The Dow Jones Industrial Average endured two days last week where it lost more than 400 points, bringing the popular index more than 900 points lower over the 5-day trading week. And the volatility has bled into the current week as an early pop on Monday gave way to another close in the red by end of day.

This should come as no surprise and is yet another reminder that short-term setbacks are always part of the equation for investing in stocks.

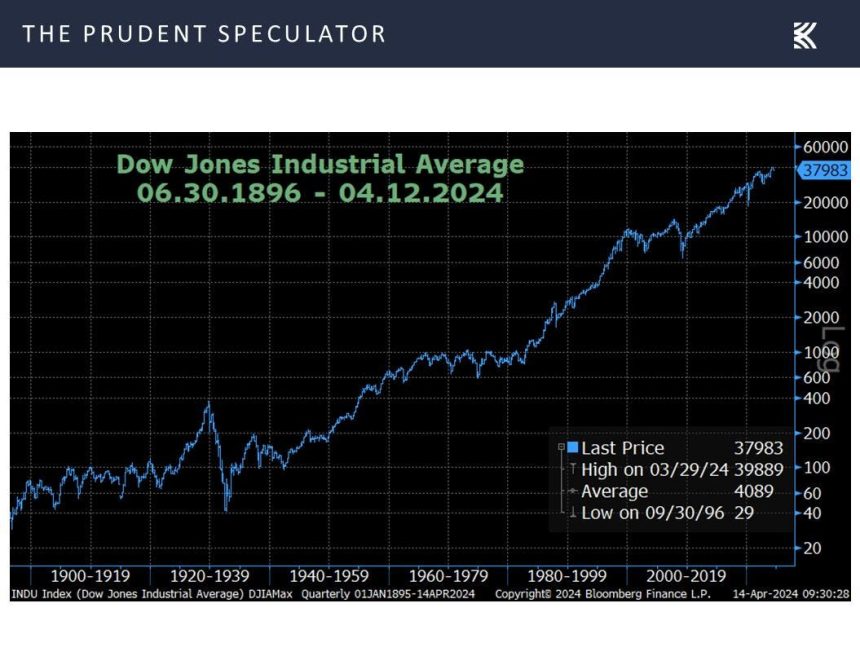

Of course, a simple price chart (which ignores dividends and the impact of their reinvestment) shows that the long-term trend in the Dow has been markedly higher.

Looking at the S&P 500 going all the way back to 1928, there have been 5% or greater drops without a gain of equal magnitude three times a year on average, while corrections of 10% have happened every 11 months on average and 20% Bear Markets have occurred every 3.4 years on average.

To be sure, unrest in the Middle East was not the only issue troubling traders last week as inflation at the consumer level for March came in higher than expected. Indeed, the full Consumer Price Index (CPI) rose 3.5% (est. 3.4%) on a year-over-year basis and the core CPI (excludes volatile food and energy prices) climbed 3.8% (est. 3.7%).

Obviously, many traders have been betting on Fed rate cuts and lower bond yields. So, the knee-jerk reaction has been to sell stocks, despite rewarding historical results for equities over the long run, whether inflation is rising or falling or whether it is high or low.

This particularly has been the case for Value stocks. As demonstrated in the following tables, the style has historically performed admirably both as the CPI is rising (and falling) and after it has risen (or fallen). I also find it very intriguing that Value stocks have done better subsequent to a CPI reading above the 2.7% median inflation rate than below.

STOCK OF THE WEEK – CITIGROUP

Citigroup

C

Restructuring charges aimed at simplifying the organizational structure totaled approximately $1 billion but are expected to yield approximately $1.5 billion in annualized run-rate savings over the medium-term, primarily through a headcount reduction of about 7,000. Additionally, the firm incurred repositioning costs of roughly $260 million, primarily targeting efficiency enhancements across the organization. Looking ahead, management has incorporated a more normalized level of repositioning into guidance, which aims for a downward trend in quarterly expenses to a range of $53.5 billion to $53.8 billion excluding the FDIC special assessment.

CEO Jane Fraser offered, “I said 2024 will be a pivotal year for us, as we put our business and organizational simplification largely behind us and we focus on two main priorities, the transformation and the performance of our businesses and the firm. Last month marked the end to the organizational simplification that we announced in September. The result is a cleaner, simpler management structure that fully aligns to and facilitates our strategy. We are now more client-centric. We’re already seeing faster decision-making and a nimbler organization at work. We have clear lines of accountability starting with my management team, fewer layers, increased spans of control and frankly, much less bureaucracy and needless complexity. This will all help us run the company more efficiently, will enhance our clients’ experience and improve our agility and ability to execute.”

Citi’s balance sheet remains strong as the CET1 ratio ticked up to a preliminary 13.5% and tangible book value per share grew to $86.67 despite the return of $1.5 billion in capital to common shareholders, including $500 million through share buybacks.

Given the near-50% return since Halloween, I like that the market has seemingly started to give Citi credit for progress in simplifying and turning around the banking giant. Citigroup continues to travel down its path of transformation, and while the journey hasn’t been swift, after a few years of focus on operational transformation and divestitures, it seems that leadership is turning its eyes toward expense reductions and controls, a good thing in my mind. Ms. Fraser’s new flatter Citi structure will eliminate management layers which the C-suite believes will speed decision making, driving increased accountability and strengthening the focus on clients.

Despite the rally in recent months, I find significant long-term potential upside, as the shares trade for 9.5 times NTM earnings and for less than 70% of tangible book value, while the yield is a solid 3.6%.

This is a condensed version of a full-length article posted 4.15.2024 on theprudentspeculator.com. The Prudent Speculator’s weekly commentary is curated each week as a valuable resource for recent stock market news, investing tips and economic trends. To receive regular reports like this one along with free stock picks sign up here: Free Stock Picks – The Prudent Speculator.

Read the full article here