Marriage can be a wonderful institution—until it isn’t. Perhaps you know what you want and are ready to get out. Or maybe you would like your spouse to change their mind. Maybe you are looking for justice for everything you have endured. Or perhaps you just want to return to some semblance of normalcy.

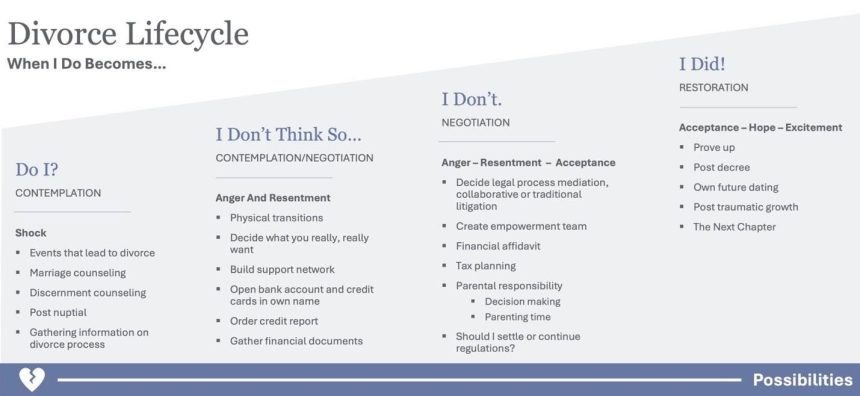

Whether you think you might want a divorce, were surprised by the possibility of it, or even amicably agreed to it, divorce is a challenging process. A great deal of decision-making and time goes into legally ending a marriage. Our Divorce Lifecycle summaries key issues at each stage. Below are crucial steps you can consider to prepare for your divorce while prioritizing your emotional and financial well-being.

Get Ready

Divorce presents many emotional and financial hurdles. The initial stages of the divorce lifecycle come with self-reflection and contemplation. During these stages it can be beneficial to write down the impact (both positive and negative) divorcing will have on your relationship with your spouse, children, community, and yourself. The early stages also include gathering information on the divorce process, and potentially exploring alternative solutions such as marital or discernment counseling. Asking yourself the right questions up front can minimize emotional and financial stress throughout the divorce process.

Gather Financial Information

Once the initial shock of divorce has settled in and “Do I?” has evolved to “I Don’t Think So” it is important to have a grasp on your full financial picture by taking complete inventory of your assets and liabilities. Gather as much information as you can on your investments, retirement accounts, property, checking and savings accounts, and emergency funds. Check your credit report and get statements of any mortgages, credit card debt, personal lines of credit, or auto loans. Make a list of all sources of income in your marriage (compensation, bonuses, stock sales, etc.) as well as a list of memberships and perks. It is also imperative to create a good filing system, both paper and electronic, and gather any tax returns you can. If you don’t have easy access to any or all of this information, don’t worry. If you choose to get divorced your attorney should be able to get it.

It can be immensely helpful to set up a new email for all communication involving the divorce and electronic folders by category. The process can take years and containing all divorce emails in a separate account will help you quickly access past communications and prevent you from being triggered from an unexpected divorce email when you are checking your work or standard personal email accounts.

Understand the Road Ahead

After you have taken inventory of your financial landscape, the next step is building a supportive network of loved ones and professionals to help you navigate the emotional and legal challenges of divorce. The “I Don’t Think So” and “I Don’t” stages can be filled with anger and resentment. It is beneficial to reach out to friends, family, or a therapist for support and guidance and talk to others who have been through divorce to get ideas on building your empowering team of professionals. Online resources such as Divorce.com and SurviveDivorce.com can give you crucial insights and education to help you decide how to legally end your marriage with the least amount of cost, complexity, and collateral damage.

A supportive network will be crucial to help navigate the emotional challenges and provide different perspectives. A well-rounded team usually includes hiring an attorney, financial advisor, and therapist or divorce coach as well as getting your own accountant, estate planning attorney, and insurance professional.

Divorce often comes with a great deal of physical transitions. It is essential to get a handle and come to terms with the physical transitions you and your children will have to make such as new living and childcare arrangements, daily schedules, and responsibilities. Spouses may find themselves having to make more decisions together to get divorced than they did the last few years of their marriage.

You will also want to spend time with yourself to confront the questions that will keep you awake at night (e.g., Can I afford to keep the family home? Will childcare arrangements have to change? Will I have to give up part of my business or go back to work?). These concerns are normal – along with countless others – and experiencing sleepless nights during the process is common. Self-care and surrounding yourself with an effective team of professionals is paramount. An excellent Certified Divorce Financial Analyst (CDFA®) can collaborate with your attorney to show you how potential settlement scenarios will allow you to pay for your needs far into the future and ensure you get the best settlement possible.

Every divorce is unique. This lifecycle is a general summary most divorcing women and men experience. It is essential to tailor these steps to your specific circumstances and know you will reach the “I Did!” stage that is full of acceptance, hope, and excitement. Please reach out to a Corient Wealth Advisor if you or a loved one could benefit from our Pre-Divorce Checklist or additional resources on the divorce lifecycle.

How will you navigate the Divorce Lifecycle to create a next chapter of wealth and wellbeing?

CONTENT DISCLOSURE

This information is for educational purposes and is not intended to provide, and should not be relied upon for, accounting, legal, tax, insurance, or investment advice. This does not constitute an offer to provide any services, nor a solicitation to purchase securities. The contents are not intended to be advice tailored to any particular person or situation. We believe the information provided is accurate and reliable, but do not warrant it as to completeness or accuracy. This information may include opinions or forecasts, including investment strategies and economic and market conditions; however, there is no guarantee that such opinions or forecasts will prove to be correct, and they also may change without notice. We encourage you to speak with a qualified professional regarding your scenario and the then-current applicable laws and rules.

Advisory services are offered through Corient Private Wealth LLC and its affiliates, each being a registered investment adviser (“RIA”) regulated by the U.S. Securities and Exchange Commission (“SEC”). The advisory services are only offered in jurisdictions where the RIA is appropriately registered. The use of the term registered” does not imply any particular level of skill or training and does not imply any approval by the SEC. For a complete discussion of the scope of advisory services offered, fees, and other disclosures, please review the RIA’s Disclosure Brochure (Form ADV Part 2A) and Form CRS, available upon request from the RIA and online at https://adviserinfo.sec.gov/. We also encourage you to review the RIA’s Privacy Policy and Code of Ethics, which are available upon request.

Our clients must, in writing, advise us of personal, financial, or investment objective changes and any restrictions desired on our services so that we may re-evaluate any previous recommendations and adjust our advisory services as needed. For current clients, please advise us immediately if you are not receiving monthly account statements from your custodian. We encourage you to compare your custodial statements to any information we provide to you.

Read the full article here