem miles with United partners

Once you’ve racked up enough United MileagePlus miles to redeem for an award ticket, you can check your options directly through United’s website or mobile applications. Searching for an award flight is simple. On the website or app, enter your desired departure airport or city and final destination alongside your travel dates, number of travelers and desired cabin class. Be sure to check the “Book with miles” box in order to see available flights that can be paid for in MileagePlus miles.

EXPAND

From there, you can view all award seats available to your destination with United, its Star Alliance partners and other partner airlines. You can then book your award flight using your miles.

EXPAND

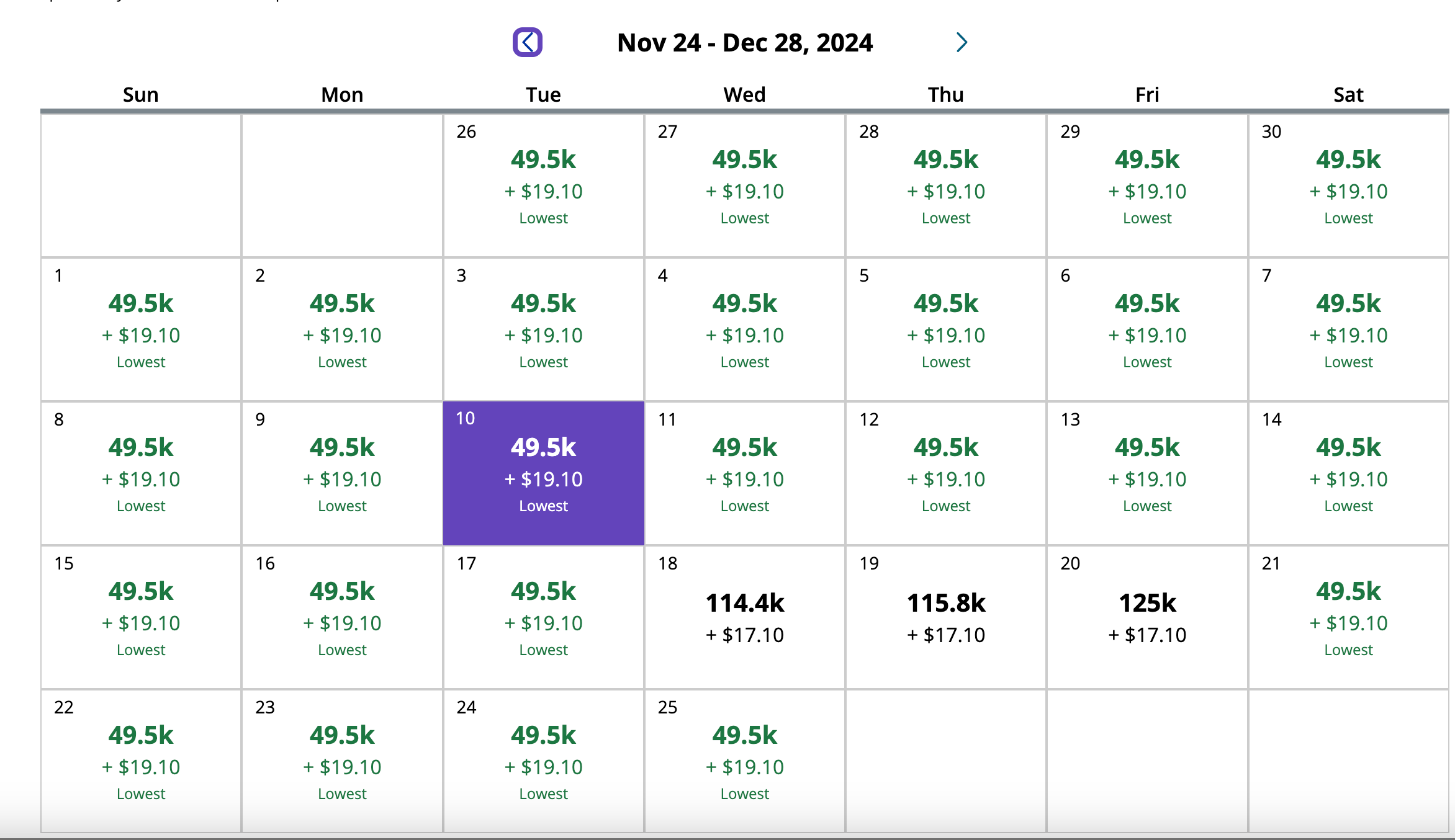

United also allows you to view a 30-day calendar to find which days have the lowest miles costs.

EXPAND

Frequently asked questions

-

In addition to airline partners, you can also earn United MileagePlus miles with hotel and rental car partners as well as a few retailers.

-

- Macy’s

- Teleflora

- Walmart

- Goldbelly

- Harry & David

- VRBO

- CLEAR

-

The best transfer partners for United can vary depending on your goals and desired destination. Be sure to review all the options and make the choices that best work for you.

-

You can earn miles without flying by spending on a United co-branded credit card, transferring Chase Ultimate Rewards points to United at a 1:1 ratio, or through United Dining and shopping programs.

The bottom line

With a global network of partner airlines, hotels and shops, there are numerous ways to earn and redeem United MileagePlus miles. If you’re a frequent traveler with United, its wide range of airline partners can help you stretch your MileagePlus miles even further with added destinations and access.

Just remember, your United miles will often go furthest when you book United flights directly through United. And to maximize your miles rewards over time, don’t forget to check for additional partner benefits when you book a hotel, rent a car or shop with partner retailers.

*The information about the United℠ Explorer Card and United Club℠ Infinite Card has been collected independently by Bankrate.com. The card details have not been reviewed or approved by the card issuer.

Read the full article here