You can lower your credit card interest without hurting your credit score by negotiating a reduced interest rate with your credit card company, making extra payments, which allows you to reduce your balance sooner and pay less interest overall, or working with a nonprofit credit counseling agency like American Consumer Credit Counseling (ACCC). A structured approach, such as a Debt Management Plan, can significantly reduce interest rates and simplify monthly payments while helping you stay on track and build your credit back. I have compiled some credit-safe ways to reduce interest costs and avoid common mistakes that could hurt your score, and will share them below.

Key Takeaways

You can reduce credit card interest without damaging your credit if you choose the right strategy.

Small changes like asking for a lower rate can make a big difference in your monthly payment and the amount of interest you pay long term.

Making extra payments alone reduces the interest you will pay long term, but does not change your interest rate.

Nonprofit support through ACCC can provide structure and reduced interest rates without needing to take on more debt when using a debt management plan.

Making on-time payments and having a clear plan can improve your financial health and credit over time.

A Home Equity Line of Credit (HELOC) has often been a method used to pay off credit card debt, but if your debt-to-income ratio is too high, you may not be eligible for a HELOC.

Debt Settlement and Consolidation can have a long-term negative impact on your credit score.

Why is Credit Card Interest so high?

Credit card interest rates are high because credit cards are unsecured loans. Unlike a home or a car, nothing is backing them. If you don’t pay your mortgage or car payment, the lender can take it back, but with credit cards, there is no collateral. Since there is no collateral, the credit card companies take more risk if you don’t pay off your debt, so they charge higher interest rates to protect themselves against default.

How do Credit Card Companies Determine Interest Rates?

The interest rate you receive when you apply for a credit card is set by the credit card company. According to the CFPB, credit card companies look at several key factors when deciding on the APR or interest rate you will be offered.

- Your credit score

- Your payment history

- The amount you owe

- Default history

Your interest rate affects how much interest is added to your balance and how much progress you make with each payment. Keep in mind that the minimum payment is not based on your interest rate.

Credit card companies usually use one of two methods to calculate minimum monthly payments.

- A flat percentage of your total balance

- A fixed dollar amount plus interest and fees

You would need to check with your credit card company to determine which method they use. Some companies will use the larger of the two listed above.

How Can I Lower My Interest Without Hurting Your Credit

- Call Your Credit Card Issuer

- Ask for a lower APR (especially with a good payment history).

- No credit impact, and it can lead to real savings.

A higher APR means more of your minimum payment goes to interest; it will take longer to pay off the balance.

A lower APR means more of your payment goes to reducing your actual debt

- Make More Than the Minimum Payment

- Reduces the balance faster, which means less interest.

- Try biweekly payments or rounding up to the next $50/$100.

- Look Into a Balance Transfer (With Caution)

- 0% APR intro offers can help, but only if you pay off during the promo period.

- May result in a temporary credit score dip due to a new account inquiry.

- If you don’t pay off the balance during the introductory period, the balance will be subject to a higher interest rate, up to 18-29% or higher.

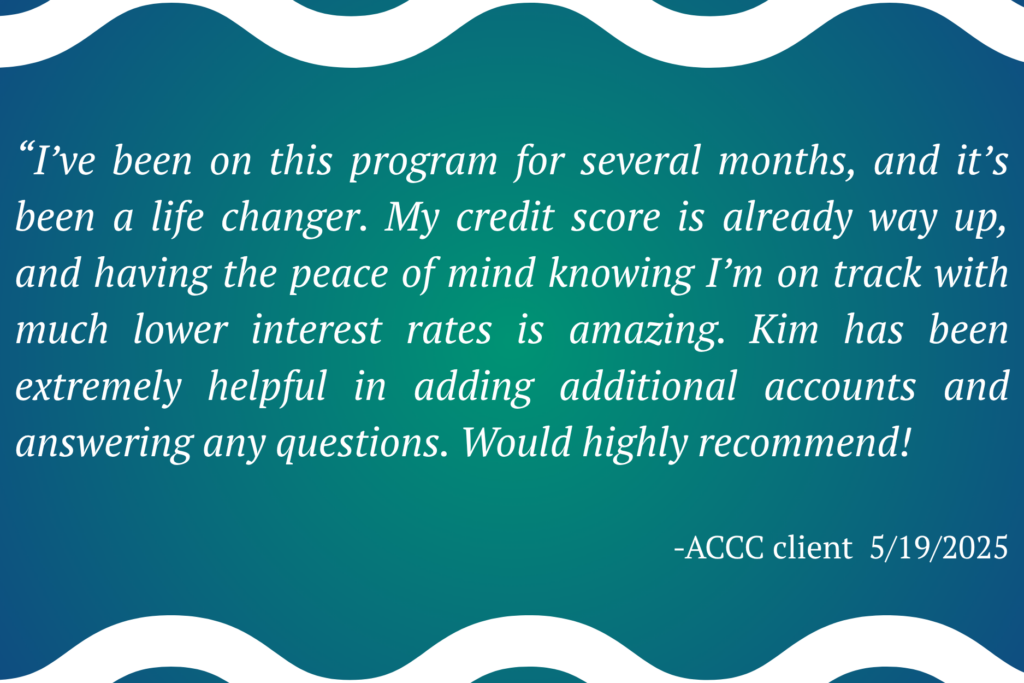

- Work with a Nonprofit Credit Counseling Agency (like ACCC)

- Through a Debt Management Plan, you may qualify for lower interest rates and a single monthly payment.

- While most credit card companies will require that accounts be closed, clients typically see long-term credit improvement from consistent on-time payments.

- No new loans, no credit damage from consolidation or settlement scams.

What to Avoid If You Want to Protect Your Credit

If you want to protect your credit, don’t miss payments, as it can do long-term harm. A missed payment can significantly lower your credit score because payment history makes up the largest portion of your credit score, about 35%. Even one late payment can stay on your credit report for up to seven years and signal to lenders that you are a higher risk.

Also, avoid closing old accounts on your own—it can hurt your credit utilization and account age. When you close accounts, your credit utilization ratio can increase, and the average age of your credit history may decrease.

Debt settlement can seriously damage your credit. These programs often require you to stop making payments so the settlement company can pressure creditors into accepting less than you owe. This leads to late fees, collections, charge-offs, and a major drop in your credit score. Even if a settlement is reached, your credit report will show that the account was “settled for less than the full amount,” which can stay on your report for up to seven years and make future borrowing more difficult.

Debt consolidation loans can also pose risks if not managed carefully. While they may offer a lower interest rate, they require taking out a new loan, triggering a hard credit inquiry and potentially lowering your credit score. If you continue using your credit cards after consolidating, you could end up deeper in debt.

How Do I Know When I Need Help Paying Off Credit Card Debt?

If you’re juggling multiple credit card payments and still seeing your balances grow, it may be time to seek help. When interest charges are eating up your payments or you’re relying on credit just to cover everyday essentials, it’s a clear sign that your debt is becoming unmanageable. Getting support early can help you avoid long-term financial damage and start building a plan to regain control.

One of the best proven methods to lower credit card interest without hurting your credit score is to work with American Consumer Credit Counseling (ACCC) to review your budget and learn how a debt management plan can help you get back on your feet financially. It is not a quick fix, but it’s a sustainable solution that helps you make long-term changes, reduce interest rates, and pay down your debt with a single, manageable monthly payment. With the right support and a clear plan, you can regain control of your finances and your peace of mind.

If you’re struggling to pay off debt, ACCC can help. Schedule a free credit counseling session with us today.

Read the full article here