Millions of borrowers were notified this week that they will not have to make a student loan payment in July. The Biden administration has directed loan servicers to place many borrowers enrolled in the SAVE plan into a special type of forbearance in anticipation of payments getting recalculated and reduced. SAVE is a new income-driven repayment plan that often has lower payments and gives borrowers a pathway to student loan forgiveness.

“We look forward to providing millions of borrowers with lower monthly payments as part of the Biden-Harris Administration’s work to provide the most affordable student loan repayment plan ever,” said an Education Department spokesperson yesterday.

Here’s what borrowers need to know.

Faster Student Loan Forgiveness And Lower Payments Under Biden’s SAVE Plan

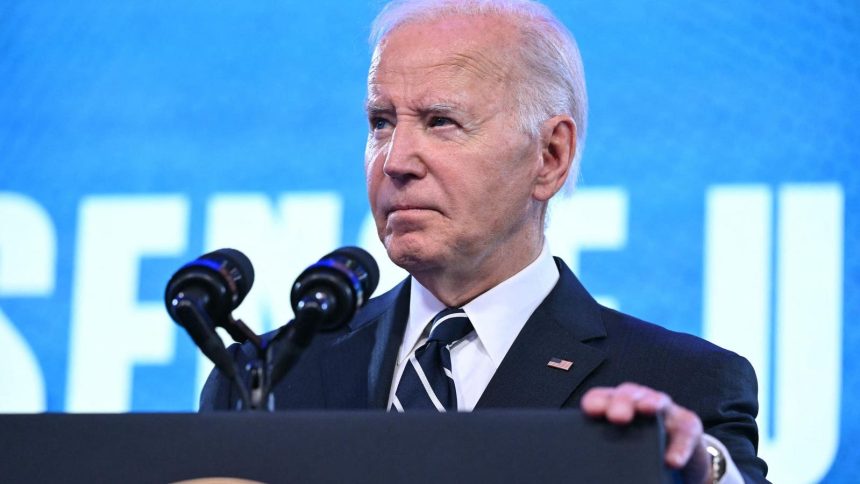

President Joe Biden debuted the Saving on a Valuable Education, or SAVE, plan last fall. Officials have described the plan as the most affordable and most beneficial income-driven repayment plan. The program features lower monthly payments, an interest subsidy that will eliminate any future balance increases for borrowers who are underwater on their payments relative to interest accrual, and accelerated student loan forgiveness for those who took out small amounts of debt.

But the SAVE plan is about to get even better for borrowers. Starting on July 1, a new repayment formula for the plan will go into effect. This update will slash the monthly payments for undergraduate borrowers by half as the plan’s “discretionary income” formula is reduced from 10% to 5%. Borrowers who have graduate school loans will also see a reduction to their payments if they have undergraduate loans as well; the amount of the reduction will depend on the proportion of their graduate and undergraduate student loan debt.

Student Loan Payments Paused For July As New Formula Goes Into Effect

More than eight million borrowers have enrolled in SAVE, according to the Education Department, and many of these borrowers will have their payments recalculated under the new formula that goes into effect next month. In anticipation of this, and in an effort to avoid some of the repayment chaos that plagued the student loan system when the Covid-19 payment pause ended last fall, the Education Department has directed loan servicers to place impacted borrowers in an “administrative forbearance” for the month of July, cancelling any payment that would otherwise be due.

Borrowers started receiving notices this week that their servicer “has placed an Administration Forbearance on your account” from July 1 through July 31. The Education Department confirmed that the forbearances are being applied at the direction of the Office of Federal Student Aid.

“As the Department finalizes preparations with student loan servicers to implement borrowers’ new, lower monthly payments capped at 5% for undergraduate loans under the SAVE Plan, some borrowers may be placed in a brief processing forbearance to ensure they can access the full benefits of the SAVE Plan and that their new payment amounts are accurate,” said the department spokesperson. During the forbearance, “no payment is required” and borrowers’ interest rates will be temporarily set to 0%.

Forbearance Will Count Toward Student Loan Forgiveness Under PSLF And IDR

Under new regulations, mandatory processing forbearances can now count toward student loan forgiveness for IDR plans as well as for Public Service Loan Forgiveness. This is a significant departure from past practice, when these types of forbearances would not count, and borrowers could face significant setbacks in making progress toward eventual loan forgiveness.

The Education Department confirmed that the July administrative forbearance will count toward student loan forgiveness. Borrowers “will receive credit toward IDR forgiveness and Public Service Loan Forgiveness (PSLF),” said the department spokesperson.

SAVE’s Student Loan Forgiveness And Repayment Benefits Face Legal Challenges

While the Biden administration works to implement the student loan payment reductions under SAVE, the plan is facing two serious legal challenges brought by a coalition of more than a dozen Republican-led states. The states are seeking to block the program, arguing that President Biden exceeded his authority in establishing such a generous IDR plan.

Last week, a federal judge in Kansas gave the Biden administration a partial victory in one of the challenges when it dismissed the lawsuit for eight out of 11 states. But the court allowed the lawsuit to proceed for the three remaining states associated with that legal challenge.

Meanwhile, a ruling is expected any day from a judge in Missouri who is overseeing the second legal challenge. The court held a hearing on the states’ request for a preliminary injunction earlier this month. If granted, the injunction would block SAVE for new enrollees while the litigation continues; it is unclear if borrowers currently enrolled in SAVE would be able to get their payments reduced in July as the administration intends. A ruling is expected any day.

Read the full article here