When you were little, saving money meant stuffing a piggy bank with dollars you earned from doing chores. But then, when you heard the ice cream truck coming down the street, you couldn’t pull your money out in time because that piggy bank was so hard to open! So much for impulse spending, am I right?

Whether you realized it or not, that hard-to-open piggy bank was teaching you how to save your money and delay gratification.

And now that you’re older and intentionally saving for things that cost more than a Rocket Pop, you need a better place to stash that cash than a ceramic farm animal on your dresser. But what’s the best option? Don’t worry—I’ve got the inside scoop on when it makes sense to use a money market vs. a savings account.

What Is a Money Market Account?

A money market account is a type of savings account that usually offers a higher interest rate and easier access to your money than a typical savings account. That means you can get checks or a debit card to spend the money in your account—though you might be limited on how often you can make a withdrawal. You’ll probably also need to make a higher initial deposit or keep a higher monthly balance in a money market account than a typical savings account.

Money market accounts and savings accounts are kind of like siblings. They’ve got similar DNA, but they look (and act) a little differently. That said, here are a few places where you could open your money market account:

- Your local bank

- An online bank

- A credit union

What Is a Savings Account?

A savings account is an account you can open with your local bank or credit union. It gives you a safe place to put your hard-earned money that you won’t (or shouldn’t) touch for a while. Your bank may require a minimum balance in your savings account, which is okay because having money in savings is the point! Let’s be real. If you need to spend, that’s what your checking account (or actual cash on hand) is for. Think of it like this: Savings accounts are for stashing cash. Checking accounts are for cash flowing. Checking accounts and savings accounts work well together, like best friends who share back and forth, but they shouldn’t be seen as the same.

Here’s another note. Regular savings accounts used to earn a decent amount of money in interest. Well, not so much today. When it comes to savings accounts, even a high-yield savings account, your first concern should be saving money, not your rate of return. Think of it as a safer version of your childhood piggy bank—one you don’t have to shake upside down to get cash out!

What Can I Expect From a Savings Account?

From an everyday, run-of-the-mill savings account, you can expect:

- A limited number (usually six) of transfers or withdrawals per month

- A (very) small rate of interest

- A safe place to keep money you won’t be using for a little while—ahem, like your starter emergency fund

Also, look out for any fees that come with a new savings account. You’ll normally have to meet a minimum balance to avoid them.

Money Market Account vs. Savings Account: What’s the Difference?

All right, people. When it comes to stockpiling cash for emergencies or long-term goals like a down payment on a house, money market accounts and savings accounts are both great options. The biggest difference you’ll find between a money market account vs. a savings account is the amount of access you have to your money.

Calculate the growth of your money market account with this free tool.

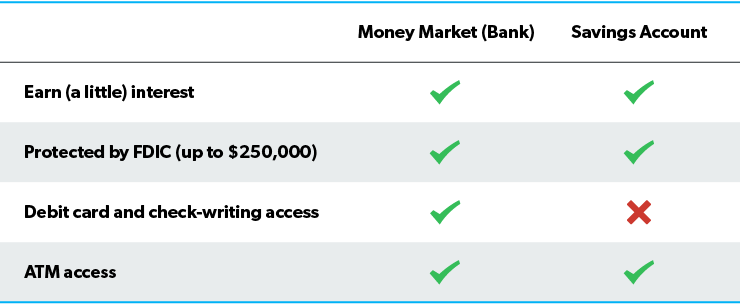

A money market account gives you the freedom—and flexibility—of writing checks and making withdrawals. It sometimes even comes with a debit card. On the flip side, a savings account is meant to be more stable for deposits—so no checks and no debit card for spending.

Money market accounts usually pay a little bit more interest than a run-of-the-mill savings account. (Both are around 0.5%.) But a high-yield savings account could earn you 3% or more in interest.

Let’s compare money market and savings accounts a little more closely:

Both money market accounts and savings accounts at banks and credit unions protect you in case your bank goes under—this includes neobanks and brick-and-mortar banks. Both the Federal Deposit Insurance Corporation and the National Credit Union Administration will cover your deposits all the way up to $250,000.

Quick note: Money market accounts are very different from money market fund accounts (sometimes called money market mutual funds). Money market funds live in the investment world—which means they aren’t for stashing savings you might need for big purchases or emergencies.

Both money market and savings accounts also give you the opportunity to earn interest—depending on your bank’s current rates. But don’t forget: This is an account for savings. You’re not really trying to make money on this money. It’s more like an insurance policy for specific events like emergencies, a down payment on a house, a family vacation, or even next year’s Christmas fund.

Which Account Should I Choose?

Okay, it’s coming down to decision time. When you’re considering a money market account vs. savings account, your choice really depends on where you are in your wealth-building journey—or as we call it at Ramsey, the 7 Baby Steps.

Baby Step 1 is saving up $1,000 strictly for emergencies. This starter emergency fund works best in a regular ole savings account—especially because some money market accounts require a minimum deposit higher than $1,000.

By putting your starter emergency fund in a savings account, you’ll still be able to access it, but it’ll be a little harder than swiping a card or writing a check to get to it. In a pinch, you can make online transfers from your savings account to your checking account. (Remember, your checking and savings accounts are best buds.) This is where discipline comes in—don’t touch your savings unless you really, really need to. Just don’t.

You’ll leave that $1,000 in there as you work on paying off all of your debt (Baby Step 2). Once you’re debt-free (woo!), you’ll start working on saving 3–6 months of expenses in a fully funded emergency fund (Baby Step 3). As you see those dollar signs add up, it can make more sense to put that cash in a money market account.

The point I want to leave you guys with is this: Whether you put your money in a money market account or a savings account, the most important thing to remember is that saving for life’s big events is the smart thing to do. It’s a game changer. And the best way to learn how to be smart with your money is with Financial Peace University (FPU). FPU has helped millions of people learn how to manage their money like no one else. Now it’s your turn!

Start FPU today and learn how to build wealth that lasts.

Read the full article here