A federal judge will issue a major decision on a popular Biden administration student loan forgiveness and repayment plan within the next two weeks. The impacts of that decision could have implications for millions of borrowers, and may also be a preview of how subsequent legal challenges will play out.

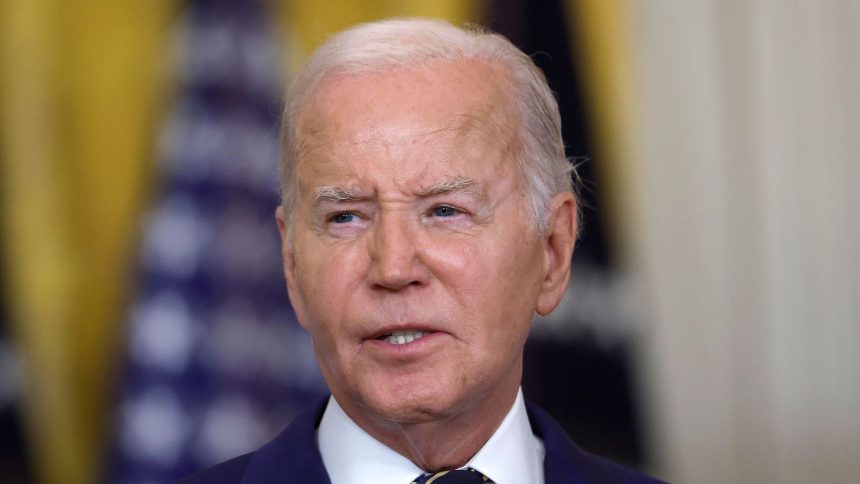

The ruling will be in response to a legal challenge brought by a coalition of Republican-led states which are seeking to block the new SAVE plan. SAVE — which stands for Saving on a Valuable Education — is President Joe Biden’s new income-driven repayment plan designed to provide sweeping benefits including lower payments and faster loan forgiveness. Oral arguments on a preliminary injunction were held earlier this week.

Here are the key updates, and what borrowers should know about the anticipated decision.

Legal Challenge To Biden’s New Student Loan Forgiveness And Repayment Plan

The Biden administration has touted the new SAVE plan as the most affordable income-driven repayment option ever. The plan has several notable features including a larger income exemption (which allows lower-income borrowers to have no repayment obligation), a more affordable repayment formula compared to other IDR plans, and an unprecedented interest subsidy that will prevent any future balance increases by cancelling interest that accrues in excess of borrower’s payment.

Like all IDR plans, enrolling in SAVE can allow borrowers to qualify for student loan forgiveness in 20 or 25 years, depending on whether or not they have graduate school loans. But borrowers who took out small amounts of federal student loan debt can get faster loan forgiveness under SAVE — potentially in as little as 10 years if they borrowed $12,000 or less.

The coalition of Republican states — led by Missouri and Kansas — filed two lawsuits seeking to block the new SAVE plan. The states argue that the plan goes beyond what Congress authorized and is essentially a backdoor mass student loan forgiveness plan. The Biden administration counters that Congress expressly authorized the creation of IDR plans under the Higher Education Act in 1993, and gave wide latitude to the Education Department to craft the parameters of those plans.

Court Ruling Could Block Biden Plan For Borrowers, Cutting Off Loan Forgiveness And Lower Payments

The GOP-led coalition filed a request for a preliminary injunction — a procedural move that, if granted, would block implementation of the SAVE program while the litigation continues in court. On Monday, a federal district court in Missouri held a hearing on this request.

During the hearing, the challengers (led by the state of Missouri) maintained that the new SAVE plan is illegal, and implementation would directly and imminently harm the states because the associated student loan forgiveness would deprive them of revenue. Attorneys for the Biden administration countered that those arguments are speculative, particularly given that the challenging states waited months to file a lawsuit after SAVE was first unveiled last fall. The administration contends that IDR plans like the SAVE program were clearly authorized by Congress under the Higher Education Act, and the Education Department went through a lengthy and detailed negotiated rulemaking process involving broad input from the public and key stakeholders.

The federal judge did not offer many clues about how he would rule, but indicated that he would issue a decision within two weeks.

How The Ruling Could Impact Student Loan Forgiveness And Repayment Under SAVE

During the hearing, the parties suggested that if the judge sided with Missouri, the SAVE plan would be blocked for borrowers seeking to apply. However, the eight million borrowers already enrolled in SAVE (and the roughly 400,000 borrowers who have already received student loan forgiveness under the program) may not be impacted.

That said, the preliminary injunction — if granted — is a temporary procedural tool that would block the program while the litigation continues. If SAVE ultimately gets overturned in the course of that litigation, borrowers already enrolled in SAVE could be impacted.

If the court rules against Missouri and the other states and denies the preliminary injunction, they would likely appeal that decision. Last year, many of these same states (including Missouri) challenged the Biden administration’s one-time student loan forgiveness plan, and the case got dismissed. But the states appealed, and the federal appeals court reversed the decision, allowing a preliminary injunction. The Biden administration then appealed that decision to the Supreme Court, which ultimately overturned the program entirely.

Decision Could Impact Biden’s Next Student Loan Forgiveness Plan

The Biden administration is finalizing a separate new student loan forgiveness plan, intended as a fallback option for the one that the Supreme Court overturned last summer. That plan could provide billions of dollars in relief to 25 million borrowers or more.

Last month, a federal appeals court rejected a key challenge to another Biden student loan forgiveness plan, the IDR Account Adjustment. This program has already resulted in more than $51 billion in debt relief, with more on the way. The administration cited to that decision in its arguments opposing the legal challenge to the SAVE plan.

But legally speaking, the SAVE plan is closely related to Biden’s new student loan forgiveness program. Both were established under the Higher Education Act, albeit under different provisions. Both went through a lengthy negotiated rulemaking process to establish the parameters and regulations governing the program. Both are intended to provide student loan forgiveness benefits. So depending on how the SAVE legal challenge plays out, the outcome could impact anticipated lawsuits that will likely be filed once Biden’s new loan forgiveness plan is released.

Read the full article here