In my work as a wealth advisor, I often find that people are seeking to accomplish more than just financial security. They strive for a greater sense of purpose and a way to make a lasting impact on the world around them. This is where philanthropy and generosity comes into play. These are powerful tools that can not only benefit others but also enhance a person’s own financial well-being and overall satisfaction with life that cannot be quantified with numbers.

Scarcity Mindset: A Barrier to Generosity

One of the main obstacles to embracing financial generosity is the scarcity mindset. This belief that resources are finite and must be hoarded can lead to a reluctance to share wealth, even when we have more than enough to meet our own needs. In some communities, this thought process has been instilled in core belief systems rooted in trauma and pain. However, research has shown that this mindset is a self-fulfilling prophecy. By focusing on lack, we create a reality of scarcity. Embracing an abundance mindset, on the other hand, can open up new possibilities for financial generosity and personal growth.

Helper’s High: The Psychological Benefits of Giving

The act of giving triggers a cascade of positive emotions and physiological responses. Studies have shown that donating to charity activates the same reward centers in the brain as receiving money or experiencing pleasure. This phenomenon, known as the “helper’s high,” can lead to reduced stress, increased happiness, and a greater sense of purpose. Furthermore, research has linked charitable giving to lower levels of depression and anxiety, as well as increased longevity.

Financial Generosity: A Reflection of Values and Legacy

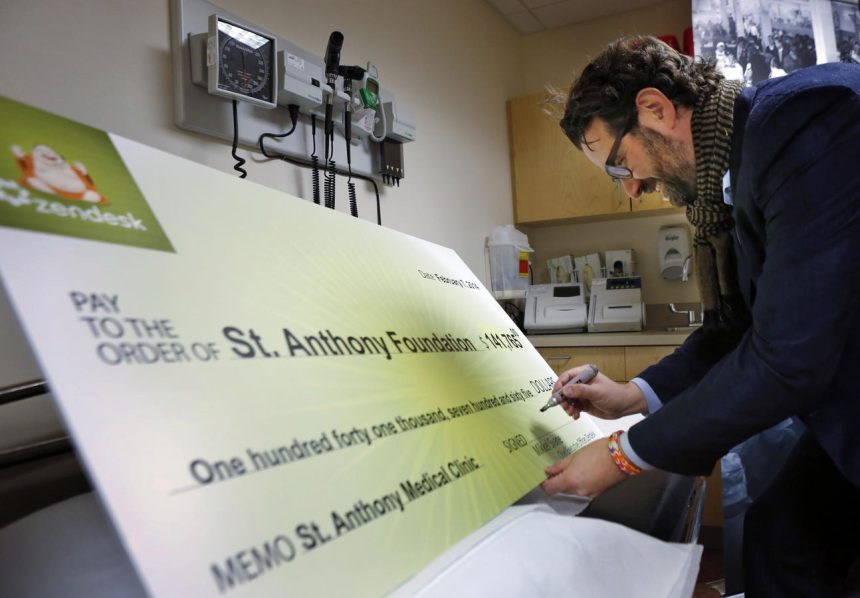

Beyond the emotional and psychological benefits, financial generosity is a powerful way to express your values and leave a lasting legacy. By supporting causes that align with your beliefs, you can make a tangible impact on the world and inspire others to do the same. Whether it’s donating to your alma mater, funding medical research, or supporting social justice initiatives, your financial contributions can create a ripple effect that extends far beyond your own lifetime. However, once you decide why you want to give, how much to give and when, the next important task to tackle is how you want to give and the best way to do that.

Integrating Philanthropy into Financial Planning

As a wealth advisor, I encourage my clients to incorporate philanthropy into their financial plans in a way that is both strategic and meaningful. This can involve setting aside a percentage of income or assets for charitable giving, establishing a donor-advised fund, or exploring impact investing opportunities.

Donor-Advised Funds: Establishing a donor-advised fund or DAF, offers a flexible and tax-efficient way to manage your charitable giving. You can contribute cash, securities, or other assets to your DAF, receive an immediate tax deduction, and then recommend grants to your favorite charities over time. DAFs also allow you to consolidate your charitable giving into one account, simplifying recordkeeping and grantmaking.

Impact Investing: Impact investing allows you to align your investment goals with your social and environmental values. Impact investments aim to generate positive social or environmental impact alongside a financial return. There are a growing number of impact investment opportunities available, including community development financial institutions commonly known as CDFIs, social impact bonds, and sustainable investment funds.

Targeted Giving: As the giver, you can always choose to direct your financial generosity towards causes that resonate most with you. Here are a few common examples:

- Supporting Universities: Donations to universities can help fund critical research, provide scholarships to deserving students, and expand educational opportunities for future generations.

- Empowering Non-Profits: Non-profit organizations play a vital role in addressing a wide range of social and environmental challenges. Your contributions can be crucial for the organizations ability to support essential services for the underprivileged, advocate for policy change, or promote innovation in various sectors.

- Strengthening Religious Organizations: Religious organizations provide spiritual guidance, foster community, and offer vital social services. Financial contributions and tithe can help them maintain their facilities, support outreach programs, and continue their mission of serving the community.

Uplifting as You Climb: Giving Black

In Black communities, philanthropy holds a particularly significant meaning. Historically, communities of color in America have faced systemic barriers to wealth accumulation, including discrimination, limited access to financial resources, and the still present effects of historical injustices. Despite these challenges, giving back has always been a core value in Black communities, often fueled by a strong sense of collective responsibility and a desire to uplift one another to better position the next generation for success.

Financial generosity within minority communities often takes the form of supporting local businesses, funding scholarships for students, investing in community development projects, and contributing to organizations that address social justice issues. These acts of giving not only have a direct impact on the lives of individuals and families, but also play a crucial role in strengthening the community as a whole, fostering resilience, and creating a legacy of empowerment and possibilites for future generations. By recognizing the unique challenges and strengths of these communities, the financially successful can play a vital role in facilitating and encouraging philanthropic endeavors from others by leading by example to investing in the people and efforts that better those communities. This gives individuals and organizations the opportunity to be vital in progress and the ability to create a lasting impact.

The Impact of Philanthropy: By the Numbers

The impact of financial generosity is undeniable. In 2022, Americans donated a roughly $499.33 billion to charity, the majority of from individuals. This displays that even during less profitable years in the economy and stock market , such as the US expereinced in 2022, there is still a strong presenc culture of giving. These donations fund critical research, provide essential services to those in need, and drive innovation across various areas that other wise would go underfunded.

Although giving is its own gift, its important to know that this charity often has a multiplier effect! Every dollar donated can generate multiple dollars of impact, as charities leverage these funds to create jobs, provide education and healthcare, and address pressing social and environmental challenges that are deeply important to the givers as well as the recievers. In this way way, financial generosity is not just a feel-good act; it’s a strategic investment in a better future. By incorporating philanthropy into your financial plan, you can create a legacy and impact that extends far beyond your own lifetime, leaving a lasting imprint on the world and inspiring future generations.

Read the full article here