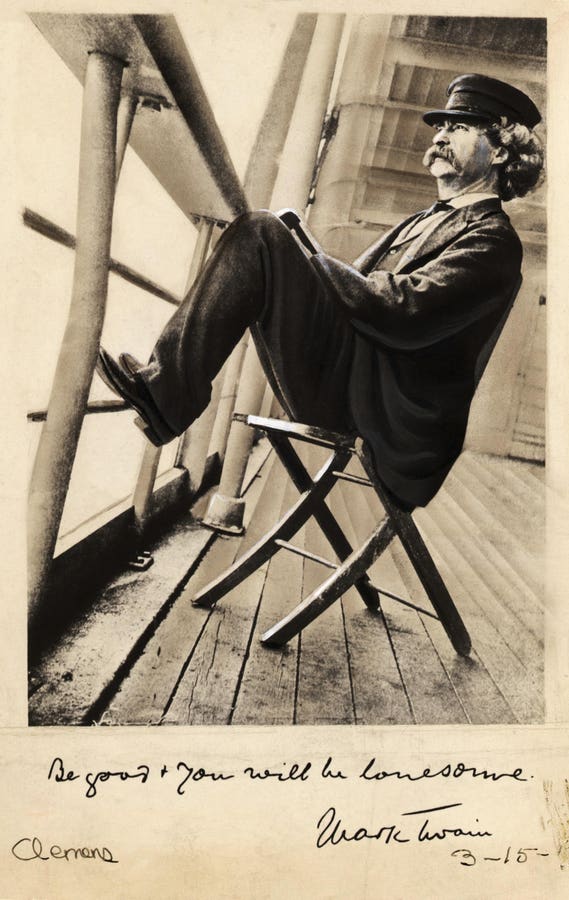

Mark Twain said, “Get your facts first, and then you can distort them as much as you please,” but the American humorist didn’t realize that some folks would skip getting the facts! After all, in a Wall Street Journal Editorial titled The Economy Is Good. Why Don’t People Know It?, noted American Economist and former vice chair of the Federal Reserve Alan S. Blinder wrote: “A Harris poll conducted a few weeks ago for the Guardian found that 49% of Americans believe that unemployment is at a 50-year high, 72% think inflation is increasing, and 56% think the U.S. is in a recession. Not one of these propositions is remotely true. That same poll even found that 49% think the S&P 500 stock market index is down for the year.”

I realize that we are operating in a highly polarized political climate and that polls sometimes tell us more about the pollsters than anything else, while only 2,119 adults were surveyed. Still, the responses are shocking, and it would seem that my oft-cited Vannevar Bush quotation, “Fear cannot be banished, but it can be calm and without panic; it can be mitigated by reason and evaluation,” is today more valuable than ever.

Not surprisingly, I always encourage investors to look beyond the headlines as the stock market, meaning the broad-based indexes, had a very good first half of the year, but the market of stocks lagged far behind. Incredibly, the proverbial monkey throwing darts would just as likely have picked a loser as a winner in the first six months of 2024.

With the major market averages up smartly through June 30, but the average stock in the red, there has been a dispersion of returns. So far in July, Value stocks like those I have long favored have gotten some time in the sun, with the Russell 3000 Value index outperforming the Russell 3000 Growth index by more than 400 basis points from the end of June through July 18. Still, the group remains very much reasonably priced relative to interest rates and its Growth counterparts on a historical multiple of earnings basis.

WHEN THE MARKET HOLDS A SALE, WE LIKE TO GO SHOPPING

Despite the latest rotation toward stocks of the Value type, there is plenty of room for the trend to continue just to get back to equilibrium. I also think the current dynamic has made it much easier to cash in chips on fairly valued stocks and reinvest the proceeds into undervalued names. After all, the objective of most investors is to sell high and buy low, and we have long preferred to buy stocks that have (temporarily, we believe) gone on sale.

One such stock is Jabil (JBL), which plunged more than 11% after the contract manufacturer reported fiscal Q3 results. Jabil earned an adjusted $1.89 per share versus $1.99 in the year-ago period and the $1.85 consensus analysts estimate. Electronic Manufacturing generated $3.4 billion of revenue, down 18% year-over-year due to lower revenue in end markets, renewable energy and digital print. Margins for the segment came in at 5.7%, which was a 20 basis-point improvement over the same quarter a year ago. Management said revenue for the Diversified Manufacturing segment came in at $3.4 billion, down 23% compared to the same timeframe a year ago due to the mobility divestiture. The core margin for the DMS segment was 4.6%, up 50 basis points year-over-year.

CEO Mike Dastoor commented, “The team has executed well in FY ’24 amid a dynamic environment. Considering this, we divested our mobility business, a key strategic decision, we’re capturing growth in the AI data center space and we’re working towards our commitment to repurchase $2.5 billion of our shares, all while dealing with end-market softness in renewables, EVs and semi-cap equipment, which we expect to be short-term in nature. Yet when you take a step-back and put it all together, the company remains resilient and on track and we expect to deliver on key metrics, including 5.6% core margins and strong free cash flow in excess of $1 billion on $28.5 billion of revenue.”

Revenue headwinds have blown strongly this year, particularly in the automotive industry, where demand has softened, and concerns of overcapacity prevail. Still, I suspect the company’s exposure to A.I. is lost on some investors, an area that has yet to fully hit its stride. The valuation, including a forward P/E ratio near 13, remains inexpensive, while the free cash flow yield is north of 8%.

This is an exert of a Special Report Update to available to subscribers of The Prudent Speculator with an update to our 2024 Stock Market Outlook. The Prudent Speculator’s content is curated each week as a valuable resource for recent stock market news, investing tips and economic trends. To receive regular reports like this one, sign up here: Free Stock Picks – The Prudent Speculator.

Read the full article here