Soon after the 2024 elections results rolled in, the speculation began about what they might mean—especially when it comes to the economy and taxes. One common assumption is that a Republican victory will immediately lead to tax cuts. But if we’ve learned anything from history, it’s that what we think will happen—and what will actually happen—may be different things. While tax cuts may be in the cards, how quickly they get pushed through is uncertain.

Results

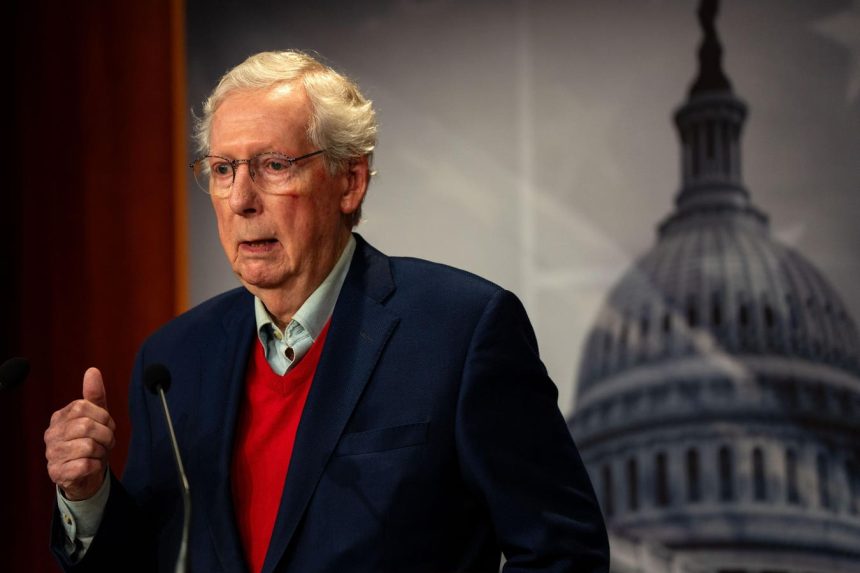

Earlier this week, the Republicans claimed victory in the White House and, unless there’s a surprise in the next few days, that will also be the case in both the Senate and the House. Most assume that should mean that Republicans can quickly easily push through their economic and tax agenda.

There’s just one thing potentially standing in their way—reconciliation.

Reconciliation is a wonky word that gets bounced around quite a bit. Here’s where it comes into play and why it matters for 2025.

Budget Process

Congress is responsible for passing a budget each year. As part of the process, Congress passes 12 annual appropriation acts—you can think of appropriation acts as funding bills. When appropriations have not been passed by October 1—the deadline for the budget for the fiscal year—Congress temporarily funds the government by passing what’s known as continuing resolutions. These resolutions typically keep funding at the same levels as the previous year until a larger appropriations bill (a so-called omnibus bill) can be pushed through Congress.

That’s what’s happening in Congress now. Despite the fact that the current fiscal year began on October 1, we don’t yet have a budget for it. That’s not necessarily surprising—it’s been the case in each fiscal year since 1997—but it does have the potential to create chaos in an election year.

Just before the October 1 deadline, the Senate voted 78-18 to pass a continuing resolution to extend federal spending and avoid a government shutdown. However, that resolution is only good through December 20. If Congress can’t reach an agreement on spending by that time, the government will run out of money and we will potentially face a shutdown.

Don’t think it could happen? In 2018, following the mid-terms, Congress couldn’t agree on a spending bill during the lame duck session. A fight over funding to build a border wall between the U.S. and Mexico resulted in a stalemate and the longest government shutdown—35 days—in U.S. history.

Even if a shutdown isn’t in the cards this year, there’s still a real likelihood that we won’t pass a budget by the end of the calendar year. As of today, the Democrats control the Senate (barely), but that won’t be the case in January. The Republicans don’t have much of an incentive to work with Democrats to pass anything by the end of the year, and they would likely benefit more from waiting until they’re in charge.

Reconciliation

Since agreeing on a final budget can be slow, to speed things up, the Senate often jumps straight to a process called reconciliation. Reconciliation is especially beneficial when one party has the majority (more than 50 votes) but not a filibuster proof majority (60 votes). The process can be complicated, but generally, under reconciliation, the goal is to combine spending and revenue provisions into a single bill.

A bigger bill can be more complicated, so you would think that you’d want to avoid it, right?

Here’s the appeal. Reconciliation bills are subject to special rules in the Senate. First, debate is limited to 20 hours, which can help a reconciliation bill get to a vote quickly. More importantly, the bill cannot be filibustered—the 60 votes necessary to stop a filibuster are not required. That’s important when one party has a majority in the Senate, as the Republicans will in 2025, but not a supermajority since they do not have the votes to overcome a filibuster. (As of this writing, with three Senate seats yet to be called, the GOP has a 52 seat majority, so it’s not getting to 60.)

If the Republicans, who don’t have a majority in the Senate now, can sidestep passing a budget until 2025, when they do have a majority, they could advance a pretty significant tax and spending agenda through reconciliation.

That, however, doesn’t mean that they can get everything they want immediately.

Byrd Rule

Thanks to the Byrd Rule (named for the late Senator Robert Byrd (D-WV), there are some limits to reconciliation. For example, under the rule, you can’t tack on policy changes that are unrelated to the budget—including tampering with Social Security. Congress likes to tack on extras to push potentially unpopular measures through on the coattails of government funding, but that’s not allowed with reconciliation.

(And while the Byrd Rule applies to the Senate, it often has impact in the House. Specifically, since House and Senate budget bills have to line up, the rule can keep the House from adding provisions that aren’t related to the budget in its version since those would have to be stripped in the Senate.)

Also notable, any bill under reconciliation cannot increase the deficit beyond the fiscal years covered—that’s usually limited to 10 years (and why tax cuts rarely last forever). Some headlines suggest that Republicans will push for massive, permanent tax cuts, only that’s not possible under reconciliation if it contributes to the deficit beyond the window.

If some of this sounds familiar, it’s because Congress relies on the process pretty often. For example, the 2022 Inflation Reduction Act was passed under reconciliation, as were the Economic Growth and Tax Relief Reconciliation Act of 2001 (sometimes referred to as EGTRRA), the Health Care and Education Reconciliation Act of 2010, the American Rescue Plan Act of 2021 (ARPA) and President Trump’s big tax cuts in his first term, the Tax Cuts and Jobs Act of 2017 (TCJA).

What does this mean for tax cuts in the coming year? To avoid violating the Byrd rule, key parts of reconciliation bills—usually tax cuts—are written so that they will expire. When you hear conversations about certain provisions in the TCJA—like those lower income tax rates or the $10,000 limit on the deduction for state and local taxes (SALT)—”sunsetting” in 2025, it’s because they were passed originally with an expiration date. You can thank reconciliation and the Byrd Rule for that.

(If you’re scratching your head wondering why the corporate tax cuts under the TCJA were allowed to be made permanent, it’s because Congress can often find some wiggle room. In this case, the reconciliation rules under the budget resolution allowed for $1.5 million in revenue costs within the 10-year budget window.)

What Will Happen In 2025?

We could potentially see Congress use reconciliation at least twice in the coming year—once to agree on a budget for the fiscal year (assuming nothing is resolved by the end of 2024) and to resolve those sunsetting provisions under the TCJA. Key Republican leaders signaled earlier this summer that they would seek to do just that if they won a majority in the Senate.

Congress could also use reconciliation to tack on or tweak some additional tax provisions like the child tax credit and expensing for research and development to the budget. Both measures were included in the Tax Relief for American Families And Workers Act Vote, which passed in the House with bipartisan support but failed to make it to a vote in the Senate. (A procedural maneuver would allow it to be resolved in 2024, but again, we typically don’t expect much out of a lame duck Congress.)

So, will we see a rush to reconciliation resulting in tax cuts? Not likely. Even if there’s largely an agreement on priorities, there’s no guarantee that it will move quickly. In 2017, Republicans controlled the White House and both Houses of Congress, yet the TCJA wasn’t passed in the House and Senate until December 20, 2017.

Read the full article here