In 2022, based on data from the CDC, there were more than 673,989 divorces in the US during that year alone. One study that asked divorcing parents why their relationship ended saw 40 percent of the participants cite issues with how their spouse handled money as a major factor. So, if you are wondering how money issues kill marriage, this article answers that question.

Money Issues in Marriage and Divorce

Disagreements about money or general economic stress can lead to increasing levels of conflict in a marriage. As a result, money issues can essentially kill the relationship. Which leads the couple to opt for a divorce. By understanding how money issues impact a marriage, you can take steps to address problems before they lead to a separation.

Here’s a look at the most common financial problems people encounter in marriages and how you can handle the situations.

Conflicting Money Management Personalities

A key concept to remember in thinking about money and marriage is that money is inanimate. It is important because of the values and meaning people place on money.

This means that financial conflicts in marriage are really conflicts about values, not necessarily about dollars and cents.

This is often reflect in people’s behavior. For example in some cases, one spouse is a “spender” while the other is a “saver.” They have different money management personalities, impacting their priorities and values, and influencing their spending patterns in ways that don’t always make sense to their spouse.

Even if a couple is debt-free, conflicting viewpoints on money can cause strife. One may view the other as a cheapskate while the other sees the first as being irresponsible. This is because the couples have placed different values and meaning onto money.

Issues of Expense Management

If both spouses earn an income, coming up with a reasonable way to split expenses can be challenging. At times, one spouse may feel that the arrangement isn’t fair, creating an air of resentment if they feel that they are shouldering more of the burden than is due.

For example, if a couple initially agrees to split household expenses down the middle, but one earns substantially less than the other, conflict can arise. The spouse with the lower income may believe that they are getting the worse end of the stick, as their spending power is limited by a larger degree.

In some cases, this can be mitigated by adjusting the allocations. Using a percentage-based approach may make it feel more equitable. However, this can also lead to issues if the higher earner perceives this option as a punishment for making more money.

Additionally, splitting income and expenses can make joint planning more difficult. It may be hard to determine how things should work if one spouse loses their job unexpectedly or wants to quit their position to pursue something else, whether that be a new career, more education, or starting a family.

Problems with Debt

Debt can be a contentious topic. Many adults bring financial baggage into a marriage since they likely have debts that they are bringing with them into the relationship. If one spouse has negative feelings about the other’s debt load, this can lead to conflict.

Similarly, disagreements about joint debt can harm a marriage. For example, if one spouse maxes out a credit card without the others knowledge, this can feel like a significant breach of trust. Further, if the rising debt total hinders other financial goals, resentment can build as one spouse makes it difficult for the other to feel financially secure.

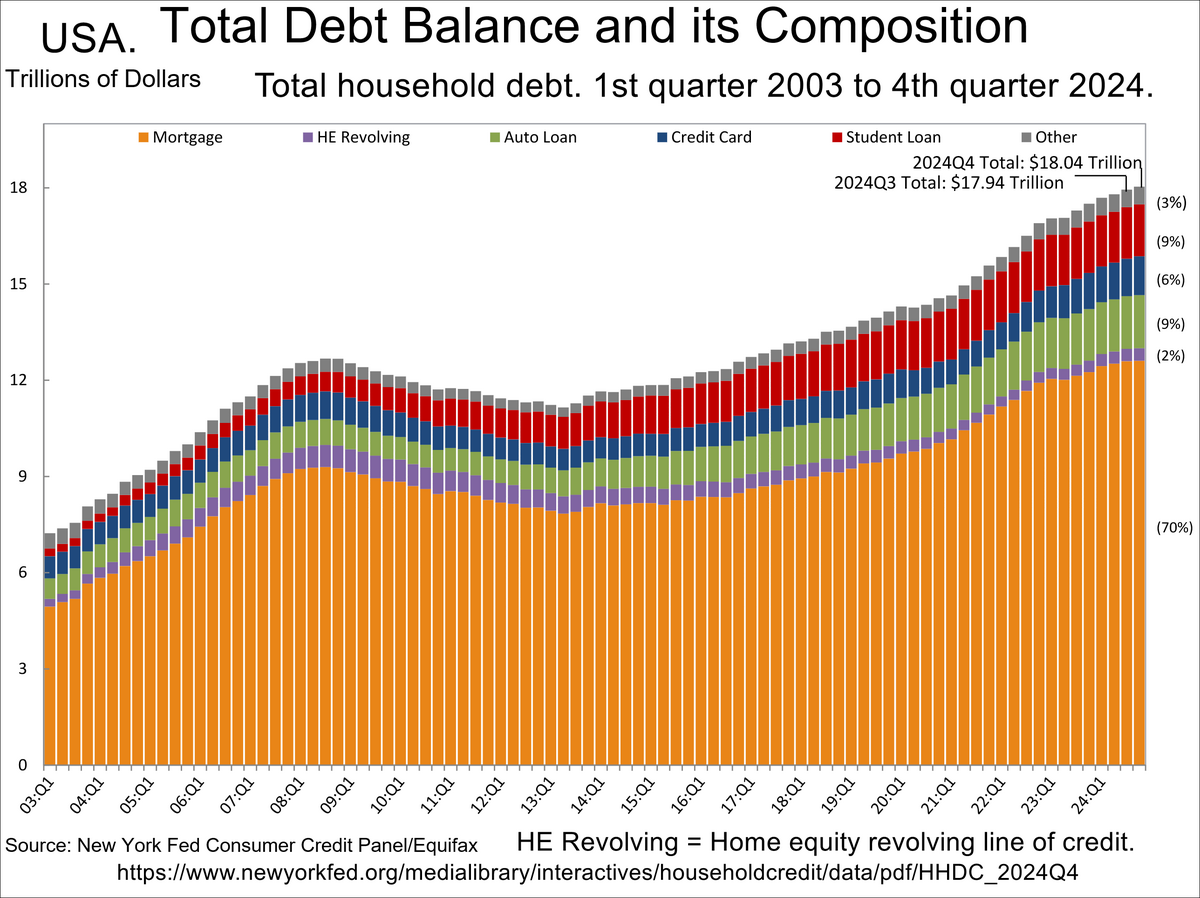

Here is a chart of total US household debt from 2003 to 2024. It shows clearly that household debt has increased substantially in the last two decades.

What this means is that large amounts of debt puts a strain on the household. This is true even in situations where both spouses believe the debt was necessary or unavoidable. Fear about a lack of financial well-being increases tension. A lack of liquidity can also harm the household’s quality of life, something that can breed frustration and lead to more stress.

Addressing Money Issues Before Divorce

In many cases, the best way to prevent money issues from leading to a divorce is to talk about money frequently. Have in-depth discussions about debt, savings goals, spending patterns, and other aspects that may cause conflict.

By listening to each other and planning together, you can seek out a happy medium. You can align your priorities so that each spouse gets some of what they need, and everything feels fair. As a result, having a monthly or quarterly discuss is critical if you want to avoid divorce. Another helpful approach would be to use a couples worksheet or guide discussion exercise.

David Bach has a number of good ones in the back of his book, Smart Couples Finish Rich. The Gottman Institute also has an number of excellent articles on marriage and money, here.

Have you had money issues in marriage before? Do you think financial problems led to your divorce? Tell us about your experience in the comments below.

Read More:

- 5 Rules for a Financially Blissful Marriage

- How a Polygamous Relationship Can Impact Your Finances

- 5 Things to Remember During a Divorce

- Worried About Getting A Prenup – Try Hello Prenup

If you enjoy reading our blog posts and would like to try your hand at blogging, we have good news for you; you can do exactly that on Saving Advice. Just click here to get started.

Read the full article here