Key takeaways

- Inflation isn’t as high as it was just a few years ago, but prices still rose 3.5 percent during the 12 months leading up to April 2024.

- The right credit card helps you get something back for each dollar you spend, which you can redeem to keep costs down.

- Bankrate data shows that 75 percent of credit card users who pay their balances in full each month also pursue credit card rewards.

Data out of the U.S. Bureau of Labor Statistics shows that inflation rose 3.5 percent over the 12 months leading up to April 2024. This figure is down from the sky high inflation figures we saw from government sources just a few years ago, but it still means everything we buy costs more now than it did before.

Fortunately, there are ways to make up for the rising costs of everything from groceries to household supplies, energy costs, dining out and discretionary spending — or at least get close. With the right credit card, you can get something back for each dollar you spend, then redeem your rewards to help reduce your credit card bill or get some items for free.

If you decide to use credit card rewards to help offset rising costs this year, you will just want to go about it the right way. This means using credit cards to your advantage and never, ever carrying a balance that accrues interest from one month to the next. This move would put you in good company. After all, Bankrate’s Chasing Rewards in Debt Survey showed that 75 percent of U.S. adults who typically pay their credit card in full each month also make an effort to maximize credit card rewards.

Choose the right card to offset rising prices

One of the most important moves that can “beat inflation” this year is choosing the right credit card to begin with, or at least one that offers generous rewards in categories you spend a lot in. If you’re someone who spends considerable sums at the grocery store, for example, you can consider top grocery store credit cards like the American Express® Gold Card and the Blue Cash Preferred® Card from American Express. Likewise, spending a lot on gas or dining out means you would be better off with a card that offers more bonus rewards in these categories.

You can also look for a card that offers a solid rewards rate in a range of everyday spending categories. A good example in this category is the Wells Fargo Autograph ℠ Card, which offers 3X points on restaurants, travel, gas, transit, popular streaming services and phone plans and 1X points on other purchases. This card doesn’t charge an annual fee, and it offers a generous bonus opportunity to boot.

At the end of the day, what makes the most sense for you depends on which categories you spend money in on a regular basis. You may need to break out bank and credit card statements from the last few months to get an overview of your spending, but this move can help you decide which type of rewards credit card to get.

Redeem cash back for statement credits

Those sitting on a stash of rewards can easily use their cash back to combat inflation and high prices in general. For example, redeeming for cash back often means getting a check in the mail that can be used for groceries, household bills and more. Likewise, redeeming for statement credits actively reduces the amount of one’s credit card bill, keeping more money in your pocket over time.

EXPAND

Even redeeming rewards for gift cards can help battle inflation. After all, many rewards cards offer gift cards to retailers that offer household essentials, including options like Walmart, Lowe’s and Target.

Just remember to make sure the card you choose offers an acceptable valuation when you redeem rewards for gift cards, cash back or statement credits. We recommend only going this route if you’re getting at least 1 cent per point in value or more.

Pick up a flexible rewards credit card

Picking up a flexible rewards credit card that works in a program like American Express Membership Rewards or Chase Ultimate Rewards can also help you fight inflation, particularly if you have travel plans on the horizon. After all, cards in flexible programs let you cash in your rewards for easy options like cash back or gift cards if you need to, but you can also save on travel expenses if you have a trip coming up.

With credit cards that offer transferable points, you can turn your rewards into airline miles or hotel points to get better redemption values. As just one example, you could transfer Chase Ultimate Rewards points to a partner like Southwest Rapid Rapid Rewards, where the average point value is 0.0 cents apiece according to Bankrate valuations.

From there, you could use your new Southwest points to book a flight instead of paying cash, although you’ll have to pay a nominal amount in airline taxes and fees (around $6 one-way for domestic flights).

Book travel through credit card portals

According to Bankrate’s March 2024 Summer Vacation Survey, 43 percent of U.S. adults planning a summer vacation plan to pay for their trip with a credit card they pay in full. This puts them in the position of maximizing rewards on their spending that they can use to offset summer travel bills.

See if any rewards cards you own let you book travel with a better-than-normal redemption value. The Chase Sapphire Preferred® Card and Chase Sapphire Reserve®, for example, get you 25 percent and 50 percent more value for your points, respectively, when you use them to book travel through the Chase portal. This discount can apply to airfare, hotel stays, rental cars and more.

This means that, not only are you using your points to get travel you don’t have to pay for, but you’re getting a better redemption value than the typical 1 cent per point you get for other redemptions like cash back and statement credits.

Use money-saving offers to get something back

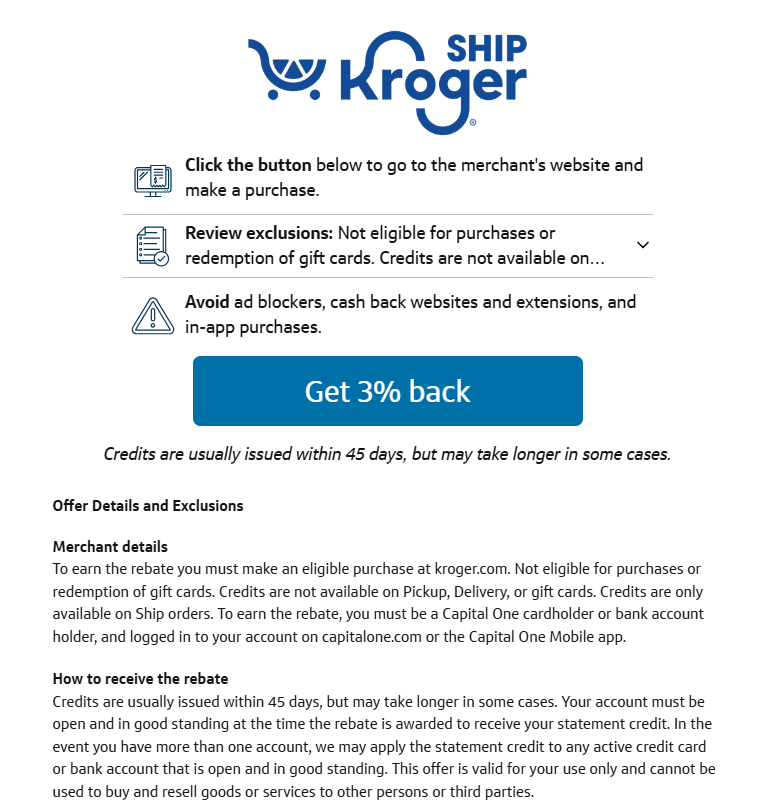

Some credit card rewards programs offer a selection of deals that let you get something in return when you make eligible purchases. For example, Chase has Chase Offers and American Express has its popular Amex Offers program. Capital One also has its own deals called Capital One Offers.

All these programs work similarly, although they only apply when you add an offer to your eligible card and meet purchase requirements that are laid out ahead of time. For example, Capital One Offers is currently showing deals like 3 percent back at Walmart and 4 percent back at Kroger when you make an eligible purchase.

EXPAND

Just remember that limitations typically apply. For example, the Kroger offer lists that cash back cannot be earned on pickup orders, and that you cannot use this bonus offer for purchases of gift cards.

Never pay credit card interest

The final (and most important) way to fight inflation is to avoid paying the higher interest rates being charged on everything right now. This includes credit card interest rates and interest charged on other types of loans. You can save money by avoiding situations where you have to borrow money if you can and by paying more than the minimum on loans you have.

In the meantime, you’ll only want to use credit cards for the purpose of earning rewards if you have the discipline and ability to pay your credit card balance in full each month. After all, the average credit card interest rate right now is teetering around 20.66 percent, so it makes no sense to try to earn the average of 1 percent to 3 percent back in rewards while paying interest each month.

Also be aware that, if you do have credit card debt right now, you can quit paying sky-high interest rates for up to 21 months if you transfer the debt to a new balance transfer credit card. While an upfront balance transfer fee will likely apply, you may be able to save hundreds of dollars (or thousands) in interest payments depending on how much debt you have and the rate you’re currently paying.

The bottom line

Rising prices have definitely made it more difficult to get ahead, but a credit card can be a valuable tool when it comes to saving money or getting free stuff. Just remember that paying credit card interest will wipe out the benefits of using a credit card in almost every scenario, so you should always pay your balance in full each month.

Read the full article here