The inflation paradigm that ruled the last 20 years began to shift in the 2020 COVID pandemic year. A combination of supply chain issues, work stoppages, and massive global government stimulus reignited inflation, particularly in labor costs and in raw materials. Over the last four plus years, many commodity prices have risen substantially from their pre-pandemic levels. In addition, military conflicts in the Ukraine and Middle East raise the risk of further price increases.

With this as a backdrop, this month, Kenley Scott, William O’Neil + Company’s Sector Strategist, and I examine previous inflation cycles to gain context on how this current cycle looks.

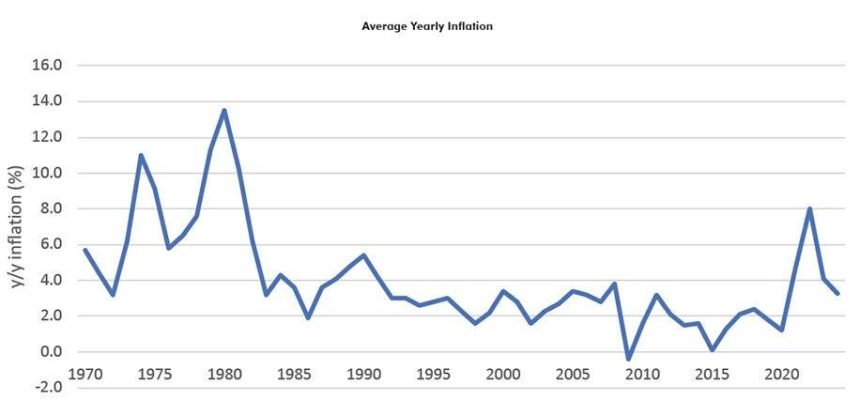

As Figure 1 shows, over the last 50+ years, inflation in general has been relatively contained between zero to 4%. However, from its COVID low, inflation rose steadily to an eight percent high in 2022. While it has declined since then, it has remained stubbornly high and currently sits at 3.3% after re-accelerating over the last several months. Although it is masked in the annual data below, inflation has ticked up from 3.1% y/y in January, to 3.2% in February, and 3.5% in March.

Figure 1: Long-Term Inflation

Matching the uptick in inflation, commodity prices have generally started to move higher again. Why does it matter? As commodity prices rise, US yields have tended to move higher as well. Figures 2 and 3 below are two comparisons of the Reuters/Jefferies CRB (Commodity Research Bureau) Index versus the US 10-year bond yield on a trailing five-year, trailing 20-year, and trailing 40-year basis. As one can see, the correlation between the two is high.

Figures 2 & 3: Comparison of CRB Index Versus 10-Year Treasury Yield

Often commodity sectors have tended to outperform when inflation is higher (surprise, surprise), while the stock market has done better when inflation is coming down. As shown in Figure 4, over the past 54 years, when inflation has averaged greater than 3% (monthly y/y average for each year), the S&P 500 has averaged a 5% gain while Energy stocks have recorded a 10% gain. Conversely, with inflation below 3% the S&P 500 averaged a 13% gain and Energy stocks a 7% gain. The relationship for Material stocks is not as clear, in part because the sector includes both beneficiaries (base metals, agriculture) as well as those likely hampered by higher costs (chemicals). Note: for the purposes of this article, “alpha” indicates excess return relative to the S&P 500.

Figure 4: Table of Annual Inflation and Energy/Materials Sector Performance – by Inflation Range

During decades where inflation has trended higher, like the 1970s, the S&P 500 has produced lackluster returns while commodity-driven sectors have performed better. In time periods where inflation has been muted, stocks have outperformed as shown in Figures 5 and 6. Interestingly, the current period (2020–2024) has seen much higher inflation than the previous 39 years, yet the overall market has performed better than commodity sectors. As a result, commodity sectors may be due for a “catch up” period if the US economy remains resilient.

Figure 5: Annual Inflation and Energy/Materials Sector Performance by Decade

Figure 6: Energy Sector Quarterly Datagraph

Going deeper into two of the cases where something slightly different than the historical averages occurred:

1) Periods where high inflation (>4%) and high interest rates but the stock market stays strong and Energy/Materials sectors underperform: This occurred from 1988–1991 when inflation averaged 4.6% for four years, but the S&P 500 still averaged a 15% annual gain and easily beat Energy and Materials. It also happened in 2023 when 4% average inflation did not stop the S&P from rising 24% and beating both Energy and Materials by double digits.

2) Higher commodity prices and Energy/Material sector outperformance, but not overly high inflation and the general stock market still strong: This occurred from 2003–2007 when Energy averaged +18% alpha and Materials +22% alpha over the five-year period. But inflation was only 2–3% annually, and the S&P 500 still rose an average of 11% for five years. This example could be reoccurring now. Currently, inflation is around 3.5% and Energy and Materials are picking up relative performance, but the S&P 500 still looks healthy overall, up 10% YTD.

O’Neil Global Advisors would be concerned if a return to much higher overall inflation occurred as this generally coincides with weak stock market performance. It is possible that the currently rising commodity prices in oil, copper, gold, silver, and steel are not enough to cause another double-digit inflationary period like the 1970s. This is also dependent on wages, supply chains, wars, and national trade policy. Nonetheless, we like both the technical and fundamental setups in these areas, and given the history shown above, we may be in the middle of an extended commodity cycle today. We have turned especially positive considering the breakout in the Reuters/Jefferies CRB Index: 19 different commodities with leading weights in Energy (40%), Agriculture (40%), Base Metals (13%), and Precious Metals (7%) shown in Figure 7. The individual commodity charts are found in Figure 8. Most commodities have either broken out or are threatening to. While we would not have commodity-related stocks be the totality of our portfolio, we would overweight them relative to the overall market in this climate.

Figure 7: Weekly CRB Index

Figure 8: Mini Gold, Silver, Oil & Gas, Copper, and Steel ETFs

Kenley Scott, Director, Global Sector Strategist at William O’Neil + Co., an affiliate of O’Neil Global Advisors, made significant contributions to the data compilation, analysis, and writing for this article.

Disclosures

No part of the authors’ compensation was, is, or will be directly or indirectly related to the specific recommendations or views expressed herein. O’Neil Global Advisors, its affiliates, and/or their respective officers, directors, or employees may have interests, or long or short positions, and may at any time make purchases or sales as a principal or agent of the securities referred to herein.

O’Neil Global Advisors, Inc. (OGA) is an SEC Registered Investment Adviser. Information relating to investments in entities managed by OGA is not available to the general public. Under no circumstances should any information presented in this report be construed as an offer to sell, or solicitation of any offer to purchase, any securities or other investments. No information contained herein constitutes a recommendation to buy or sell investment instruments or other assets, nor to effect any transaction, or to conclude any legal act of any kind whatsoever in any jurisdiction in which such offer or recommendation would be unlawful. The past performance of any investment strategy discussed in this report should not be viewed as an indication or guarantee of future performance. Nothing contained herein constitutes financial, legal, tax or other advice, nor should any investment or any other decision(s) be made solely on the information set out herein.

© 2024, O’Neil Global Advisors Inc. All Rights Reserved. No part of this material may be copied or duplicated in any form by any means or redistributed without the prior written consent of OGA.

Read the full article here