THIS POST MAY CONTAIN AFFILIATE LINKS. PLEASE SEE MY DISCLOSURES. FOR MORE INFORMATION.

Managing your money can feel overwhelming when your accounts, budgets, and goals all live in different places.

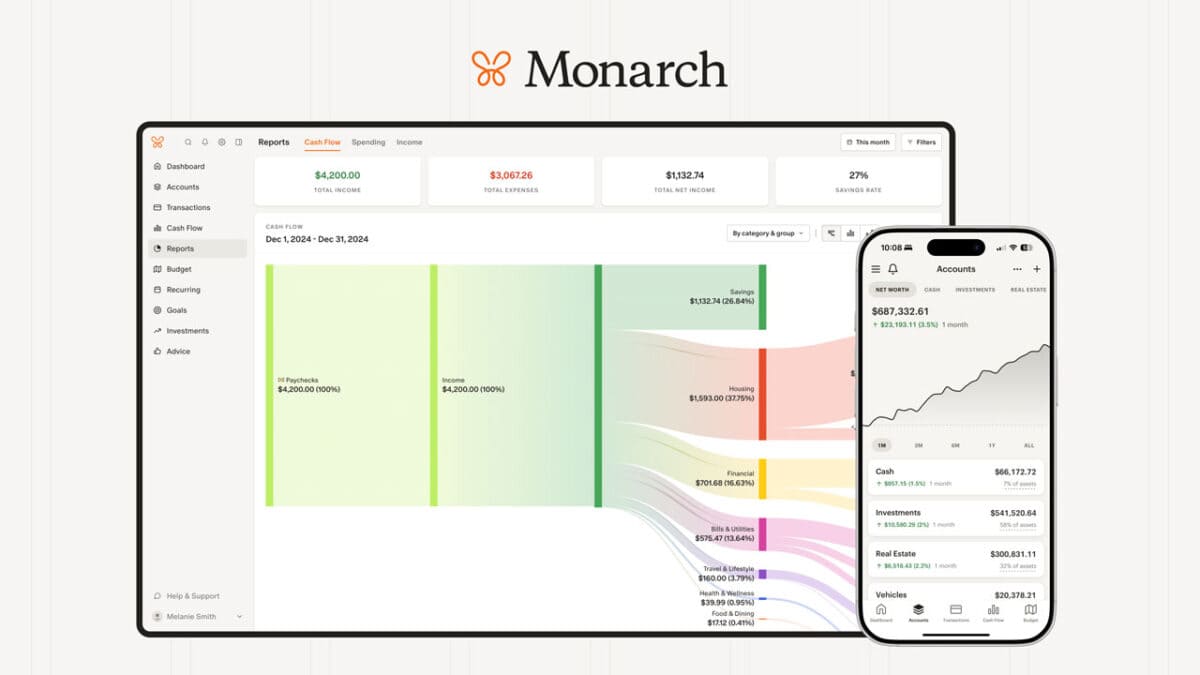

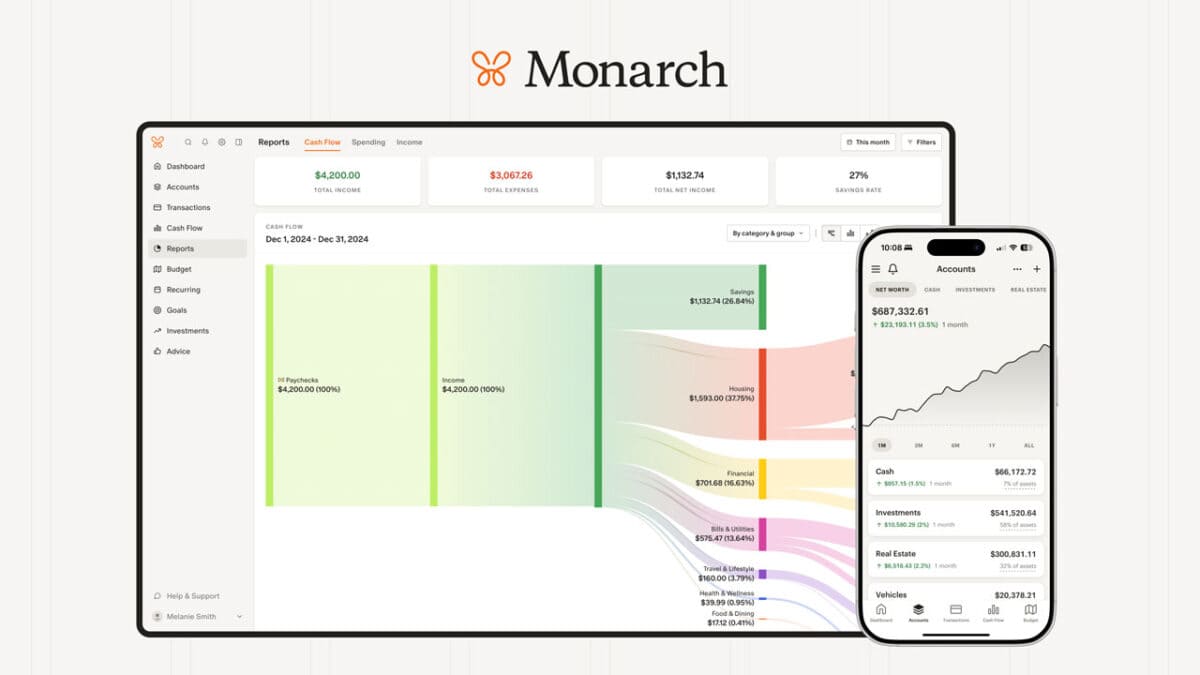

Monarch Money aims to fix that by bringing everything together in one clean, powerful dashboard.

In this Monarch Money review, I’ll walk you through how the app helps you track spending, manage budgets, and stay on top of your goals.

It does this all while giving you a clear, real-time picture of your financial life.

I use Monarch Money myself and love it, but I’ll also share where it falls short and how it compares to competitors like YNAB, Copilot, Simplifi, and Quicken Classic.

I’ve tried most budgeting apps over the years, so I have a good idea of the advantages and drawbacks of them.

By the end, you’ll know whether Monarch Money truly fits your financial style, or if another tool might be a better match.

Monarch Money Review

- Ease of Use

- Account Syncing Reliability

- Budgeting & Goal-Setting Tools

- Value for Money

Summary

Monarch Money makes it easy to take control of your finances. You can connect all your accounts, track your spending, and plan for the future—all in one simple, ad-free app. Click here to start your free trial and save 50% off your first year with code MONARCHVIP.

Monarch Money Review

What is Monarch Money?

Monarch Money is an all-in-one money management app that makes managing you finances simple.

You can connect your financial accounts, see where your money’s going, and set goals that actually motivate you.

It’s built for real life: flexible enough for solo users, yet perfect for couples and families managing shared finances.

It supports two main budgeting styles:

- Category budgeting – assign spending limits by category

- Flex budgeting – organize costs into fixed, flexible, and non-monthly groups

You can also upload receipts, split transactions, keep tabs on your investments, and track your net worth over time.

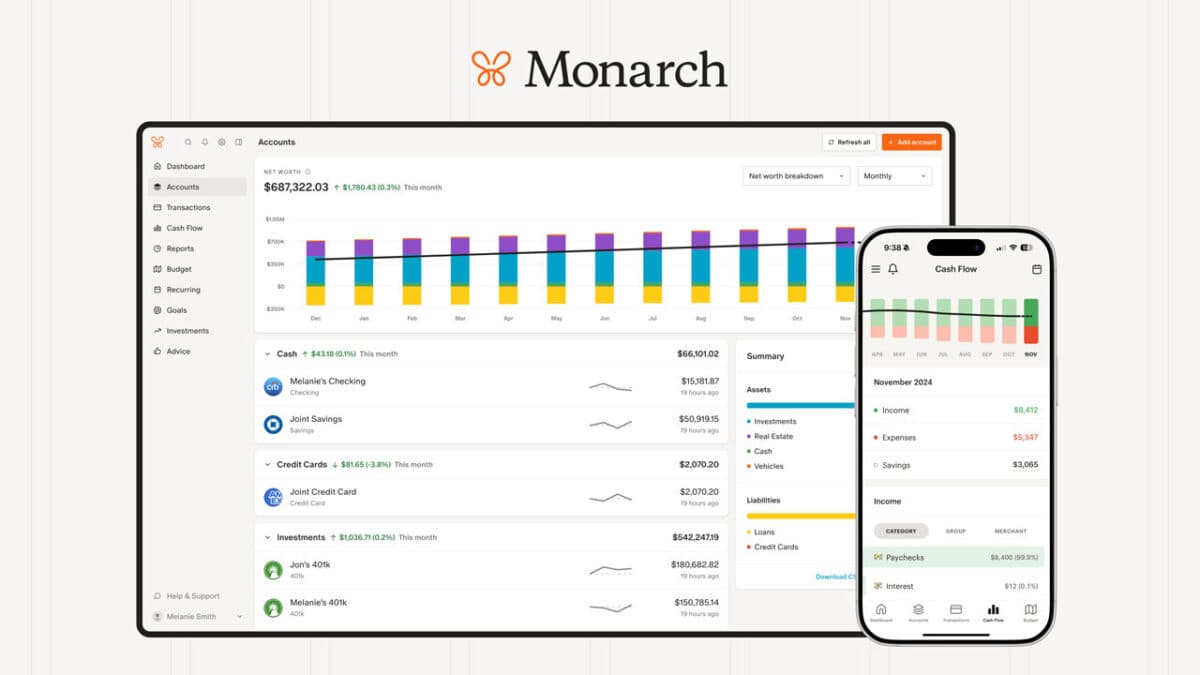

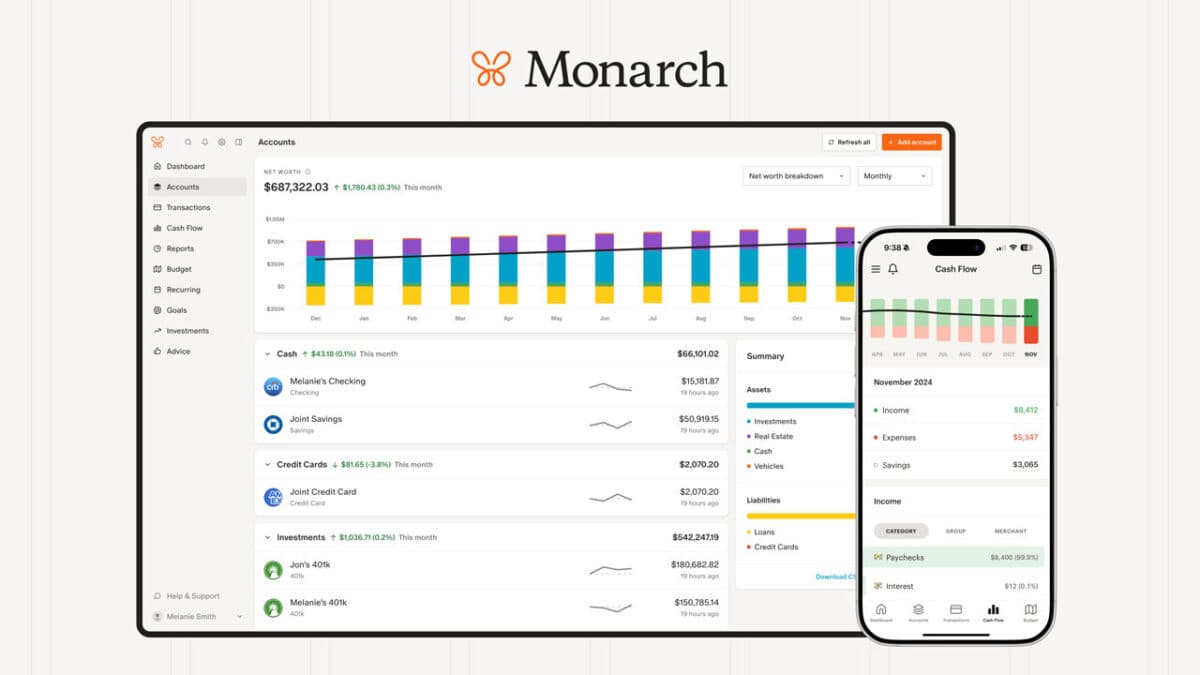

The dashboard is customizable, letting you see your most important data first.

This budgeting tool works on the web, iOS, and Android, syncing across devices for easy access.

I manage my money mostly on my desktop (and I recommend you do too, simply because of how powerful the web-based platform is), but love having the app on my iPhone so I can see where things stand when I’m on the go.

Who Is Monarch Money For?

You’ll find Monarch Money useful if you want to manage finances with someone else or prefer a flexible budgeting system.

It’s popular among couples, families, and former Mint users who want a shared view of income, expenses, and goals.

That doesn’t mean you won’t find it valuable if you are single.

It’s just that it was designed for couples to manage their finances as a team.

If you like detailed tracking, you can set savings targets, monitor investments, and review reports showing spending patterns.

The app’s sharing feature lets multiple users log in under one subscription, so everyone sees the same numbers in real time.

Because Monarch doesn’t sell your data or store account passwords, it’s also a good choice if you care about privacy and security.

They even offer a seven day free trial before paying for a monthly or yearly plan.

The service operates on a monthly subscription model, allowing users the flexibility to choose between monthly and annual billing.

Best Budgeting Tool

Monarch Money

Track your spending, set goals, and grow your net worth—all in one place. Try Monarch Money free for 7 days, and when you’re ready to upgrade, use code MONARCHVIP to save 50% off your first year.

Try Monarch Money for Free!

We earn a commission if you make a purchase, at no additional cost to you.

Key Features and Tools

Comprehensive Financial Dashboard

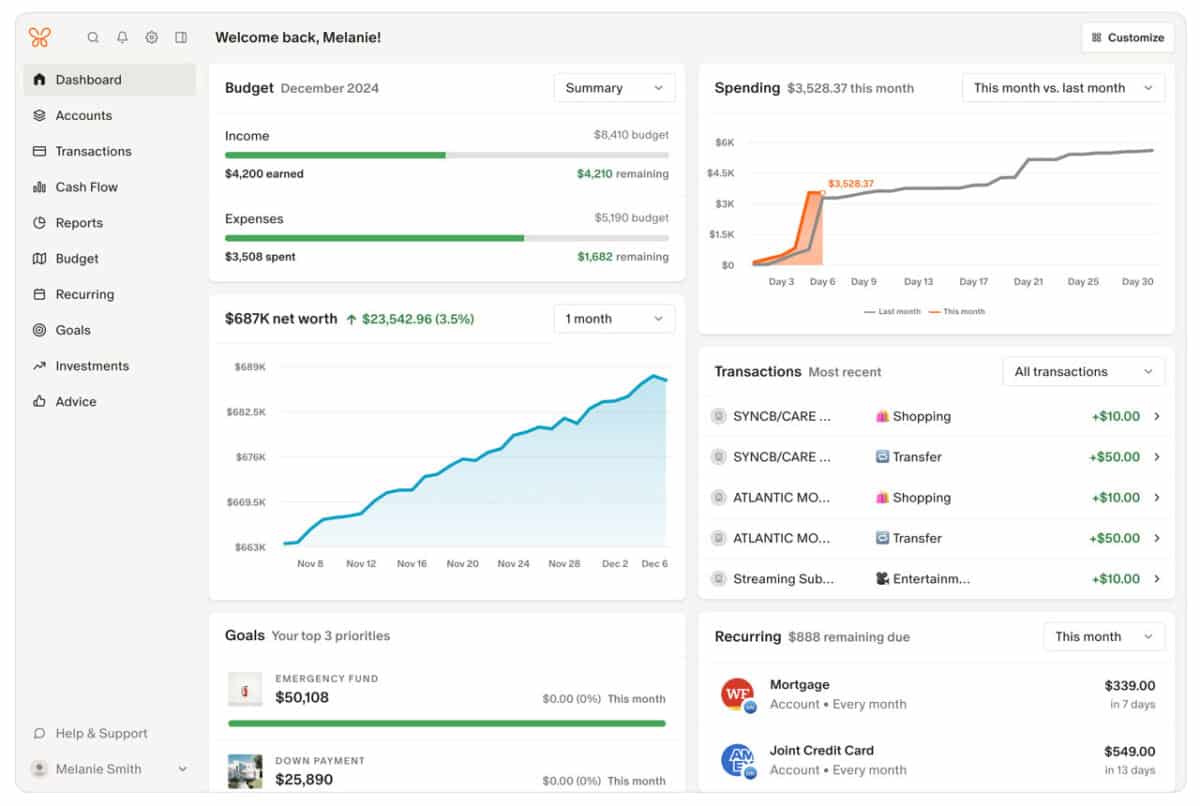

You can see all your financial details in one place through Monarch Money’s dashboard.

It shows your balances, budgets, and spending trends in simple charts and tables, providing a visual breakdown of your finances.

This helps you understand where your money goes and what you can adjust.

The dashboard updates automatically, so you always have current information.

You can view your net worth, cash flow, and category breakdowns as well, without switching screens.

What I love is that you can also customize the layout to highlight what matters most.

If you want to focus on household spending, savings goals, or investment performance, you can set up the dashboard to only show this information.

This makes it easier to stay focused on your priorities.

With other budgeting apps, the ability to customize the dashboard is limited or in some cases, non-existent.

Account Integration and Data Aggregators

Monarch connects to your bank accounts, credit cards, and investment platforms through secure data aggregators.

These connections let you see all your financial activity in one app without manual entry.

Once linked, the app automatically imports transactions and updates balances.

You can tag expenses, create custom categories, and track recurring payments.

If you have accounts at multiple financial institutions, Monarch’s integration saves you time.

It consolidates transactions from different bank websites, so you no longer need to log into each bank website separately to track your finances.

You can link popular banks like Chase, Capital One, and USAA, as well as smaller regional banks and credit unions.

The app uses encryption and read-only access to keep your information protected.

Collaboration Features for Couples and Families

Monarch Money includes collaboration tools that make it easier to manage shared accounts and budgets with others.

You can invite a partner or family member to view and edit your financial roadmap.

Each person can track expenses, set goals, and manage shared expenses in real time.

This helps you stay on the same page about bills, savings, and financial priorities.

You can assign roles and permissions, so everyone has the right level of access.

For example, maybe you want your accountant or financial advisors to see your budget, but you don’t want them to have the ability to make changes.

In this case, you can give them a lower access level to see the information they need and nothing more.

These collaboration features make it simple to plan together without sharing passwords or switching devices.

Budgeting Methods and Flexibility

Monarch gives you control over how you plan and track your spending.

It also emphasizes goal setting, allowing users to create and manage financial goals alongside their budgets.

You can assign transactions to detailed categories, adjust flexible spending limits, and manage both monthly and irregular expenses in one place.

In fact, this platform offers you two different way to budget – category and flexible budgeting.

Category Budgeting Explained

Category budgeting helps you see exactly where your money goes each month.

It’s very similar to zero based budgeting systems.

You divide your expenses into categories such as groceries, transportation, dining, and entertainment.

Each category has a set budget, which helps you stay aware of your habits.

Monarch automatically sorts activity into these categories.

You can edit or rename them to match your lifestyle.

For example, you can have a “Food” category to track all things food related.

Or if you want to get more detailed, you can create additional categories like “Dining Out” and “Coffee” to see exactly what you purchased on what category.

You can view your account data in charts or tables, making it easy to compare actual expenses to your projected amounts.

Over time, this method helps you identify areas to cut back or reallocate funds.

Flex Budgeting System

Flex budgeting gives you more freedom than fixed monthly limits.

Instead of assigning every dollar to a specific category, you group expenses into fixed, flexible, and non-monthly types.

It is a modern day twist on the popular 50/30/20 rule of budgeting.

Fixed costs include rent or loan payments.

Flexible costs cover things like dining or shopping, where spending can vary.

Non-monthly costs include annual fees or holiday gifts.

This system works well if your income or expenses change from month to month.

You can shift money between flexible categories without breaking your overall budget.

Monarch then tracks these changes automatically, so you can see how adjustments affect your total expenses.

Flex budgeting helps you stay realistic while still maintaining structure.

You decide where to tighten or loosen based on your goals.

Handling Non-Monthly and Recurring Expenses

Monarch helps you manage non-monthly and recurring bills and expenses so they don’t surprise you later.

You can mark bills or subscriptions as recurring, and the app adds them to a monthly calendar view.

This feature shows upcoming charges and helps you prepare ahead of time.

For example, if your annual insurance payment is due in June, you can spread savings across earlier months.

You can also track subscriptions like streaming services or gym memberships.

It lists these in one place, making it simple to cancel unused ones.

By planning for irregular costs, you avoid gaps and keep your expenses consistent throughout the year.

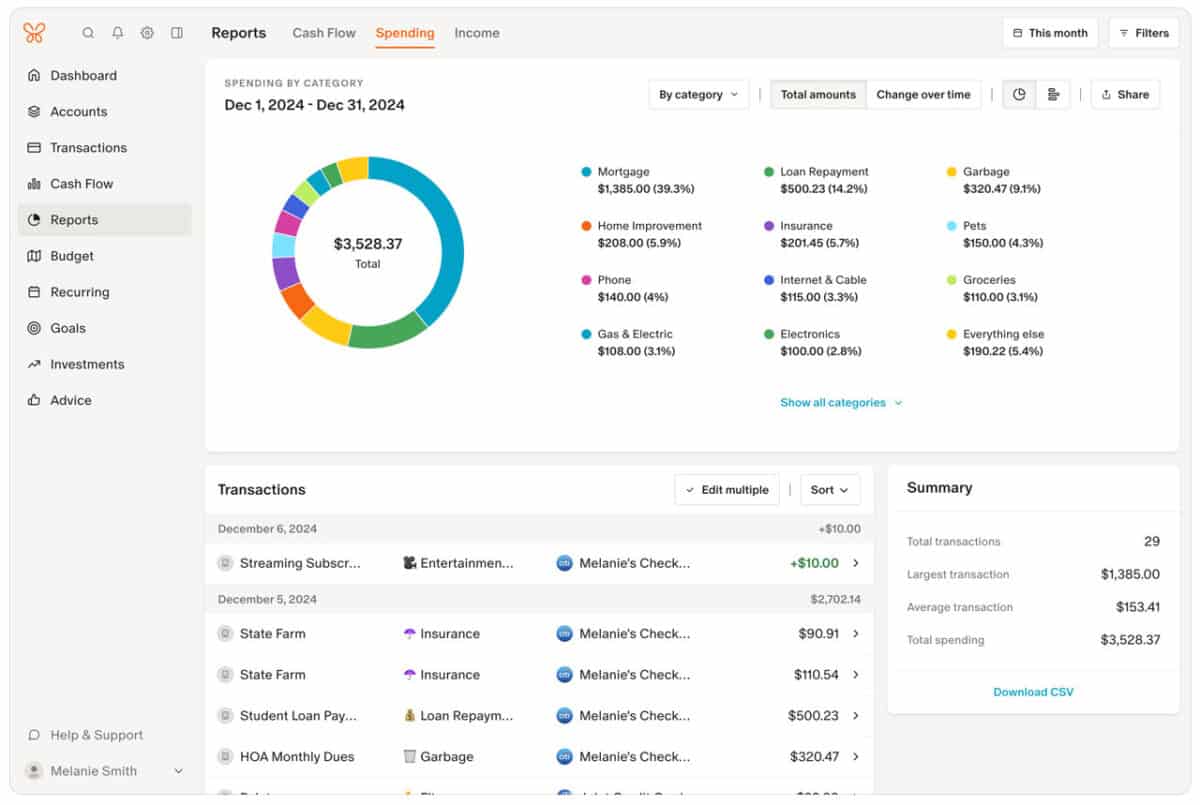

Tracking Spending and Financial Progress

Customizable Spending Categories

Monarch Money lets you create and adjust expense categories that fit your lifestyle.

You can start with default groups like groceries, transportation, or entertainment, then rename, add, or delete them as needed.

You can even assign emojis for each category, for those who like visuals.

The software also allows you to set up individual savings goals for specific purposes, making it easy to track progress toward each goal separately.

Smart Transaction Management

The app automatically imports your transactions once you link your financial accounts.

Then it uses your transaction history to help you identify patterns and improve your money decisions.

You can then review, edit, or split them into multiple categories if a purchase covers more than one type of expense.

You can add notes, upload receipts, or hide specific transactions to keep your records clean.

Monarch also learns from your edits, improving how it categorizes future expenses.

This feature has come in handy for me.

We belong to Plant Fitness and Monarch put this expense into the fees category since the name of the transaction is “iclub fees”.

Once I updated the category to “Gym”, all future Planet Fitness charges go under this category.

Another example is with our cell phone.

This one the software has not figured out how to properly categorize, but I am OK with that.

While we do have a cell phone bill, the bill itself is not 100% cell phone.

We subscribe to some streaming services through our phone plan to save money.

Each month I have to go into this charge and split it between cell phone and TV.

While I would love for the software to categorize this correctly, it can’t know or do everything, so I just know it’s a small update I need to make.

Finally, I love the ability to add notes to transactions so in the future, I can click to remind myself of the expense.

For example, we had some tree work done. I put this in the “Home Maintenance” category and then made a note, “tree work”.

I didn’t want to create a category for something that happens once every few years and the note helps me to find the expense in the future.

Cash Flow and Net Worth Tracking

Monarch combines data from your checking, savings, credit cards, loans, and investment accounts to show your complete financial picture.

You can view your cash flow – income versus expenses – through charts that highlight trends over time.

Your net worth updates automatically as account balances change.

This includes assets like investments and liabilities such as loans or credit card debt.

You can also create custom reports to analyze spending or progress toward savings goals.

These insights help you see if you’re moving closer to financial stability or need to adjust your budget.

Having all this information in one dashboard makes it easier to measure your growth and make informed decisions about your finances.

Setting and Managing Financial Goals

Monarch lets you create custom financial goals that fit your needs, such as saving for a vacation, paying off debt, or building an emergency fund.

You can assign each goal to one or more savings accounts and track progress automatically as your balances change.

A wide range of account types are supported for goal tracking, making it easy to manage all your financial objectives in one place.

You can view your goals in a clear dashboard that shows how close you are to reaching each target.

The app updates your progress as new transactions occur, so you always see real-time results.

To help you stay on track, you can set it up to send reminders and visual progress bars.

You can adjust your goals anytime, whether you want to increase your savings rate or change deadlines.

This flexibility makes it easier to adapt your strategy as your financial situation changes.

Investment Tracking Capabilities

Monarch connects to thousands of brokerages and investment accounts, giving you a full picture of your portfolio.

You can see your net worth, track performance over time, and review asset allocation in one place.

The app automatically pulls in balances and account activity from your linked accounts.

You can categorize by type, like stocks, bonds, or retirement funds, to better understand where your money is going.

Monarch’s reports help you spot trends and compare your growth with your goals.

You can also hide or filter accounts to focus on specific assets.

This feature helps you make informed decisions without switching between multiple platforms.

The biggest downside for me when it comes to investments is that you can’t see dividend income or detailed gain/loss information.

But, the investment tracking was recently introduced, so it is still in beta.

I am confident with future updates, this section of the platform will see improvements.

Credit Card Management

Monarch Money makes managing your credit cards as simple and stress-free as possible.

With its robust credit card management system, you can connect all your credit card accounts, no matter which financial institutions you use.

This means you get real-time updates on all your transactions, balances, and payments, all in one place.

To help you stay on top of your credit card payments, it offers customizable alerts and notifications.

You’ll get reminders when bills are due, and you can set up alerts for specific activities or categories.

This helps you avoid late fees, interest charges, and the stress of missed payments.

Plus, by tracking all your accounts in one place, you’re less likely to overlook a payment or let your spending get away from you.

Credit Score Monitoring

While Monarch Money focuses on managing your finances and investments, it also supports credit score monitoring.

You can view your credit information alongside your expenses and savings data, giving you a more complete financial overview.

Seeing your credit score next to your budget helps you understand how your borrowing habits affect your overall financial health.

You can track changes in your score over time and identify areas for improvement.

Pricing, Plans, and User Experience

Now let’s talk cost.

Monarch Money charges a subscription fee for full access but includes a short trial so you can test its features first.

It is available and highly rated on the Google Play Store, highlighting its popularity and user satisfaction among Android users.

It’s also available for download on the Apple App Store, making it easily accessible to iOS users.

The app focuses on a clean, ad-free experience with strong syncing, customizable dashboards, and tools for both individuals and couples who want to manage all their finances in one place.

With that said, I’ve found that using the web version is the best.

Not that there is anything wrong with the app version, I just prefer working on my desktop/laptop over a tablet or phone.

And Monarch’s internal research shows people who use the desktop version are more likely to be long term users and see more results.

Subscription Costs and Free Trial

Monarch Money offers one premium plan that unlocks every feature.

You can pay $99.99 per year (about $8.33 per month) or choose to pay $14.99 monthly.

Both options include the same tools, so the annual option simply saves you money.

You get a 7-day free trial, regardless if you choose monthly or annual, which gives you full access to test the software before paying.

During this trial, you have complete access to all the budgeting features, allowing you to link accounts, track expenses, create savings goals, and more.

Understand there is no permanent free version, which may be a drawback if you prefer free tools.

However, the pricing reflects its focus on privacy and reliability—there are no ads, upsells, or data sales.

For many users, this makes the subscription worthwhile.

If you have any issues with your subscription or during the free trial, you can contact support for assistance or to cancel your trial before you are charged.

Additionally, if you sign up using my link and use the code MONARCHVIP, you get free access for 7 days and save 50% off the annual plan.

Best Budgeting Tool

Monarch Money

Track your spending, set goals, and grow your net worth—all in one place. Try Monarch Money free for 7 days, and when you’re ready to upgrade, use code MONARCHVIP to save 50% off your first year.

Try Monarch Money for Free!

We earn a commission if you make a purchase, at no additional cost to you.

Pros and Cons of Monarch Money

Pros of Monarch

- Ad-free and private experience

- Works for both individuals and couples

- Connects with over 13,000 financial institutions

- Customizable dashboard and budgeting options

- Reliable syncing and cross-device access

Cons of Monarch

- No free plan after the trial

- Slightly higher cost than some competitors

- Investment tracker lacks detailed information

Why I’m A Fan of Monarch

I’ve been using Monarch for a little over a year now.

I love it because it makes it easy for my wife and me to budget.

Before Monarch, I was the “owner” of managing our household finances and would update her on where we stand.

But now, she is an active participant.

I took the time to set things up and invited her with a link inside the app.

She has her own login and can see everything, even make notes, add categories, etc.

I also love that I don’t have to reauthorize our bank accounts all the time.

Unlike Mint, where I would have to reauthorize our multiple bank accounts all the time, I’ve never had to do this with Monarch.

There is nothing more frustrating than wanting to see where you stand financially and having to log back into your accounts and then wait for them to sync.

Now, as much as I hype this software, there is one issue I have and that is with investments.

I want a detailed look at my investments and Monarch doesn’t do this….yet.

The investment tracker is in beta, so I am hoping that with future updates, this issue gets resolved.

Still, it is good enough for an accurate net worth number.

Monarch Money vs You Need A Budget

Both Monarch Money and You Need A Budget (YNAB) help you manage your spending, but they take different approaches.

You’ll notice Monarch focuses on flexibility, and lets you link all your financial accounts, credit cards, loans, and even investments.

You can view your entire financial picture in one place.

YNAB on the other hand sticks to a strict zero-based budgeting method.

It focuses only on this and doesn’t include investment tracking.

| Feature | Monarch | YNAB |

|---|---|---|

| Budgeting Style | Flexible (category or cash flow) | Zero-based budgeting |

| Account Sync | Bank, credit cards, loans, investments | Bank and credit accounts |

| Collaboration | Share with partner/family | Single-user focus |

| Free Trial | Yes (7 days) | Yes (34 days) |

| Price | $14.99/mo or $99/yr | $14/mo or $109/yr |

You might prefer Monarch if you want a broader financial overview and tools for goal tracking or net worth monitoring.

It also allows you to invite partners or family members at no extra cost.

YNAB works best if you like structure and want to assign every dollar a job.

It offers strong educational support, including guides and workshops, to help you stick to your plan.

Both apps charge a subscription fee, but each offers a short trial so you can test which one fits your situation better for free.

Monarch Money vs Copilot Money

When comparing Monarch Money and Copilot Money, you’ll notice that both help you manage your finances, but they take different approaches.

Monarch focuses on detailed budgeting and planning tools, while Copilot Money emphasizes simplicity and personalized insights.

You can connect multiple accounts in the app to see your entire financial picture in one place.

Copilot Money also links your accounts but highlights spending patterns and gives you quick, actionable tips.

| Feature | Monarch | Copilot Money |

|---|---|---|

| Budgeting Style | Flexible (category or cash flow) | Simple budgeting with automated insights |

| Interface | Customizable dashboard | Clean, minimal design |

| Collaboration | Share with partner/family | Single-user focus |

| Free Trial | Yes (7 days) | Yes (30 days) |

| Price | $14.99/mo or $99/yr | $13/mo or $95/yr |

If you like hands-on control, Monarch gives you more ways to plan, track, and adjust your goals.

You can even invite others to collaborate on shared budgets.

If you prefer a guided experience, Copilot Money’s AI-driven insights and easy navigation make it simpler to stay on track without much setup.

It’s important to note that Copilot Money only works on Apple devices, whereas Monarch works on Windows and Apple devices.

For me, I really like Copilot Money, but I work on a PC, so I would have to do all my budgeting on my iPad, which was a deal breaker for me.

Both apps allow you to try them out for free, so you can test which one fits your style of managing money best.

Monarch Money vs Simplifi

When you compare Monarch Money and Quicken Simplifi, you’ll notice that both help you manage your finances, but they focus on different things.

Simplifi aims to make budgeting simple and quick, while Monarch gives you a deeper look at your full financial picture.

You’ll find Simplifi easier if you want a clean layout and straightforward tools.

It’s built for daily expense tracking and setting short-term goals.

Some users mention minor syncing bugs, but it’s still user-friendly and backed by Quicken’s long history.

Monarch, on the other hand, gives you more control over customization.

You can track your net worth, investments, and cash flow in one place.

It also supports shared household budgets, which can help if you manage finances with a partner.

| Feature | Monarch | Quicken Simplifi |

|---|---|---|

| Bank Syncing | Reliable | Occasional issues reported |

| Interface | Customizable dashboard | Clean and simple |

| Best For | Advanced users, investors, families | Beginners, simple budgets |

| Investment Tracking | Yes | Limited |

| Price | $14.99/mo or $99/yr | $48/yr |

If you like detailed insights and long-term planning, you may prefer Monarch.

But if you want a lighter, easier app to start budgeting fast, Simplifi might suit you better.

Both offer free trials, so you can test which one fits your style.

Monarch Money vs Quicken Classic

When you compare Monarch Money and Quicken Classic, you’ll notice they serve different kinds of users.

Monarch focuses on a modern, cloud-based experience, so you can access your data anywhere.

Quicken Classic offers a more traditional desktop setup with deeper financial tools.

It also stores data locally, though it now includes cloud sync options for backup and mobile access.

| Feature | Monarch | Quicken Classic |

|---|---|---|

| Platform | Web & Mobile (Windows/PC/Android/Apple) | Desktop (Windows/Mac) |

| Price | $14.99/mo or $99/yr | $84/yr |

| Budgeting | Strong focus | Included but less visual |

| Investment Tracking | Basic portfolio view | Advanced tools and reports |

| Collaboration | Shared household budgets | Single-user focus |

| Business Tools | Not available | Includes small business features |

You’ll find Monarch easier to set up and more visually appealing.

It automatically imports transactions, categorizes spending, and tracks goals.

Quicken Classic gives you more control over details like custom reports, tax planning, and rental property management.

It’s great if you like to dig into financial data or manage multiple accounts in one place.

If you prefer a clean, simple dashboard and mobile convenience, Monarch fits better.

But if you want detailed analysis and offline control, Quicken Classic might feel more comfortable.

Monarch Money vs Rocket Money

When comparing Monarch Money and Rocket Money, the biggest difference comes down to control versus automation.

Rocket Money (formerly Truebill) focuses on automatically managing your finances, identifying subscriptions, negotiating bills, and tracking expenses with minimal effort.

It’s perfect if you want quick insights without diving too deep.

However, some of its best features, like subscription cancellation and bill negotiation, require a premium plan or commission-based fees.

Monarch, on the other hand, gives you more flexibility and depth.

You can build a custom budget, set financial goals, and track your net worth and investments in one dashboard.

However, it doesn’t negotiate bills or cancel subscriptions, but it gives you cleaner data, better organization, and stronger tools for long-term financial planning.

| Feature | Monarch | Rocket Money |

|---|---|---|

| Pricing | $14.99/mo or $99/yr | Free, Premium Plan pricing varies |

| Best For | Custom budgeting and long-term planning | Automating savings and subscription tracking |

| Investment Tracking | Yes | Limited |

| Bill Negotiation | No | Yes (with paid plan) |

| Net Worth Tracking | Yes | Basic |

| Interface | Modern and highly customizable | Simple and automated |

If you want a hands-off app that finds ways to save money automatically, Rocket Money might be your pick.

But if you prefer to take an active role in your finances, like planning, tracking, and building wealth over time, Monarch gives you far more control.

Frequently Asked Questions

What are users saying about Monarch Money on Reddit?

You’ll find that many Reddit users like Monarch Money for its clean design and ability to link multiple accounts.

They often mention that it’s a good option for couples or families who want to manage shared budgets.

Some users also say it helps them stay organized after switching from Mint.

Are there any common complaints about Monarch Money?

The most common complaints involve the lack of a free plan and occasional syncing delays with certain banks.

A few users also mention that setup takes time, especially when customizing categories.

However, most agree that once it’s set up, the app runs smoothly.

Is Monarch Money worth it?

If you want an ad-free budgeting tool with detailed tracking and strong customization, you may find it worth the cost.

It’s especially helpful if you manage multiple accounts or share finances.

Is Monarch Money Legit?

Yes, Monarch Money is a legitimate financial app.

It’s been reviewed by major outlets like Forbes Advisor and NerdWallet, both of which confirm that it’s a real company offering secure, paid financial management services.

Can Monarch Money be trusted with personal financial information?

You can trust Monarch Money with your data because it doesn’t store your banking passwords or move money between accounts.

It uses third-party data providers with strong encryption and security standards.

Your information stays private and protected.

You can learn more about the security Monarch takes here.

How much does Monarch Money cost?

Monarch Money offers two paid options.

The monthly plan costs $14.99 per month, and the yearly plan costs $99.99 per year (about $8.33 per month).

You can try it free for seven days before subscribing.

Who are the creators of Monarch Money, and what is their background?

Monarch Money was founded by former Mint and Intuit employees who wanted to build a more flexible, user-focused budgeting app.

Their background in financial technology helped them design a tool centered on privacy, customization, and collaboration for individuals and families.

Final Thoughts

At the end of the day, Monarch Money just makes managing my finances easier.

It’s simple enough to use every day, yet powerful enough to handle everything from tracking investments to building long-term goals.

I’ve tried a lot of budgeting apps, and Monarch is the one I actually stuck with because it helps me see where my money’s going and feel confident about the future.

If you want to test it out for yourself, grab the free trial and use the code MONARCHVIP to save 50% off your first year.

It might just become the last budgeting app you ever need.

Best Budgeting Tool

Monarch Money

Track your spending, set goals, and grow your net worth—all in one place. Try Monarch Money free for 7 days, and when you’re ready to upgrade, use code MONARCHVIP to save 50% off your first year.

Try Monarch Money for Free!

We earn a commission if you make a purchase, at no additional cost to you.

Read the full article here