With more and more news stories of credit card theft, people begin to look for ways to protect themselves. One company that they will likely come across in their search is Lifelock and many wonder, “Is Lifelock a scam?” The good news it that it’s not a scam in the literal sense. The bad news is that it probably doesn’t offer you all the protection that you think it does.

About Lifelock

LifeLock, now called Lifelock by Norton was founded in 2005 by Todd David and Robert Maynard. In 2017 LifeLock was acquired by Symantec for $2.3 Billion and later sold to Gen Digital Inc., where the software was marketed as a bundle with Norton 360. The product has various tiers – with individual plans offering up to $1,000,000 coverage for legal expertise, $25,000 in theft reimbursement and credit monitoring coverage.

While there are a number of people who have been happy with the LifeLock’s services, there are quite a few who have complaints about LifeLock’s policies and practices. For example, LifeLock has a 1.08 rating (out of 5) from the Better Business Bureau, and over 1,324 complaints closed in the last three years (here).

Here are a few reasons why you don’t need LifeLock:

Their Guarantee Doesn’t Protect Against Direct Losses

While LifeLock pledges to spend $1 million to restore a customer’s identity after they’ve been a victim of identity theft, that guarantee doesn’t actually protect the customer against charges incurred. Nor does the guarantee promise to restore the money that was lost.

Overpriced

LifeLock charges $11.99 a month for their services, which comes out to a total of $143.88 for the year. While you may think that this is a reasonable price to pay to secure your identity from being stolen, many of the services that LifeLock promises are free of charge elsewhere. While it may take more of your personal time to call up credit companies to set up fraud alerts or opt out of credit card offers, it will save you from paying $12 a month for a third party to do the same thing.

Fraud Alerts

One of LifeLock’s practices is asking credit bureaus to put free fraud alerts on all your accounts so that both you and LifeLock will be notified of any fraudulent activity. Instead of having LifeLock, a third party, ask the credit bureaus to enact this on your behalf, you can place a fraud alert on your information yourself. You only have to notify one bureau, as they will notify the remaining two of the fraud alerts placed on your accounts.

Renewing Fraud Alerts

Fraud alerts expire after 90 days, and LifeLock claims that they’ll automatically renew your alerts once the 90 days are up. While it’s easy to have an automatic renewal for the fraud alerts on your accounts, it’s also pretty easy to just call up the credit bureaus and request another fraud alert. If you’re worried about forgetting to do so, just make a note on your calendar to remind you.

Pre-Approved Credit Card Offers

Almost everyone has experienced receiving tons of spam mail that include pre-approved credit card offers. While LifeLock claims that they will request that your name be removed from such junk mail offers, you can do this yourself. Just go to optoutprescreen and put in all your information instead of handing it over to LifeLock.

Credit Reports

LifeLock also says part of its services include ordering a free annual credit report for its users. However, you can order a free annual credit report from annual credit report, which works with the three approved credit bureaus, and may be able to get more free credit reports as well. It’s far safer to go through a legitimate, government approved credit bureau than a third party site.

Sneaky Advertising

While identity theft should always be a cause for concern, LifeLock’s practices are based more on the fear of identity theft rather than identity theft itself. The company’s marketing practices want you to believe that there’s a large chance that your identity will be stolen and that only they can prevent that. However, there are several steps you can take on your own to help prevent identity theft.

Disputing Fraudulent Charges

LifeLock also claims that while it won’t dispute the fraudulent charges you receive, it will help you cancel your credit cards and contact all your financial institutions. Instead of letting LifeLock help you contact your bank, do it yourself. Most financial institutions will forgive fraudulent charges if you notify them within 30 to 60 days. It may take a lot of time on the phone to replace everything and get those charges cleared up, but it’s better to have them taken care of entirely.

Billing Issues

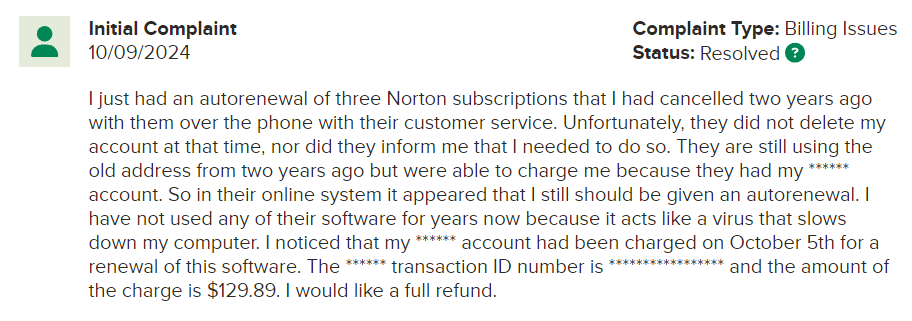

Some people online have complained that after cancelling their subscription to LifeLock, the company has continued to charge them monthly fees. For example, here is what one user said about their service.

Many third party credit or financial organizations and businesses are often charged with this complaint, so it’s in your best interest to think very carefully about whether or not you want to deal with this type of problem.

Third Party

One of the biggest reasons why you don’t need LifeLock is that, in the end, it’s a third party business who will now have access to all your personal information. Most people know that they shouldn’t give out their social security number to third parties, as that’s one of the biggest targets for identity theft. LifeLock is a quick and easy solution, but you’re far better handling identity theft prevention yourself. There’s no need for a third party to have access to your information or to take steps that you could complete yourself.

Readers, what has your experience with LifeLock been? Leave us a comment below.

Read the full article here