Let’s say that you are holding shares in a blue-chip company. The stock has done well in the last few years. But, you need a way to generate more income. You could always sell your shares, but you think the stock will continue to increase in value. So you want to hold onto the shares. How do you make money from the stock without selling your shares?

Here is how to unlock the hidden potential.

Dividends: The Power of Compounded Reinvestment

If the stock you are holding pays dividends, you could simply do nothing. Just sit back and reinvest the payments. This tried-and-true method allows you to reinvest your earnings back into the very stocks that generated it. You get the benefit of your portfolio growing exponentially. This works well.

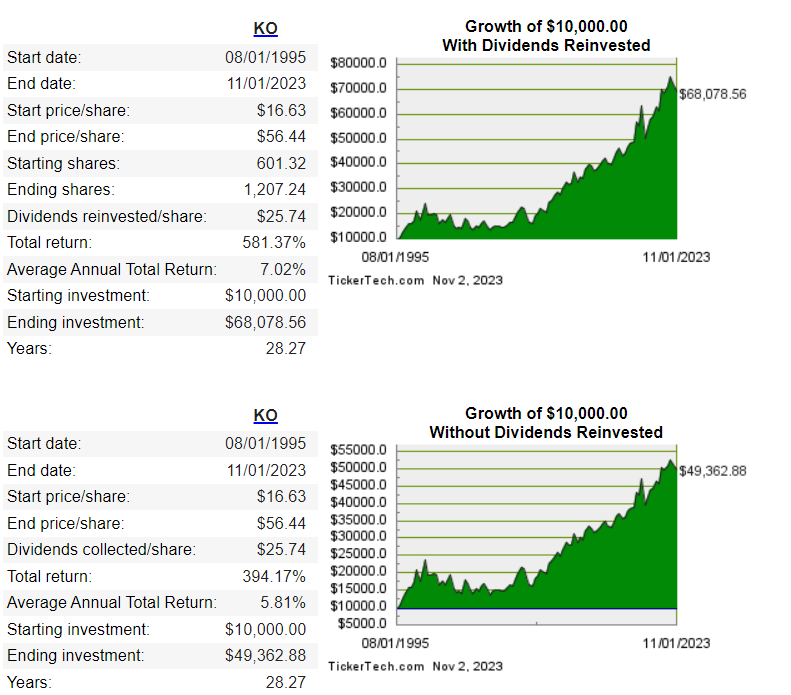

Here are a couple of comparative charts. They show the growth of the Coca-Cola company over the last 28 years. The long and short of it is that if you simply let the stock sit and compound and you reinvested all your dividends, you’d have roughly doubled the number of shares you own and increased the value from 49 thousand to 68 thousand.

Image courtesy of Dripreturnscalculator.com

So, one way to make money from stocks without selling them is just to hold the stocks and collect the dividends, or let them reinvest.

Lending Your Shares via Brokerage Lending Programs: Passive Income on Steroids

Another good strategy that lets your stocks work for you even when you’re not actively trading is lending your shares.

Most of the major brokerage companies, like Schwab or Fidelity, have programs that allow you to lend your shares. The companies need the shares to meet the demand for short selling.

These programs usually have special names. In Schwab’s case, it is called the “Fully paid Program”. In Fidelity’s case, it’s called ‘Full paid lending”.

Here are some quick points about these lending programs:

- There is usually an application process. You have to talk with a real person.

- Most brokerages have net worth requirements. They want to be sure you have to have enough money to know what you’re doing.

- You generally retain economic control of your shares. You can always cancel the program if you’re not happy.

- The brokerage house will generally pay you interest on the loaned shares. Interest will vary based on the security in question. Usually, the interest accrues daily and is paid monthly.

- In general, you’ll still get your dividend payments or cash instead of the dividend

It’s like having a tireless financial assistant that generates revenue round the clock. So, with this option, sit back, relax, and let your stocks do the heavy lifting!

Selling Options: Strategic Maneuvers for Maximum Gains

Third on the list of ways to make money from your stocks without selling them is trading options. This advanced technique allows you to profit from market movements without relinquishing ownership.

When people talk about options, they’re referring to financial instruments that are based on the value of the underlying stock. They are contracts that offer buyers the opportunity to buy or sell the underlying asset at a specific price. Unlike futures contracts, buyers of options contracts don’t have to buy or sell the asset if they decide against it.

Each options contract will have a specific expiration date – the contract holder must exercise their option by this date. The specific price is often called the “strike price”.

Like stocks and bonds, options are usually bought or sold through brokerage companies.

With the right strategy, options let you seize opportunities and boost your earnings potential.

Getting A Loan Against Your Shares – Margin Lending

A fourth option if you want you want to make money from your stocks and still keep them is getting a margin loan.

Basically, a margin loan lets you borrow from your brokerage firm using your stocks as collateral. Investors usually make use of margin loan funds to buy more securities, but you can also withdraw the money or use it for other reasons. When you borrow on margin, you pay interest on the loan for as long as it is outstanding. Margin loans typically have flexible and negotiable terms, but you need to keep a level of assets in the account where you have the loan at a high enough level to cover the banks risk. And, your broker dealer can sell the shares at any time.

Margin lending is regulated by the financial industry, by the exchange and the broker-dealer.

Many IRA accounts are not eligible for loans. Usually terms are better if you have more assets in the account.

Final Thought – What If You Don’t Maximize the Value of Your Shares?

As a final thought – consider doing a thought exercise. Ask yourself this: what happens if you don’t maximize the value of the shares you own? What would happen if you didn’t reinvest your dividends, lend your stock or trade options? What would be the 1-year outcome? The five-year outcome? The ten-year outcome?

The answer to these questions should help you see if any of these options make sense for you.

As always – don’t forget, that nobody will care as much about your money as you do.

Disclaimer: Remember, investing involves risks, and it’s important to do your research or consult a financial advisor before making any decisions. The strategies mentioned above may not be suitable for all investors and can result in significant financial losses. Always proceed with caution and consider your circumstances.

Read More:

- 6 Exceptional Investment Newsletters to Supercharge Your Portfolio

- How to Build Wealth: A Step-By-Step Guide Through Real Estate Investments

- Worried About Investing in Crypto? Here Are Tips and Tricks to Keep Yourself Safe and Have Some Peace of Mind

Come back to what you love! Dollardig.com is the most reliable cash back site on the web. Just sign up, click, shop and get full cash back!

Read the full article here