Key takeaways

- A proposed House bill aims to drastically reshape federal student aid by eliminating Subsidized Stafford and Grad PLUS loans.

- New, lower annual and aggregate loan limits will restrict federal borrowing by undergraduate, graduate and professional students.

- A dozen repayment plans will be replaced with just two for new borrowers.

- Risk-sharing will make colleges responsible for part of the cost of student loan defaults and discharges.

On April 28, 2025, Republicans in the House Committee on Education and the Workforce proposed massive changes in federal student aid programs as part of a larger budget reconciliation bill. The party may pass the budget reconciliation bill with a simple majority, instead of the 60-vote supermajority normally required in the Senate.

The proposed legislation will eliminate some federal student loan programs, implement new loan limits, simplify repayment options, reduce federal spending and make colleges responsible for a share of student loan defaults and discharges. Taken as a whole, these changes will increase the cost of borrowing federal student loans for many borrowers.

Many of these changes were inspired by the College Cost Reduction Act (CCRA), which was introduced last year but was not passed.

Repeals some student loan programs

The proposed legislation targets several federal student loan programs for elimination.

The House legislation will eliminate the subsidized Federal Direct Stafford loan for undergraduate students. This will affect low- and moderate-income students.

Impacts

While undergraduate students will still be able to borrow the same amount of Stafford loans as unsubsidized loans, this shift will increase the cost of borrowing. With subsidized loans, the borrower is not charged interest while the borrower is in school, during a six-month grace period after and during deferment.

With unsubsidized loans, unless students pay the interest as it accrues during the in-school and six-month grace periods, their loan balances could be approximately 15 percent higher upon entering repayment.

This follows the 2012 elimination of subsidized Stafford loans for graduate students.

Furthermore, the Federal Direct Grad PLUS loan would be eliminated, and access to the Federal Direct Parent PLUS loan would be restricted to situations where the student has already borrowed up to the annual limit for Federal Direct Stafford loans.

How the end of Direct PLUS loans impacts your student loan options

Experts in the know say that congressional committees currently hunting for budget cuts — the next step of reconciliation — might be looking in the wrong place: The PLUS Loan program doesn’t actually cost Uncle Sam any money. And closing the PLUS Loan program could have cascading effects for higher education financing for years to come.

Learn more

Sets new loan limits

The proposed legislation changes the annual and aggregate student loan limits for undergraduate, graduate and professional students.

| Current aggregate limits | Proposed aggregate limits | |

|---|---|---|

| Undergraduate students |

|

$50,000 |

| Graduate students | $138,500 | $100,000 |

| Professional students |

|

$150,000 |

| Parent PLUS loans | Cost of attendance minus other aid | $50,000 |

The lifetime maximum that can be borrowed by or on behalf of any given student will be $200,000.

Loan limits will be prorated based on enrollment status, so a student who is enrolled half time will get half the loan limits for a full-time student.

Keep in mind:

College financial aid administrators will also be able to establish lower annual loan limits based on the student’s program of study.

Although the undergraduate aggregate limit is higher than the current $31,000 limit for dependent students, it is lower than the $57,500 limit for independent students. Loan limits have not changed since 2008 and are overdue for increases.

Impacts

The elimination of the Grad PLUS loan, which currently has no aggregate limit, means a substantial reduction in graduate and professional students’ borrowing capacity. Previously, graduate students were able to borrow up to the full cost of attendance (minus other aid received).

The changes in loan limits for graduate students will shift some borrowing by graduate and professional students to private student loan programs.

Federal education loans have always been capped at the college’s cost of attendance, minus other aid received. But, now student loans and financial aid will be based on the median national cost of college for the student’s program of study, not the college’s actual cost of attendance.

While basing aid on the median national cost of college could incentivize cost reductions at some colleges, the combined total of a $7,395 Federal Pell Grant and $7,500 federal student loan may have limited impact on colleges with significantly higher costs. The high-cost/high-aid model is likely to continue to drive up college costs.

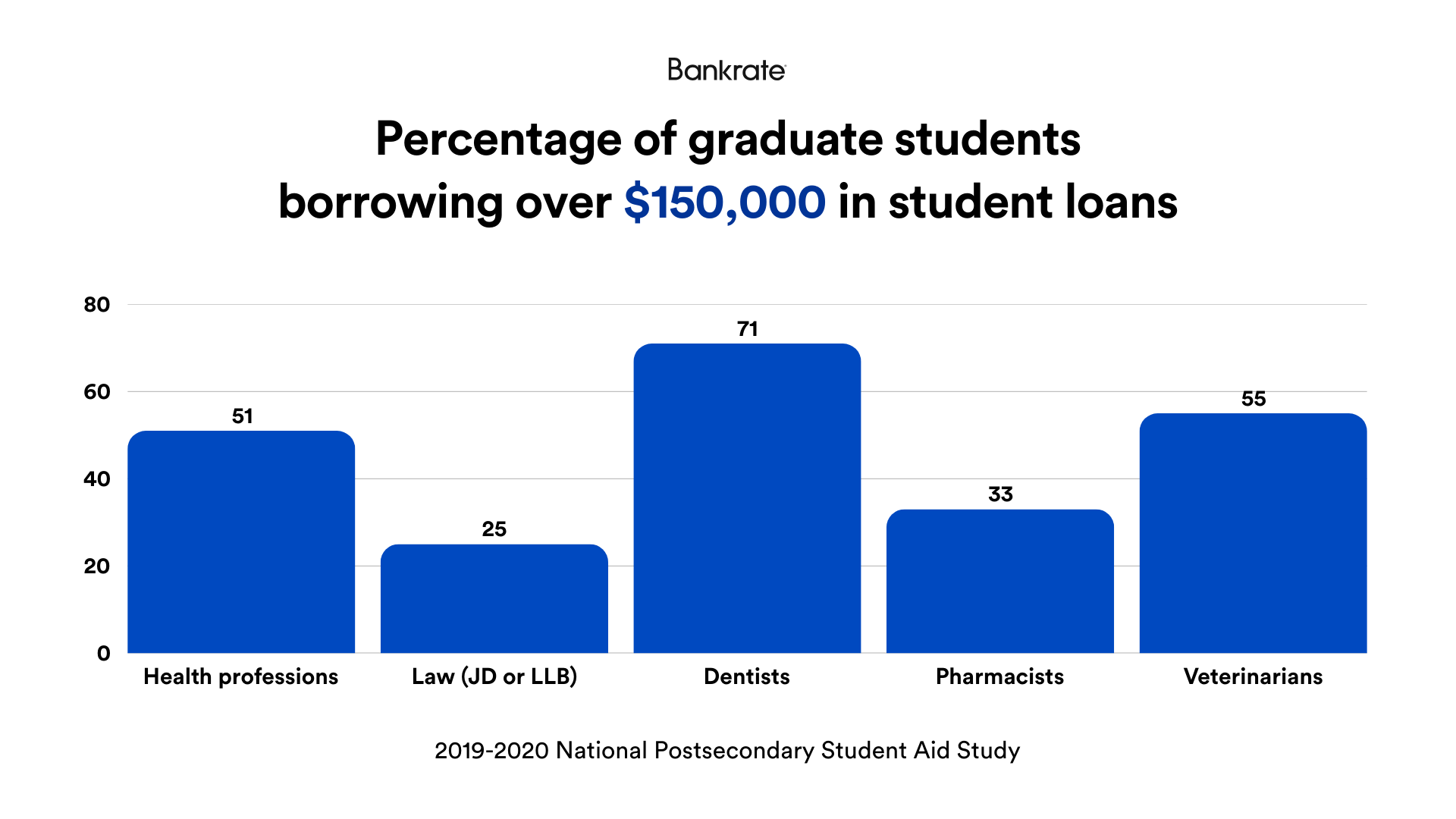

The high level of borrowing among health professions students underscores the potential impact of the proposed $150,000 cap on professional student loans. Large percentages of future doctors, lawyers and other high-income professionals borrow more than $150,000 while pursuing their needed degrees. This cap limits access to necessary funding for these programs.

Based on data from the 2019-2020 National Postsecondary Student Aid Study, more than half (51 percent) of health professions students borrowed more than $150,000. Similarly, a quarter of students seeking a law degree (JD or LLB), 71 percent of dentists, a third of pharmacists (PharmD) and 55 percent of veterinarians (DVM) borrowed more than $150,000. Among other programs, 7 percent of graduate students borrowed more than $100,000.

EXPAND

About a fifth of graduate students who borrowed beyond the new aggregate loan limits are in health professions.

Average graduate school debt in 2025

Graduate students in the U.S. leave school with about $46,798 in debt on average, according to Education Data Initiative. The average annual borrowing amount for graduate school has increased by 233 percent since 2000.

Learn more

Cuts repayment plans

The number of student loan repayment plans will drop from a dozen to just two for new borrowers. Loans made prior to July 1, 2026 will be grandfathered in, but new loans, including a new Federal Direct Consolidation Loan, will be limited to the new repayment plans.

The new Standard Repayment Plan is similar to the previous extended repayment plan. It bases the repayment term on the amount of debt.

| Total federal education debt | Repayment term |

|---|---|

|

Less than $25,000 |

10 years |

|

$25,000 to $50,000 |

15 years |

|

$50,000 to $100,000 |

20 years |

|

Over $100,000 |

25 years |

The new Income-based Repayment Assistance Plan (IRAP) pegs the annual base loan payment amount to the borrower’s Adjusted Gross Income (AGI).

| Adjusted gross income (AGI) | Annual payment percentage |

|---|---|

|

Less than $10,000 |

$120 |

|

$10,000 to $20,000 |

1% of AGI |

|

$20,000 to $30,000 |

2% of AGI |

|

$30,000 to $40,000 |

3% of AGI |

|

$40,000 to $50,000 |

4% of AGI |

|

$50,000 to $60,000 |

5% of AGI |

|

$60,000 to $70,000 |

6% of AGI |

|

$70,000 to $80,000 |

7% of AGI |

|

$80,000 to $90,000 |

8% of AGI |

|

$90,000 to $100,000 |

9% of AGI |

|

Over $100,000 |

10% of AGI |

These amounts are divided by 12 to yield the monthly payment amount. The minimum payment is $10 a month. The monthly payment is reduced by $50 for each dependent child under age 17.

The IRAP repayment term is capped at 30 years (360 months), at which point the remaining debt is forgiven. This is up from 20 or 25 years under existing income-driven repayment plans.

Keep in mind:

Parent PLUS loan borrowers are limited to the Standard Repayment Plan.

Impacts

The new Standard Repayment Plan requires a borrower to have more debt to qualify for a longer repayment term. Monthly student loan payments may be higher than under extended repayment.

The payments under IRAP are lower than under Income-Based Repayment, but higher than under the SAVE plan. It may cost borrowers hundreds of dollars more per month.

How payments could change

Imagine a borrower who owes $41,000 in Direct Loans at a 6.53 percent interest rate. Currently, they could qualify for a 25-year repayment term under the Extended Fixed Repayment Plan, yielding a monthly payment of $278. Under the revamped Standard Repayment Plan, their maximum term would be 15 years. That means a monthly payment of $358 — an $80 difference.

Changes deferment and forbearance eligibility

The proposed legislation also seeks to tighten eligibility for student loan deferments and forbearances.

The economic hardship deferment and unemployment deferment will be eliminated for loans made on or after July 1, 2025.

While forbearances will remain available, they will be limited to nine months during any 24-month period for borrowers who receive a loan on or after July 1, 2025.

Borrowers in a medical or dental internship or residency are eligible for a different forbearance, where interest does not accrue during the first four 12-month intervals. Interest accrues during any subsequent 12-month interval.

Restrictions on discharges and forgiveness

The legislation prevents the U.S. Department of Education from issuing new economically significant regulations (i.e., an impact of $100 million or more) that increase loan subsidy costs to the federal government.

The legislation also eliminates the 2022 regulations for closed school discharges and the 2022 regulations for the borrower defense to repayment.

Impacts

This makes it harder for borrowers to qualify for a closed school discharge or a borrower defense to repayment discharge, though the latter rules were not implemented due to a court battle.

Adds college accountability measure through risk-sharing

The legislation eliminates gainful employment requirements, but instead adds risk-sharing for defaulted federal student loans and other unpaid loan amounts.

Colleges will be required to pay part of the non-repayment balance of borrowers who attended their institution. The non-repayment balance includes delinquencies and defaults, as well as waived interest and loan forgiveness amounts.

There are two complicated formulas, one for completers and one for non-completers who received federal student aid.

- The formula for completers is based on a comparison of the value-added earnings with the total price of the program. The value-added earnings is defined as the difference between the borrower’s annual earnings and 150 percent of the poverty line for undergraduate students and 300% of the poverty line for graduate students, subject to a geographic adjustment.

- The formula for non-completers is based on the percentage of federal student aid recipients who do not graduate within 150 percent of the normal time-frame. For students who attended a two-year college, it is based on the percentage who do not obtain a Bachelor’s degree within six years of initial enrollment.

Impacts

The risk-sharing amounts paid by the colleges will fund the PROMISE Grants. PROMISE Grants will be available to colleges that increase college access and affordability and that provide a maximum total price guarantee. The PROMISE Grant amount is capped at $5,000.

Changes Federal Pell Grant eligibility

The legislation changes the definition of full-time enrollment for Federal Pell Grant recipients from 12 credits to 15 credits per semester. This will require students to take an extra class a semester to qualify for the maximum Pell Grant.

Students who are enrolled less than half-time will be ineligible for the Pell Grant unless they are enrolled in an eligible workforce program that provides 8 to 15 weeks of instruction.

Money tip:

The income eligibility determination for the Pell Grant will eliminate the foreign income exclusion.

Applicants who have a Student Aid Index (SAI) that is at least double the total maximum Federal Pell Grant amount for the academic year will be ineligible for a Federal Pell Grant.

Impacts

Reductions in eligibility for the Federal Pell Grant may lead to increases in student loan borrowing by low-income students.

Additional noteworthy changes

Borrowers will be able to rehabilitate defaulted federal student loans twice, instead of just once. Rehabilitation removes the record of default from your credit report.

The legislation restores the exclusion for family farms and small businesses from the definition of assets on the FAFSA.

Bankrate’s take

House and Senate committees are still finalizing the budget reconciliation bill, a lengthy and contentious process. NPR reports that House Republicans want to finalize their version of the bill to send to the Senate by Memorial Day, so constituents still have time to share their opinions about any proposed changes with their legislators. Make sure you follow student loan news closely to stay aware of any legislation that could impact your finances.

Read the full article here