Key takeaways

- United MileagePlus Dining allows you to earn United miles on everyday purchases at eligible restaurants in the program.

- Signing up for the program is free, but requires having a United MileagePlus account.

- The program does not require using a United credit card, but using one can help you earn more miles more quickly.

When saving up for your next award redemption, sometimes you wish there were easier ways to accrue miles without flying. If you’re saving for a flight on United or one of its partner airlines, the United MileagePlus Dining program can be a great option.

Once you link your credit card to a dining account, you can start earning United miles whenever you order from a participating restaurant in the program. MileagePlus Dining can help you earn more United miles without applying for a new credit card and by making everyday purchases at restaurants. If you do choose to enroll using a United MileagePlus credit card, you’ll earn additional miles when you use the United MileagePlus Dining program (on top of the miles you’ll earn with your United credit card). This guide will help you learn more about MileagePlus Dining and get started on your enrollment.

What is United MileagePlus Dining?

The United MileagePlus Dining program allows you to earn United miles when you make a purchase at participating restaurants. The program includes thousands of local and national restaurants and bars, meaning you likely have an eligible location close to you. This opportunity lets you do so easily once you set up your account and connect your credit cards. All you have to do is sign up and register your credit or debit card on the website. After that, any time you pay your bill at a participating restaurant, bar or club with the registered card, you’ll earn miles for every dollar you spend.

Keep in mind

How to sign up for United MileagePlus Dining

Signing up for the program is simple and free:

- If you are not already a United MileagePlus member, visit United’s website in order to join the frequent flyer program. You need to have an active United MileagePlus account before you can sign up for the dining program.

- Visit the dining program’s website and sign up with your MileagePlus account.

EXPAND

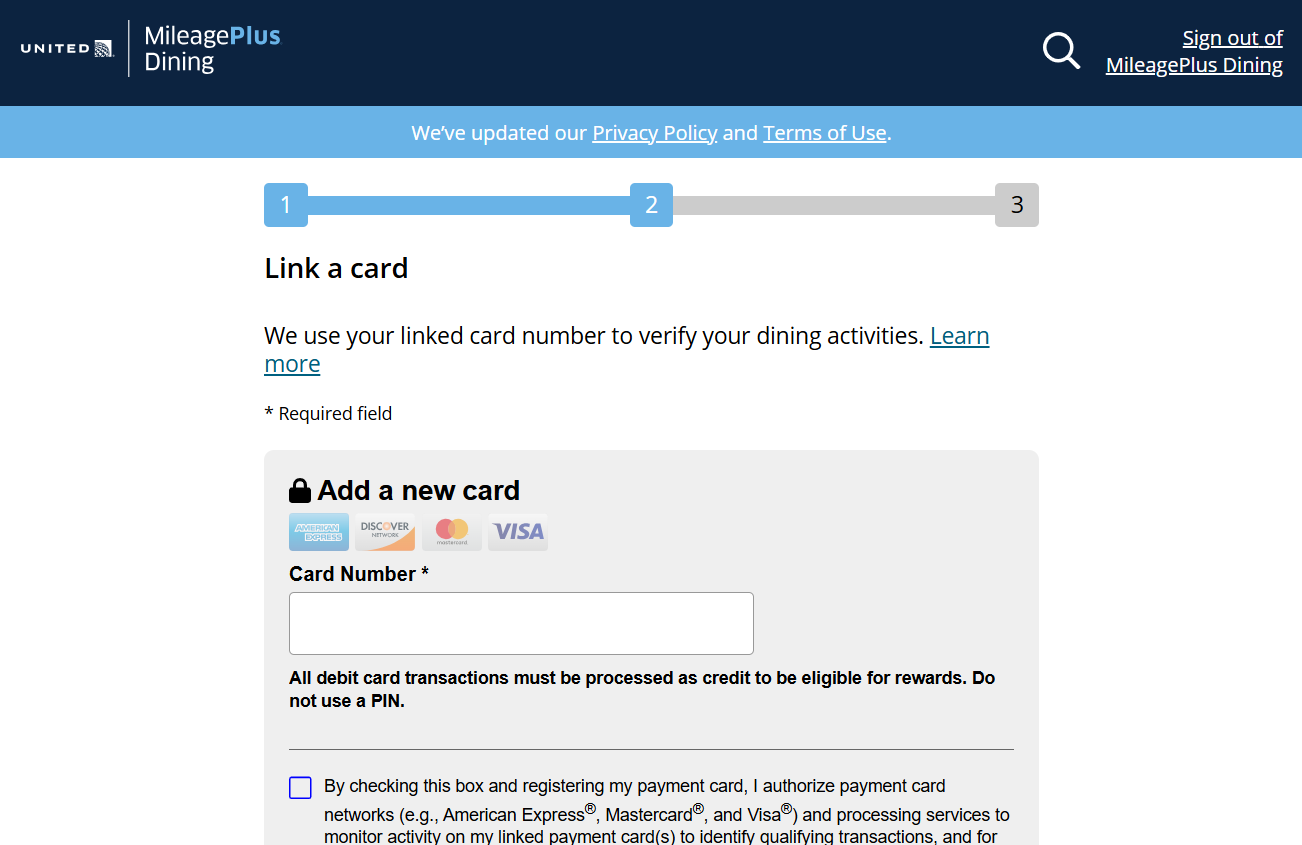

- Once you sign up, link the credit or debit cards you plan to use. Be sure to register any cards that you might use to pay your bill at a restaurant. The program will automatically award you miles whenever you use a registered card at a participating restaurant. Adding your card is done securely to keep your information safe.

EXPAND

- Use your linked credit or debit card at a participating restaurant and earn miles.

Signing up takes only a few minutes, but once you have enrolled and set up your cards for the program, you are on your way to earning miles just from your regular visits to participating restaurants and bars in the program.

How to earn miles with United MileagePlus Dining

Once you’ve set up your account and registered your cards, earning miles is easy. Every time you pay with your registered card at one of the 10,000-plus participating restaurants, bars and clubs, miles will be automatically credited to your MileagePlus account.

Here are a few tips for maximizing the program:

Sign up for emails to earn more miles

The United MileagePlus Dining program offers three earning tiers:

| Membership level | Earning rate | How to qualify |

|---|---|---|

| Basic | 1 mile per $2 | Opting out of email communications |

| Select | 3 miles per $1 | Opting in to email communications |

| VIP | 5 miles per $1 | Opting in to email communications and completing 11 qualifying transactions in a calendar year |

If you’re going to join United MileagePlus Dining, make sure to allow email communications, since you’ll earn at least three miles per dollar — instead of just one mile for every $2 spent — every time you dine out. And if you’re able to dine out at qualifying restaurants at least 11 times per year, you’ll start earning five miles per dollar with your 12th transaction.

Search for restaurants and dine out as usual

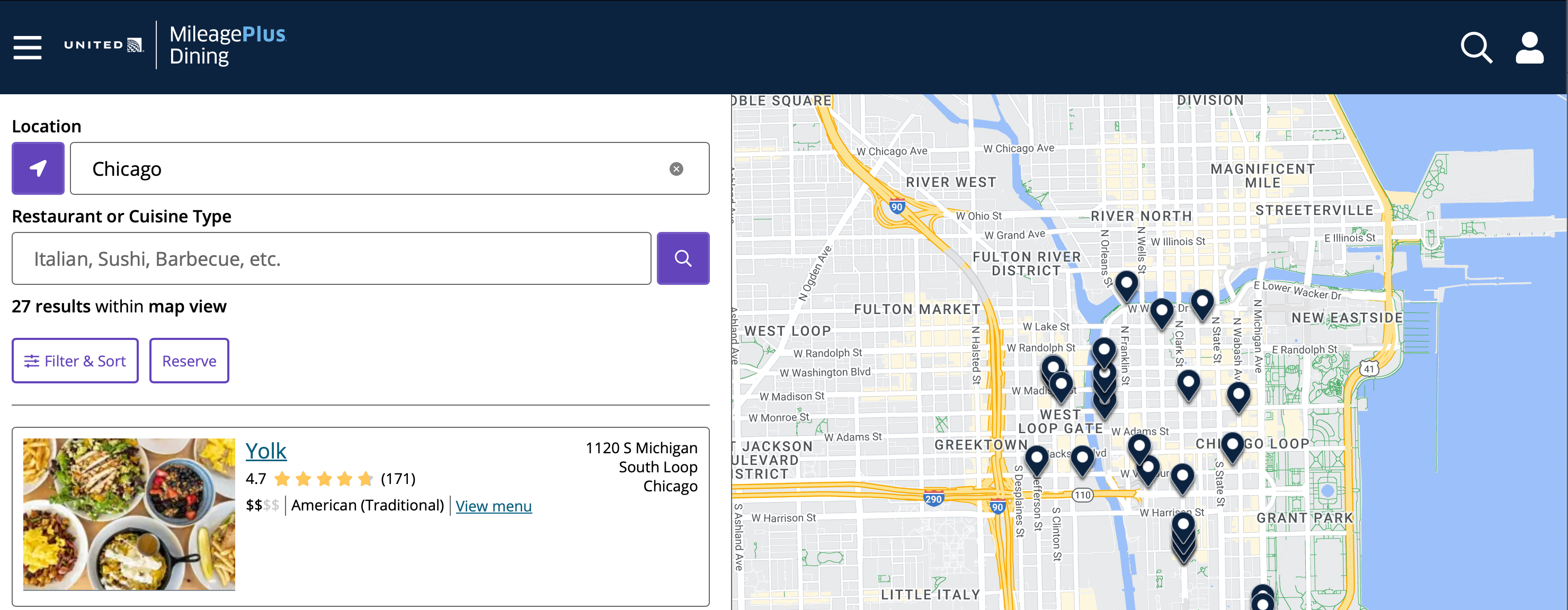

Browsing the MileagePlus Dining restaurant list is a great way to discover new eateries near your home or while traveling.

EXPAND

Finding participating restaurants and bars is easy with the MileagePlus Dining search tool.

When you make a search, the results will include photos, descriptions, reviews and average prices for each restaurant, as well as MileagePlus benefit guidelines. You can search by city or ZIP code, explore a map view of restaurants around you or search for specific foods or cuisines. For select locations, you may see additional offers if you make a reservation with the restaurant.

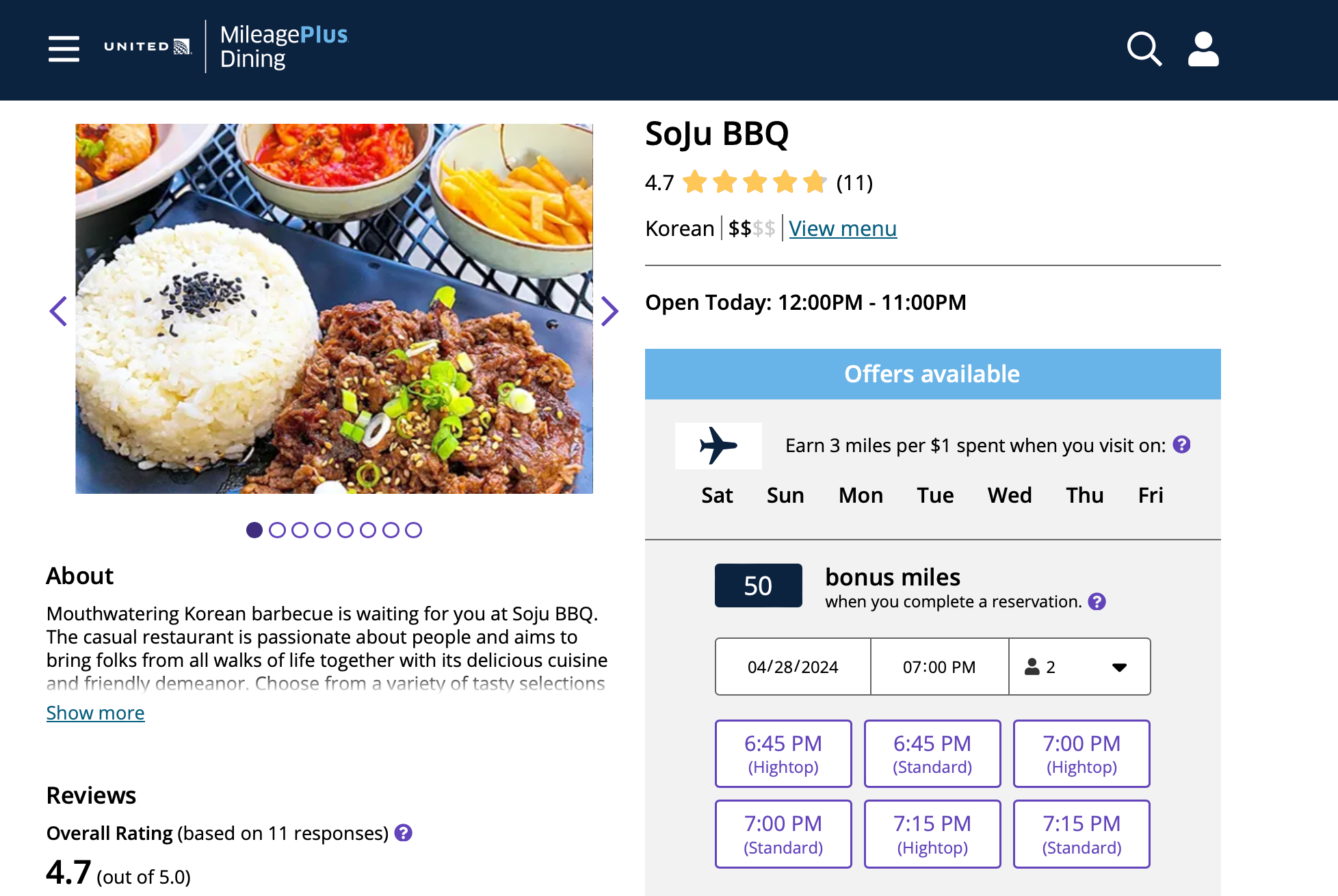

When you click on a participating restaurant or bar, you can learn more about the restaurant, read reviews, and get a sense of the price range. The site will also provide you insights into the mileage earning per dollar spent at the establishment. In addition, select restaurants let you reserve a table quickly and easily on the site.

EXPAND

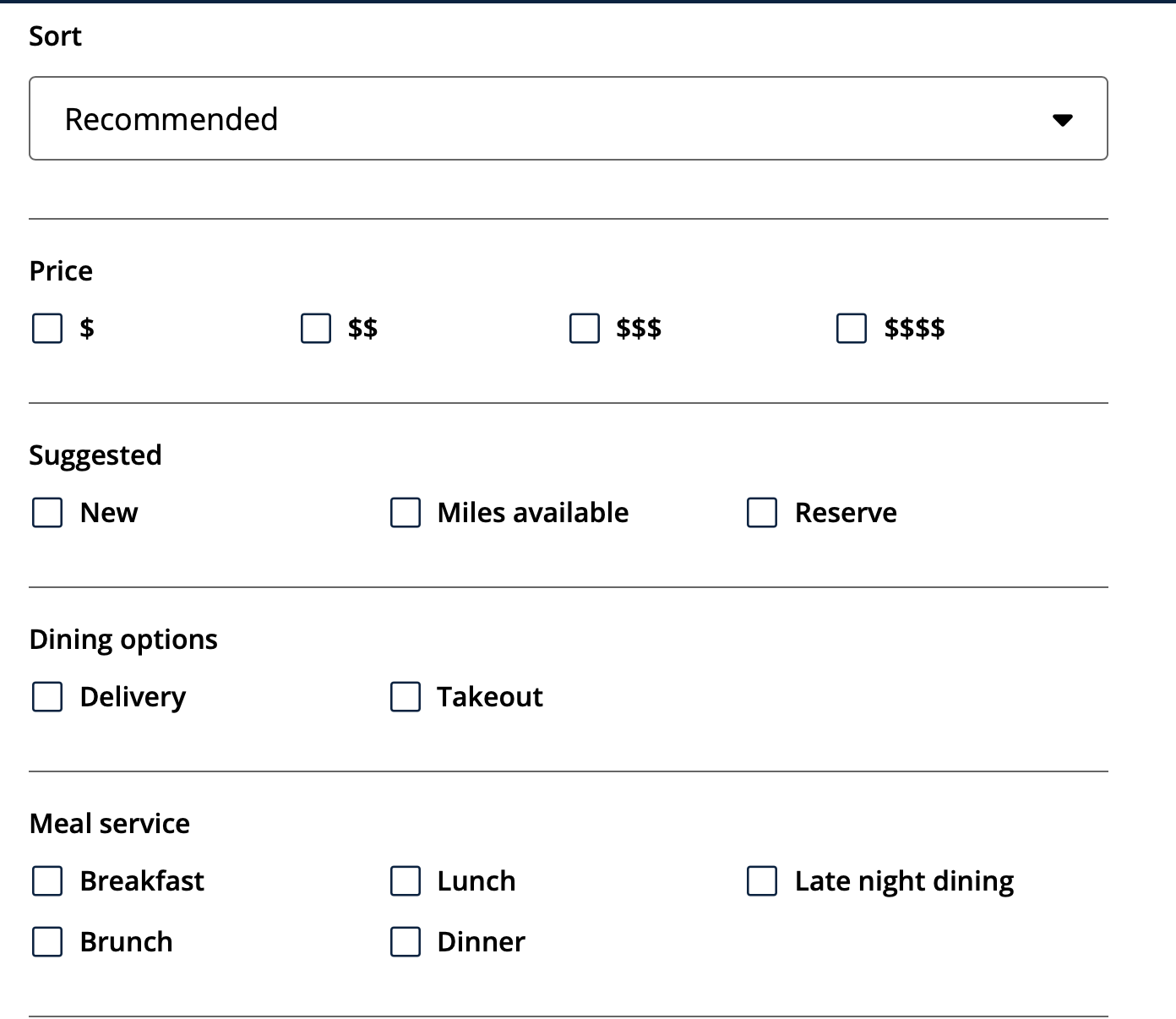

You can also filter results by distance or price and other helpful attributes for finding the right spot.

EXPAND

Of course, you don’t have to visit the website to earn miles, but it can help to know which restaurants offer rewards before you go. As long as you link your preferred cards to the United MileagePlus Dining program, you’ll automatically earn miles any time you pay for a meal at a participating restaurant.

Keep in mind:

This differs from offers in credit card shopping portals in which you have to load the offer on your card in order to benefit. With United MileagePlus Dining, you’ll earn with any restaurant in the program as long as you use a card you registered in the program.

Earn bonus miles through promotional offers

MileagePlus Dining frequently offers new and existing members the chance to earn bonus miles. Bonus offers are usually sent via email, and may require small tasks such as completing a survey, signing up for text notifications, adding a new card or spending a specific amount each visit.

EXPAND

For instance, new members can currently earn 500 bonus miles when they join MileagePlus Dining and spend $25 or more with their linked card at an eligible restaurant within their first 30 days of membership. New members will then need to review the restaurant to earn their bonus miles. Note that MileagePlus members with Premier status can earn a total of 1,000 bonus miles through this offer.

Best credit cards for United MileagePlus Dining

You can use any credit or debit card with the program, but you can also rack up more rewards if you choose strategically. For instance, Chase Ultimate Rewards can be transferred to United MileagePlus, which means you could use the Chase Sapphire Preferred® Card to earn 3X Ultimate Rewards points on your dining while also racking up United Miles through the MileagePlus Dining program. Use those Ultimate Rewards for any number of travel redemptions or transfer them to United Airlines to pool them in your MileagePlus account.

Alternatively, you may want to consider getting a United credit card. Here are the most popular:

Best for premium travel perks

-

If you fly with United frequently, you may want to consider the United Club℠ Infinite Card*, which offers numerous luxury travel perks for a $525 annual fee. For rewards, you can earn:

- 4X miles on United purchases

- 2X miles on all other travel (including airfare, trains, hotel, car rentals, rideshares and more)

- 2X miles on dining (including eligible delivery services)

- 1X miles on all other purchases

As a welcome offer, you can earn 80,000 bonus miles after spending $5,000 in the first three months after account opening. This premium travel card also comes with:

- United Club airport lounge membership (which is worth up to $650 per year)

- Free first and second checked bags for you and one companion

- Premier Access travel services (including priority check-in, security screening, boarding and baggage handling)

- Up to a $100 credit for TSA PreCheck, Global Entry or NEXUS

- 25 percent back on eligible in-flight purchases

- No foreign transaction fees

- 10 percent savings on United Economy Saver Awards (terms apply)

- IHG One Rewards Platinum Elite status

Cardholders also get the chance to earn 25 Premier-qualifying points (PQP) for every $500 spent (up to 10,000 PQP in a calendar year)

If you fly with United frequently, you may want to consider the United Club℠ Infinite Card*, which offers numerous luxury travel perks for a $525 annual fee. For rewards, you can earn:

- 4X miles on United purchases

- 2X miles on all other travel (including airfare, trains, hotel, car rentals, rideshares and more)

- 2X miles on dining (including eligible delivery services)

- 1X miles on all other purchases

As a welcome offer, you can earn 80,000 bonus miles after spending $5,000 in the first three months after account opening. This premium travel card also comes with:

- United Club airport lounge membership (which is worth up to $650 per year)

- Free first and second checked bags for you and one companion

- Premier Access travel services (including priority check-in, security screening, boarding and baggage handling)

- Up to a $100 credit for TSA PreCheck, Global Entry or NEXUS

- 25 percent back on eligible in-flight purchases

- No foreign transaction fees

- 10 percent savings on United Economy Saver Awards (terms apply)

- IHG One Rewards Platinum Elite status

Cardholders also get the chance to earn 25 Premier-qualifying points (PQP) for every $500 spent (up to 10,000 PQP in a calendar year)

Best for travel perks with a lower annual fee

-

If you want some premium travel perks but don’t want to pay the United Club Infinite Card’s $525 annual fee, you may want to consider the United Quest℠ Card*, which comes with a $250 annual fee. To start with, you can earn 60,000 bonus miles and 500 PQP after you spend $4,000 in the first three months after account opening. For ongoing rewards, you’ll earn:

- 3X miles on United purchases (after earning your annual $125 United purchase credit)

- 2X miles on all other travel (including airfare, trains, hotel, car rentals, rideshares and more)

- 2X miles on dining and select streaming services

- 1X miles on all other purchases

More perks include:

- Two 5,000-mile award flight credits each anniversary year

- Up to $125 in annual United purchase credits

- Free first and second checked bags for you and one companion

- Priority boarding

- Up to a $100 credit for TSA PreCheck, Global Entry or NEXUS

- 25 percent back on eligible in-flight purchases

- No foreign transaction fees

Plus, you’ll get the chance to earn 500 PQP for every $12,000 spent (up to 6,000 PQP in a calendar year).

If you want some premium travel perks but don’t want to pay the United Club Infinite Card’s $525 annual fee, you may want to consider the United Quest℠ Card*, which comes with a $250 annual fee. To start with, you can earn 60,000 bonus miles and 500 PQP after you spend $4,000 in the first three months after account opening. For ongoing rewards, you’ll earn:

- 3X miles on United purchases (after earning your annual $125 United purchase credit)

- 2X miles on all other travel (including airfare, trains, hotel, car rentals, rideshares and more)

- 2X miles on dining and select streaming services

- 1X miles on all other purchases

More perks include:

- Two 5,000-mile award flight credits each anniversary year

- Up to $125 in annual United purchase credits

- Free first and second checked bags for you and one companion

- Priority boarding

- Up to a $100 credit for TSA PreCheck, Global Entry or NEXUS

- 25 percent back on eligible in-flight purchases

- No foreign transaction fees

Plus, you’ll get the chance to earn 500 PQP for every $12,000 spent (up to 6,000 PQP in a calendar year).

Best entry-level United card

-

If you are new to airline credit cards, and prefer flying with United, the United℠ Explorer Card* could be a great choice since it offers numerous benefits in exchange for a $95 annual fee ($0 intro annual fee for the first year). For instance, this card offers:

- 2X miles on dining, directly-booked hotels and United purchases

- 1X miles on all other purchases

New cardmembers can also earn a welcome bonus of 50,000 bonus miles after spending $3,000 within the first three months of account opening. Other notable card perks include:

- Two United Club one-time passes per year

- Your first checked bag free (for you and one companion)

- Priority boarding; up to a $100 credit for TSA PreCheck, Global Entry or NEXUS

- 25 percent back on eligible in-flight purchases

- No foreign transaction fees

They’ll also get the chance to earn 500 PQP for every $12,000 spent (up to 1,000 PQP in a calendar year).

If you are new to airline credit cards, and prefer flying with United, the United℠ Explorer Card* could be a great choice since it offers numerous benefits in exchange for a $95 annual fee ($0 intro annual fee for the first year). For instance, this card offers:

- 2X miles on dining, directly-booked hotels and United purchases

- 1X miles on all other purchases

New cardmembers can also earn a welcome bonus of 50,000 bonus miles after spending $3,000 within the first three months of account opening. Other notable card perks include:

- Two United Club one-time passes per year

- Your first checked bag free (for you and one companion)

- Priority boarding; up to a $100 credit for TSA PreCheck, Global Entry or NEXUS

- 25 percent back on eligible in-flight purchases

- No foreign transaction fees

They’ll also get the chance to earn 500 PQP for every $12,000 spent (up to 1,000 PQP in a calendar year).

The bottom line

The United MileagePlus Dining program offers you the chance to earn United miles without changing your spending habits or applying for a new credit card. Just register your cards, enjoy your favorite restaurants in the program and watch the miles pile up.

*The information about the United℠ Explorer Card, United Quest℠ Card and United Club℠ Infinite Card has been collected independently by Bankrate. The card details have not been reviewed or approved by the card issuer.

Read the full article here