Now that the big tax push for 2023 is out of the way, it is time to plan for taxes in 2024. Part of this includes planning your charitable donations. Charity should come from the heart, but if you are charitably inclined, why not try to get the biggest bang for the buck and save taxes when you give to charity?

To get a deduction on your taxes for charity, you must itemize your taxes instead of taking the standard deduction. The Tax Cuts and Jobs Act of 2017 greatly increased the standard deduction, while also decreasing the type of deductions that can be itemized. Most people now can only itemize mortgage interest, charity, and up to $10,000 of property or state income tax. Medical expense deductions are limited, but some people have the misfortune of having enough medical expenses to also itemize. Your mortgage interest and charitable donations must be significant to reach the standard deduction of $14,900 for individuals and $29,200 for those married and filing jointly.

Given those barriers, what is the best way to make your donations to charity? I use two tactics – “tax bunching” and a donor advised gift fund.

Tax Bunching

The idea with tax bunching is to “bunch” the years that you itemize. For example, if you are a single person and you pay property taxes of $5,000 and give $5,000 per year to charity, but don’t have mortgage interest, you don’t have enough deductions to itemize. Your $10,000 in deductions is less than the $14,900 standard deduction. This assumes you don’t have state income taxes in addition to property taxes.

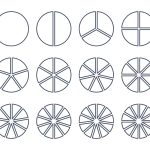

Bunching your deductions would look like this:

· Pay your 2024 property taxes early in 2024 and your 2025 property taxes late in 2024 so that you get the entire $10,000 in deductions in one year.

· Give your $5,000 to charity for 2024 throughout the year. At the end of 2024, give your charities another $5,000 donation for 2025.

Your tax deduction in 2024 will be $20,000, which is $5,100 higher than the standard deduction of $14,900. If you are in the 22% tax bracket, this will save you an additional $1,122 in taxes. In 2025, you will take the standard deduction.

Another tip is to bunch the donations of your “stuff” to charity. Last year, I took the standard deduction and this year we plan to itemize. I cleaned out closets last year, but held onto everything I wanted to give away until January, 2024. Since we are itemizing this year, we are organizing our entire house and donate everything we don’t need to charity this year. Hopefully my husband won’t keep sneaking some of those items back into the closets. Keep good records and use a reasonable donation value in itemizing the treasures you give away. Goodwill has a donation calculator as a guide.

Donor Advised Gift Fund

A donor advised gift fund allows you to donate cash or appreciated assets to a third-party fund and take the deduction in the year you make the contribution. Going forward, you can use the gift fund over many years to make donations to verified charities of your choice. Third-party providers include Fidelity and Vanguard among may others.

A donor advised fund is an excellent way to reduce the tax bite if you have an unusual year of big income, such as a large bonus from work or a sale of a rental property or business.

Here is an illustration:

· Let’s say you are single and give $5,000 per year to charity and have $9,000 in other deductions. This amount likely won’t be deductible because it is below the standard deduction of $14,900, so you take the standard deduction every year.

· You received an unusual $200,000 bonus along with $150,000 in regular income and you are now squarely in the 35% tax bracket instead of your usual 24% tax bracket.

· If you put $30,000 in a donor advised fund in the year of your bonus, you would have $39,000 in deductions, putting you $24,100 above the standard deduction and allowing you to itemize. This would save you an additional $8,435 in taxes ($24,100 x 35%) over the standard deduction.

· You can then use the gift fund to donate your $5,000 per year to charity for the next six years, and in those years, you would take the standard deduction.

· To go a little further, let’s say you have appreciated stock worth $30,000 that has capital gains of $20,000. You could donate that appreciated stock to the gift fund instead of cash, and you will save an additional 15% ($3,000) in future capital gains taxes.

Donor advised funds have underlying fees, but most are reasonable compared to the tax savings you receive. Also, the fund can be invested which can potentially increase the amount that goes to charity over time.

Tax bunching and the use of a donor advised funds are easy tactics that can save big bucks but takes a little bit of forethought. If you have an unusual income situation, talk it over early with your accountant or financial planner so they can devise the best strategy to maximize your charitable giving and reduce your taxes.

Read the full article here