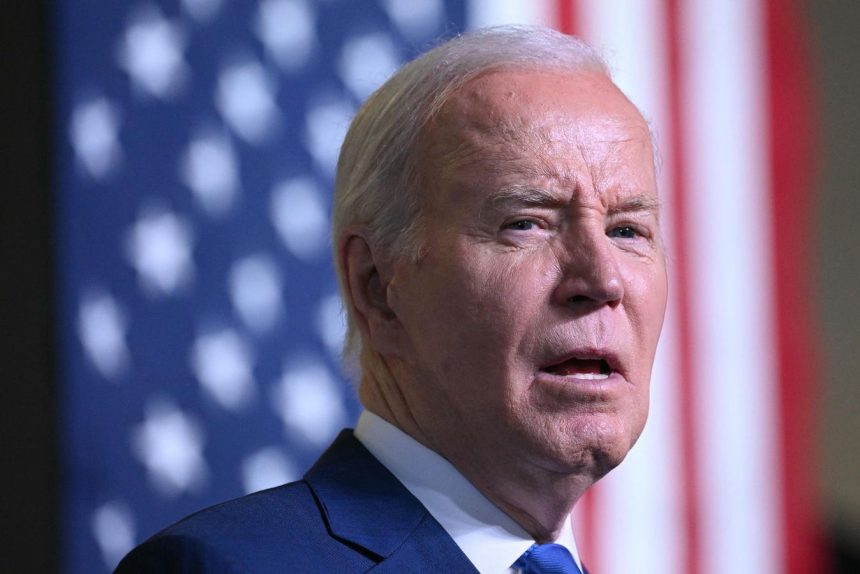

The Biden administation is preparing to roll out a new student loan forgiveness plan that would provide relief to borrowers based on hardships. Borrowers may be able to apply starting this fall. But the exact timeline is far from certain.

Unlike other elements of President Biden’s new debt relief initiative, which could result in automatic loan forgiveness for millions of borrowers, the hardship route would require an application. The Education Department has already released a preview of factors that could help officials determine whether a borrower is experiencing a hardship that would justify loan forgiveness. And more concrete draft regulations are expected soon.

Here’s the latest.

Hardship Student Loan Forgiveness Part Of Broader Biden Plan

Hardship-based student loan forgiveness is part of a broader Biden administration plan to create a robust new debt relief initiative. The new program, designed as a second attempt to enact mass debt cancellation after Biden’s original plan was overturned by the Supreme Court last year, is grounded in a different legal authority. And administration officials hope that the Education Department’s year-long process of establishing new regulations will insulate the plan from anticipated legal challenges.

The new program would provide relief to four groups of borrowers. This includes those who have experienced runaway interest, first entered repayment at least 2o or 25 years ago, attended “low-value” schools that lost their eligibility for federal student aid, and borrowers who qualify for existing student loan forgiveness programs but haven’t enrolled. The Education Department released draft regulations for these categories last month, and a public comment period is set to end later this week.

A fifth group of borrowers could receive student loan forgiveness based on personal and financial hardships that suggest that the government’s cost of trying to collect on these loans would not be justified due to a borrower’s likely inability to pay. The Education Department has not released formal draft regulations for this prong of relief yet. However, the department indicated in April that it would publish a second set of draft regulations for hardship-based loan forgiveness “in the coming months.”

‘Indicators’ Of Hardship Would Be Key To Determining Student Loan Forgiveness Eligibility

While borrowers await the publication of the draft rules for hardship-based student loan forgiveness, there are unlikely to be significant surprises. The Education Department said last month that the regulations “will mirror the proposals that achieved consensus” during a negotiated rulemaking hearing officials held in February.

At that hearing, stakeholders agreed on a number of “indicators” that could demonstrate that a borrower has “a high risk of future default” or is otherwise experiencing significant hardships. These include persistently low income, as well as large expenses and high debt burdens (not necessarily just student loan debt); age and disability status; eligibility for other government relief programs that are already means-tested; and failure to complete the requisite program degree or certificate program.

The hardship student loan forgiveness program “would help many other borrowers experiencing hardship related to student loans that creates a barrier to them fully repaying their loans or the cost of collection is not justified,” said the department.

Application Will Likely Be Required For Hardship Student Loan Forgiveness

The Biden administration hopes to implement much of the new student loan forgiveness plan on a mass scale automatically, without requiring borrowers to formally apply. For the four main categories of debt relief, this should be theoretically possible. The Education Department already has data on borrowers’ balance increases due to interest accrual, the dates when loans first entered repayment, and the schools borrowers attended. This could pave the way for automatic relief.

However, the department will likely require borrowers pursuing hardship-based student loan forgiveness to submit an application. While the department may have access to certain financial information, such as a borrower’s income if they have been repaying their student loans under an income-driven repayment plan, officials would not be able to ascertain a borrower’s overall financial picture without some form of documentation.

The Education Department’s current published guidance on the new program indicates that borrowers seeking loan forgiveness based on hardship would “receive relief through an application process,” seemingly confirming that such relief will not be automatic.

Student Loan Forgiveness Application Could Arrive This Fall, But Timeline Is Uncertain

The Biden administration has not provided a specific timeline on when borrowers can apply for student loan forgiveness tied to personal and financial hardships. However, officials have repeatedly eyed this fall for implementing relief under the new program. The department “will carefully consider comments received and aims to finalize these rules in time to start delivering relief this fall,” according to a statement last month. Aside from the delayed publication of the new regulations, officials have not publicly stated that hardship-based loan forgiveness would be on a substantially different timeline.

But it is unclear if the department will prioritize automatic relief first. If that happens, hardship-based loan forgiveness (and any associated application) could get pushed out into next year. With the Education Department already trying to implement several other debt relief programs such as the IDR Account Adjustment and settlement relief under Sweet v. Cardona, the individualized attention required to determine whether a borrower qualifies for loan forgiveness due to hardship could make any application process painfully slow.

Observers also widely expect there to be legal challenges to Biden’s new loan forgiveness plan. And given how things went for Biden during the first attempt at mass debt cancellation, it is not inconceivable that the program could get derailed before it even gets off the ground.

Read the full article here