As you complete your 2023 taxes, you may wonder how long you are required to keep your old tax returns and other paperwork associated with filing your taxes. For those with printed copies of your tax returns, you might wonder if you can scan them. Keep reading as I share how long you should keep your old taxes and how to get them out of your way.

How long do you need to keep old tax records, receipts, and total tax returns (state and federal)? Another common question is how to safely store these tax documents without feeling like a hoarder.

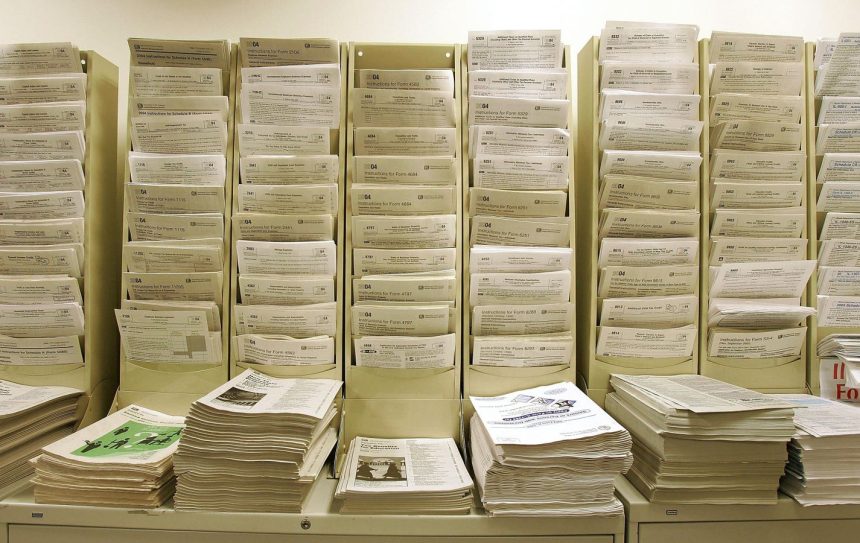

While providing tax-planning guidance over the years, I’ve met several people with countless boxes full of old receipts, documents, and tax returns. While some tax documents needed to be kept, most could have been shredded and thrown away long ago. A few of you probably have a storage unit full of boxes of old paperwork, which you will likely never look at again.

What Does The IRS Suggest About Keeping Old Tax Returns?

According to the IRS, how long you should keep your tax documents will depend on the type of files you are talking about and what kind of taxable transactions the paperwork relates to. In plainer English (but still vague), you should keep any tax records to support your income, including various tax deductions, tax credits, and exemptions, until at least the period of limitations ends for each tax return. If you aren’t a CPA or a certified financial planner, you are likely wondering what that means for you and your stacks of tax documents. I’ll explain.

What Is The Period Of Limitations?

According to the Internal Revenue Service, the period of limitations is when you can still amend your tax returns to claim a tax credit or refund. The IRS may still assess you with additional tax liabilities during this period. Specific examples of this are listed later in this article. Unless stated otherwise, a period of limitations refers to years after the taxes were filed. Tax returns filed early are considered filed on the deadline, usually around April 15. However, the time period of limitations for returns filed on extension (typically after April 15) will be years from the actual date the taxes were filed.

I’m a fan of keeping copies of your filed tax returns indefinitely. Access to copies of your older tax returns may help prepare future tax returns and make computations if you need to file an amended return. With the help of easy scanning and cloud storage of old tax docs, I don’t see many reasons to throw out older tax returns. I think we could all save a lifetime of tax returns on our computers without putting a dent in our storage limits.

Period Of Limitations That Apply To Income Tax Returns Via The IRS website

1. Keep records for three years if situations (4), (5), and (6) below do not apply to you.

2. Keep records for three years from the date you filed your original return or 2 years from the date you paid the tax, whichever is later if you file a claim for credit or refund after you file your return.

3. Keep records for seven years if you file a claim for a loss from worthless securities or bad debt deduction.

4. Keep records for six years if you do not report income that you should report and it is more than 25% of the gross income shown on your return.

5. Keep records indefinitely if you do not file a return.

6. Keep records indefinitely if you file a fraudulent return.

7. Keep employment tax records for at least four years after the date that the tax becomes due or is paid, whichever is later.

Generally speaking, you will need to keep your tax records between three and seven years. Remember to keep your tax records for seven years to be on the safe side without needing to recall the fine print. Below, I share a few exceptions to keeping tax returns for “just” seven years.

Rule of thumb: The higher your income and the more complicated your tax returns are, the more likely you should err on the side of caution and keep records longer than the IRS minimum recommendations. If you are owed a tax refund, take the time to file your taxes and get your money.

When Should You Keep Some Tax Records Longer Than Seven Years?

With seemingly unlimited digital storage, keeping old tax records seems easier than manually deleting them each year. I will likely keep my older tax records indefinitely. Also, as a business owner, I have found it interesting to revisit my income and even business expenses throughout my career as a financial planner.

Rules For Tax Records Connected To Real Property

When you own real property (house, rental property, cars, collectibles), you should keep all tax records for at least three years after selling that property and filing the corresponding tax returns. This may include but is not limited to, records for depreciation, amortization, or depletion deduction, all of which will determine whether you will realize a capital gain or loss when you sell the property. When selling a home or disposing of property, your taxable gain is not necessarily the same as the difference between the purchase and sale prices.

For those using 1031 exchanges on rental properties you own, you will need to keep your tax records even longer. Since that transaction is a nontaxable exchange, your basis in the new property will be the same as your basis in the property you owned before the 1031 exchange, plus any additional money you paid into the cost basis. In that case, you must keep records from the original property and the new property for at least three years after you sold the newer property and filed the corresponding taxes.

The exception here is if you were to do another 1031 exchange. In that case, you should keep everything forever. All kidding aside, you will need to keep records back to the first property through the current property, which, in many cases, could be decades. I know many people who have owned rental real estate longer than I’ve been alive, even a few who have owned it since before my parents were born. That is a lot of tax records to keep.

State Tax Documents Retention Requirements

Make your life simple; keep your state tax documents with your federal tax documents. Not surprisingly, the document retention rules can vary from state to state, so take a moment to figure out how long your state expects you to keep tax records. Your state’s tax agency may have a longer timeframe to audit your state tax return than the IRS has to audit your federal returns. For example, I live in Los Angeles, where the California Franchise Tax Board has up to four years to audit state income tax returns. With that timeframe, California residents should keep their state tax records for at least four years.

How To Securely Dispose Of Old Tax Documents

Please don’t just throw your old returns into the garbage. Your tax returns contain so much personal information, such as your Social Security number. You don’t want this information to fall into the wrong hands. Once you have scanned your tax documents, dispose of them securely. At the very least, shred them before throwing them in the trash.

Beyond your actual tax returns, check and see if you need any supporting tax documents for other purposes. You should keep contracts for auto loans, home mortgages, insurance documents, medical bills, and warranty information. The list of financial records you should keep is much longer than what the IRS requires.

Read the full article here