The Utility sector is generally viewed as a sleepy one by investors. However, a variety of factors are coming together that may reinvigorate both the absolute and relative performance of the sector.

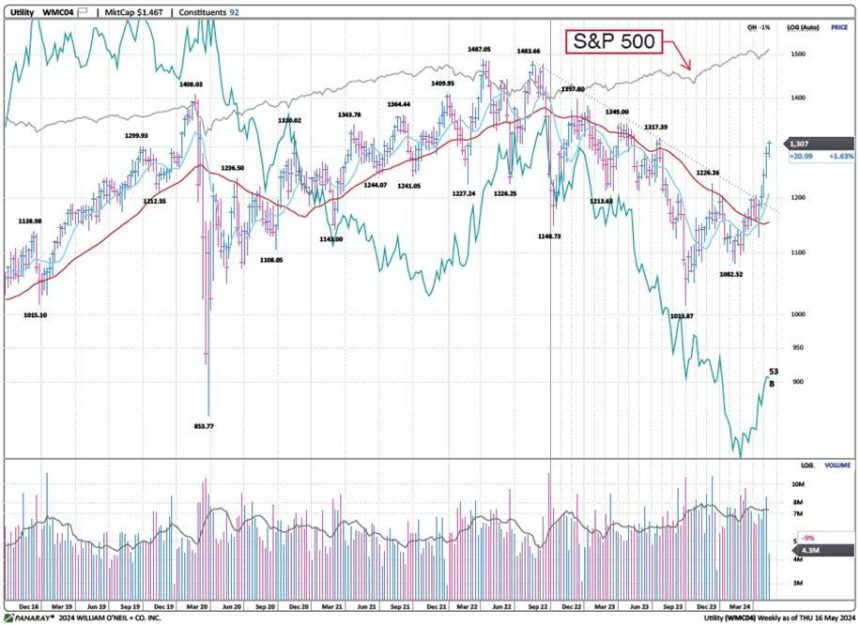

Figure 1 below shows that the Utility Sector has greatly lagged the overall stock market, as represented by the S&P 500 over the last five years. This has been recently due to two main factors: 1) higher interest rates caused by the Fed’s tightening that has made Utility stock dividend yields less attractive; and 2) slower earnings growth than the overall market as the US economy recovered from COVID. From the end of March 2020 through this week, the S&P 500 has gained over 115% versus the Utility sector +28%.

Figure 1: Utility Sector Weekly Chart

This relative graph shows the trailing 1-yr performance of the Utility sector versus the S&P 500 since 1970. It has twice neared its all-time low underperformance <-40%, most recently through mid-March 2024.

Figure 2: Utility Sector Performance Relative to the S&P 500

What is newsworthy is that this sharp relative underperformance may have come to an end. The gap over the trailing one-year has narrowed over two months, and Figure 3 shows the William O’Neil & Co. Sector Rotation Graph. Utilities are currently in the top left quadrant of sectors that have been underperforming but are now improving. Normally, the best performance comes from sectors in this top left quadrant as they move towards – and eventually into – the top right of the Rotation Graph.

Figure 3: US Sector Rotation Graphic

Looking more closely within the sector, one can see in Figure 4 that Electric Power Utilities are the strongest of the four industries. This is the segment that we believe has a strong opportunity to provide alpha to portfolios over the next 12-18 months, leading the overall sector in closing the wide gap of the past couple of years to the broader market.

Figure 4: US Utility Industry Groups Relative Rotation Graphic

Currently, about two-thirds of US electricity demand is covered by non-profit Regional Transmission Organizations. These “RTOs” oversee price-competitive markets, which are different than regional monopoly utilities that are state governed. Although RTOs must accept the lowest bids from generators, in cases where demand is sharply outstripping supply, prices are pressured to the upside.

Following a decade of flattish overall electric power growth as the existing load became more efficiently used, the next decade is expected to bring rising overall electricity demand. This will be driven largely by the mega-theme of electrification of the economy: passenger and commercial automobiles, logistics, battery storage, renewable energy transmission, homebuilding (to include heating and cooling), and commercial construction.

Figure 5 is a chart from an NRG Energy

NRG Energy

Figure 5: US Power Demand, Past and Future

In the big picture, US electricity demand forecasts can vary widely but should rise by anywhere from 1 to 3% annually over the next 10 years, depending on the adoption rate of the aforementioned trends. Because of the flattish demand for power over the past decade, there has been limited new investment in new high-voltage transmission lines. Figure 6 below from the US Department of Energy shows the expected need for additional power over the next two decades, including cases for moderate- and high-demand growth.

Figure 6: 2023 Transmission Needs Study

Figure 7 shows that under a moderate scenario for anticipated power needs, most areas of the US lack updated transmission capacity. Texas easily leads all regions in its expected shortfall. This region is served mainly by the Electricity Reliability Council of Texas, which acts like an RTO but with state oversight instead of from the national Federal Energy Regulatory Commission.

Figure 7: 2023 Transmission Needs Study – by Region

The clearest winners in a scenario of higher-than-expected electricity demand are those Utilities operating in price-competitive markets that have supply/demand imbalances, with the ability to take advantage of rising market rates for power. These, in addition to those with nuclear exposure, are now benefiting from new production tax credits signed into law with the Inflation Reduction Act (IRA) in 2022. Pure-play independent power producers (IPPs) are the best positioned and have already been well appreciated by the market:

- Constellation Energy

Constellation Energy

- Vistra Energy

Vistra Energy

- NRG Energy (NRG) sells electricity and natural gas to residential and business customers, and also provides smart home/HVAC/backup power solutions for residential customers. Growth is focused on electricity distribution Texas. It has 13GW of natural gas, coal, and solar power generating capacity.

As shown in Figure 8, these three stocks are up 90%, 150%, and 65%, YTD, respectively. They are the second, third, and fifth best stocks YTD within the S&P 500.

Figure 8: Datagraphs®

Two segments that will likely drive a large chunk of the increasing demand include data centers and – maybe surprisingly – oil and gas production. Texas is a leader in both areas. Data center demand has been well understood, but the oil and gas electrification is less discussed. Producers will face tightening emissions standards and will need to use electrification to continue producing fossil fuels. Examples of this include electrifying well production, drilling, water handling, lifting and pumping operations, and gathering and processing functions. Figure 9 below shows the increasing electricity demand from both trends.

Figure 9: Electricity Demand Forecasts

In 2023, electricity rates were flat to down but the expectation is for sharp rate increases this year, particularly in competitive markets. For instance, for NRG, expected forward prices in Texas as of mid-April 2024 were up 15-25% higher for the next three years versus eight months prior as shown in Figure 10.

Figure 10: NRG Forecasted Pricing

NRG has commented that it is in talks with “hyper-scalers” (ex: AMZN, META, GOOGL, MSFT) to increase loads for existing data centers by threefold over the next three years, not to mention newly built data centers.

The IPPs potential benefit as price expectations rise has been rewarded with significant increases in the three stocks, as shown in Figure 8. However, the stock market is also rewarding larger electric utilities and renewable energy producers, as well as service component providers. Those with significant renewable energy or nuclear energy exposure, and/or with access to markets with faster demand growth expectations, have begun working well more recently.

On nuclear power, while there are unlikely to be any large-scale nuclear reactors built in the near future, there is increasing interest in small-scale nuclear reactors. These still face high regulatory hurdles but could help ease the coming strain on power grids, particularly for large industrial/commercial users (data centers, etc.). For now, those with nuclear generating capacity are benefiting from new production tax credits in the IRA bill passed in 2022.

- The two largest nuclear power producers, Constellation Energy (CEG) and Vistra Energy (VST), were featured above as beneficiaries of other trends. They are followed by Duke Energy

Duke Energy

Public Service Enterprise Group

Other companies related to nuclear include Cameco (CCJ), which is the largest provider of uranium and refined fuel for nuclear reactors in North America, and BWX Technologies (BWXT

iShares Exponential Technologies ETF

Finally, those on the periphery that support the Electric Utility industry should also prosper. Some companies in this category include construction company Quanta Services

Quanta Services

In conclusion, though the electric power industry has classically lacked significant growth to warrant much attention, societal, government, and industry trends should all lead to an acceleration in demand in the US. The slower growth of the past led to underinvestment in capacity in the sector. As demand accelerates, both power producer profits and well as suppliers to the industry should do well. We would advise investors to consider making space in their portfolios for investment in this sector, with a favorable look at nuclear-related companies.

Kenley Scott, Director, Global Sector Strategist at William O’Neil + Co., an affiliate of O’Neil Global Advisors, made significant contributions to the data compilation, analysis, and writing for this article.

Read the full article here