Americans who are underwater on their car loans owe record amounts, and lenders are repossessing vehicles at a rate not seen since 2009.

Those are symptoms, not the cause. And the most concerning symptom might be rising auto loan delinquency rates. They’re at a 15-year high among borrowers who are 30, 60 or more days late on their payment, according to the latest data from TransUnion and an April MorningStar analysis. Plus, figures elsewhere confirm they’re on the rise for every delinquency category, from one to three months or longer.

As expected, bad credit borrowers see the worst of it: Nearly 6 percent of subprime auto loans are at least 60 days late, the highest figure since Fitch Ratings started its tracking in 1993.

So, what’s causing these unprecedented levels of delinquency, and what could restore order to the auto loan market?

First, the delinquency trends we’re monitoring

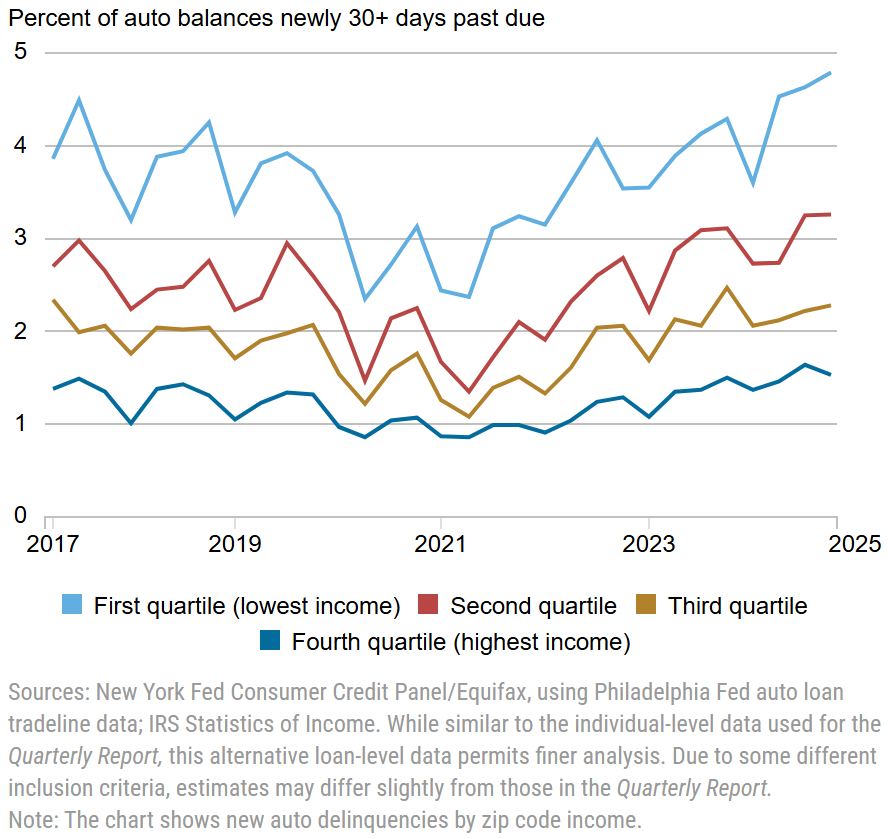

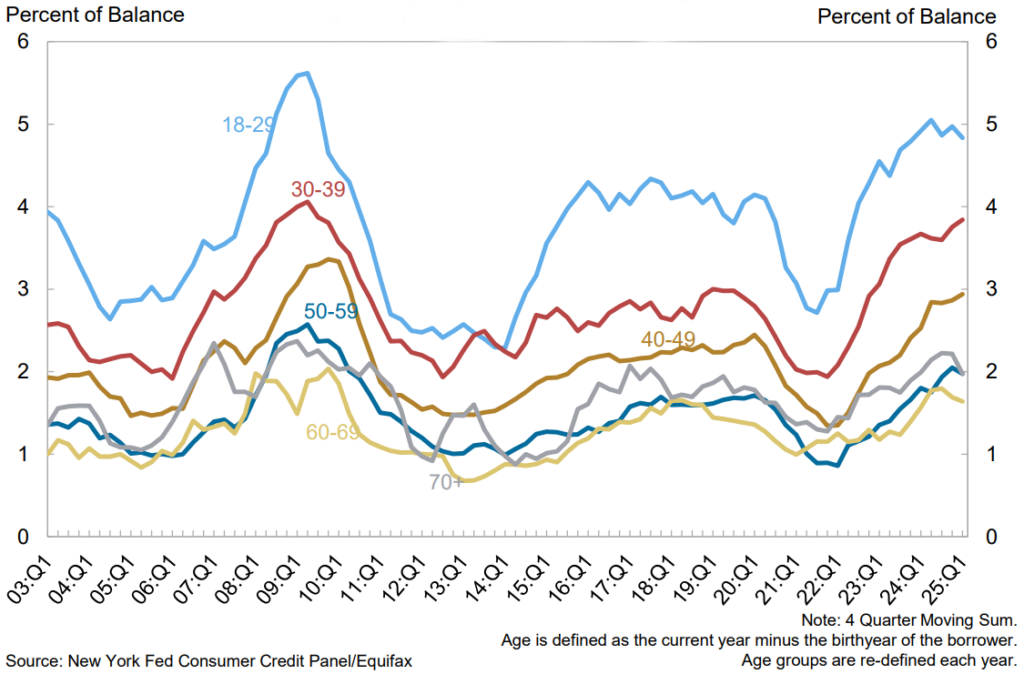

Really, this is one across-the-board trend: Delinquency is growing among borrowers of all credit scores, income levels and ages, and lenders of all types originate these delinquent loans.

1. Credit score and delinquency

Yes, subprime borrowers — generally, consumers with credit scores of 600 or below — are the most likely to fall behind on car loan payments. However, TransUnion data draws concerning trend lines for borrowers with better credit, too.

While mortgage delinquency rates are similar to pre-pandemic levels, auto loan delinquency transition rates remain elevated. High auto loan delinquency rates are broad-based across credit scores and income levels.

— Wilbert van der Klaauw, economic research advisor at the New York Fed.

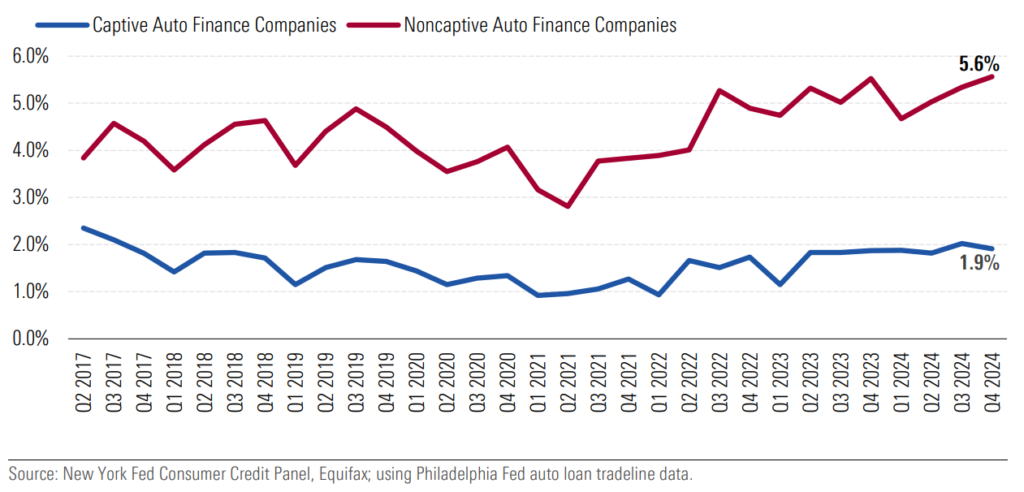

2. Lender types and delinquency

Captive lenders, or automakers’ in-house financing arms, generally attract higher-credit car buyers, sometimes with introductory APR offers. And yet, the delinquency rates on loans from this lender type remain stubbornly high as compared to pre-COVID-19 figures.

Meanwhile, car buyers without good credit remain likelier than their peers to finance a used (or possibly new) vehicle purchase with a non-captive lender. So, it’s unsurprising that delinquencies are rising fastest with this type of lender, and even eclipsing pre-pandemic levels.

3. Income level and delinquency

Just as borrowers with the lowest credit scores are more likely to become delinquent on debt, so too are borrowers with the lowest income levels. But even higher-earning groups are falling behind on their monthly dues at increasing rates.

4. Borrower age and delinquency

If we zero in on serious or late-stage delinquency — being more than three months tardy on a car loan payment — it’s hard to dispute that borrowers of every age group are falling behind at increasing rates.

Although borrowers in their 20s are more than two times likelier than seniors to become delinquent, you can see the trend lines ticking upward across every generation, according to the New York Fed’s quarterly May 2025 report on household debt and credit.

OK, but what’s causing so many car owners to become delinquent?

The experts we interviewed and the research we’re highlighting point to four factors:

1. High vehicle prices

| Average loan amount (Q4 2020) | Average loan amount (Q4 2024) | Why it hurts |

|---|---|---|

|

New cars: $36,246 Used cars: $22,444 |

New: $42,023 Used: $26,135 |

Your dollar doesn’t go as far at the dealership, car lot or for a private-party transaction. |

| Source: TransUnion |

If you go back to 2017… automakers started trimming the cars priced under $25,000 from their lineup, and increasing the number of cars they built with a $60,000 price tag or higher, and they all made the same decision at the same time to essentially say, the way the market was going, ‘we’re aiming at higher-income, better-credit buyers.’ If every [manufacturer] does that, there’s just this huge proportion of the market that’s underserved. And for inexpensive cars, a lot of people were forced into buying something more expensive than they would have wanted because the inexpensive car doesn’t really exist anymore.

— Sean Tucker, lead editor for Kelley Blue Book

2. Rising interest rates

| Average APR (Q4 2020) | Average APR (Q4 2024) | Why it hurts |

|---|---|---|

|

New: 8.5 percent Used: 4.3 percent |

New: 11.8 percent Used: 6.5 percent |

You owe more in interest to your lender, monthly and overall. |

| Source: TransUnion |

The recent rise in delinquencies over the past four quarters, despite relatively healthy labor markets, is an early sign that certain consumers are under stress from higher cost of living and elevated interest rates on floating consumer debt such as credit cards.

— Anthony Tran, assistant vice president of North American Financial Institution Ratings

3. Inflated monthly payments

| Monthly dues | Since the end of 2019, average dues are up 30-plus percent, while inflation is up about 23 percent, according to TransUnion. |

Obviously, if the last time you bought a car was five years ago, your monthly payment was $450, $500, and now it’s $740. So, that has had a spillover effect into increased delinquency.

— Experian head of automotive insights Melinda Zabritski

4. Other inflationary pressures

One way to think about it: The affordability crisis for car buyers is a delinquency crisis for car owners. After all, your vehicle’s cost (see prices, above) is just one line item in your budget. Even after you drive off the lot, inflation can still empty your wallet.

In fact, the latest inflation statistics show that gas prices are about 20 percent higher than they were before the pandemic. In addition, other car maintenance costs include:

| Increased cost vs. 2024 | Increased cost vs. 2020 | |

|---|---|---|

| Insurance | 6.4 percent | 55.3 percent |

| Auto repairs | 7.6 percent | 56.8 percent |

As Cox Automotive chief economist Jonathan Smoke reminds us, your income probably hasn’t kept pace with the inflation of these car-ownership costs.

“Many [borrowers] had taken out loans when vehicle prices, both new and used, were at their absolute peak in 2022 and 2023,” Smoke says. “Then inflation took off, and for the better part of almost two and a half years, inflation w[as] producing a negative income situation, meaning [that] while incomes were going up — at a good clip by historical standards — unfortunately, inflation was even higher.”

What this means for you

As Smoke says, the way out of a continued rise in auto loan delinquency “is to see the consumer’s financial position improving.”

And that very well could happen. If the impending trade war doesn’t come to fruition, if tariffs turn out to be more bluster than substance, and if the labor market remains stable (at least for the employed), your income should outpace diminishing inflation.

But that might not mean much if you’re already on the edge of delinquency.

“When you have a large amount of negative equity, your options, when you run into a financial challenge, are more limited,” Smoke says. “It’s harder for the lender to find a way to work with you on the loan, and you don’t have great alternatives to sell the vehicle and trade down to something smaller if you owe more than the vehicle is worth.”

With that said, consider these tips:

How to avoid an auto loan delinquency

- Stay in contact with your lender. If you feel you may be at risk of missing monthly payments, contact your lender as soon as possible. Most lenders would prefer to avoid repossessing your vehicle, so keep track of financial documents and maintain lines of communication.

- Request loan modification. Modifying your loan to get a lower car payment can help your lender avoid repossession-related expenses. You may be able to defer a few payments or shift your term to better fit your budget. However, not all lenders offer auto loan hardship programs.

- Work to pay off the loan. Catching up on payments may help you avoid repossession. This can be one of the most challenging approaches, but if there’s room in your budget, it can dramatically help.

- Sell the car. If you can’t afford your monthly payment, selling your vehicle is another way to exit your loan. Ensure that you aren’t upside-down on your loan before choosing this route. If you owe more than your vehicle is worth, trading it in is also unlikely to be an option.

- Consider refinancing. Changing your loan to get a better rate or term can lower your monthly payment. But if you have missed many payments or are in default, you won’t likely qualify for refinancing.

- Surrender your car. You can choose to surrender your vehicle — known as voluntary repossession — if you can no longer pay. Unfortunately, it’ll still negatively impact your credit. However, if you’ve maintained open communication with your lender, it might be more willing to write a goodwill letter that can minimize harm to your credit.

Read the full article here