The Biden administration has approved an unprecedented amount of student loan forgiveness for more than four million borrowers, and more relief may be on the way. But there have been many changes and updates to student debt programs and application processes, with some big updates in just the last few weeks. Navigating the already-complex student loan system amid this tumult can present challenges.

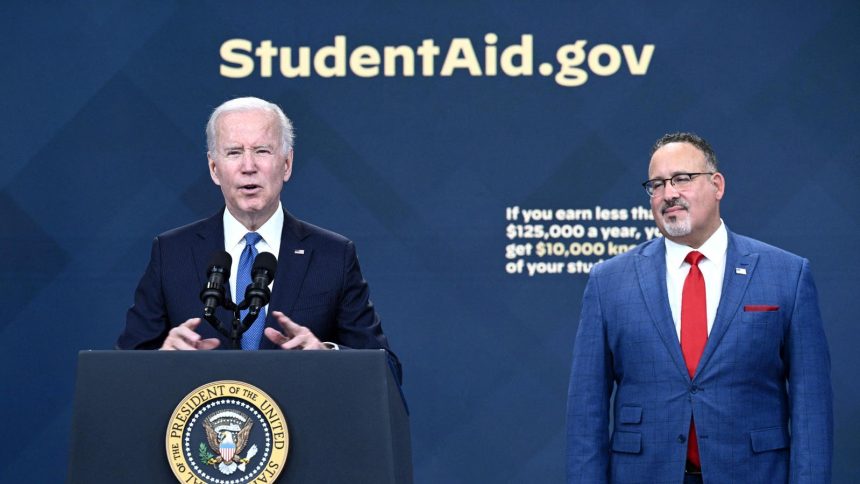

President Biden has taken a two-track approach to enacting broad student debt relief. He has implemented a number of program changes and temporary waivers to several existing loan forgiveness programs. Collectively, these “targeted” initiatives have led to $153 billion in student loan forgiveness. At the same time, the administration has been moving forward with a new student debt relief program that, if implemented, could dramatically expand these approvals. The Education Department released draft regulations for this new program last week. The plan must clear a few more steps before relief would be available, but that could happen this fall.

Here’s what borrowers need to know about applying for current and forthcoming student loan forgiveness initiatives.

Applying For Student Loan Forgiveness Under the Account Adjustment

The Biden administration has approved upwards of $49 billion in loan forgiveness for just under a million borrowers under the IDR Account Adjustment. This temporary initiative can accelerate progress toward loan forgiveness under income-driven plans, a type of federal student loan repayment plan that allows borrowers to make payments based on a formula applied to their income.

IDR enrollees can typically qualify for a discharge after 20 or 25 years in repayment, depending on their specific circumstances. The account adjustment allows past loan periods that may not have counted toward IDR loan forgiveness — such as payments made under other plans, and certain periods of deferment and forbearance — to count.

There is no formal application for student loan forgiveness under the IDR Account Adjustment. The Education Department is implementing the relief automatically for borrowers who have government-held federal student loans. The department has been approving discharges on a rolling basis every two months, and expects to complete implementation this July.

But some borrowers will need to submit some type of application in order to qualify for relief under the adjustment:

- Borrowers who have federal student loans not directly owned or held by the Education Department — such as commercial FFEL loans, school-issued Perkins loans, and HEAL loans for medical professionals — must submit a Direct consolidation application by April 30th in order to receive the benefits of the IDR Account Adjustment. This represents the most recent deadline extension by the department. As of this writing, the department has not extended the deadline again, suggesting April 30th is the final submission cutoff.

- Those who expect to receive IDR credit under the adjustment but will be short of the threshold for immediate loan forgiveness would need to apply to switch to an IDR plan (if they are not already in one) so they can continue progressing toward an eventual discharge.

The Direct consolidation and IDR applications can be accessed online at StudentAid.gov.

Applying For Student Loan Forgiveness Through PSLF

The Public Service Loan Forgiveness program can shorten a borrower’s student loan forgiveness timeline to as little as 10 years if they work in qualifying nonprofit or public employment. The Biden administration has made meaningful changes to the PSLF program through a combination of temporary waivers and more-lasting regulatory reforms, resulting in 876,000 borrowers getting approved for over $60 billion in loan forgiveness, according to the Education Department.

Only Direct loans qualify for PSLF, meaning borrowers who have non-Direct federal student loans would need to apply to consolidate through the Direct loan program. And borrowers seeking PSLF credit under the IDR Account Adjustment would need to do this prior to April 30th.

In addition, to get PSLF credit borrowers must certify their employment using the online PSLF application system. However, the entire PSLF application and processing system is temporarily shutting down starting on May 1st. During that time, borrowers can submit PSLF forms, but they will not be processed and no one will get student loan forgiveness under the program until processing resumes in July. At that time, borrowers will be able to access their PSLF information through a new StudentAid.gov dashboard.

Applying For Student Loan Forgiveness Based On A Borrower’s Medical Condition

Close to 550,000 borrowers have received $14.1 billion in student loan forgiveness due to changes and improvements to the Total and Permanent Disability discharge program, according to the Education Department. The TPD discharge program can wipe out the federal student loan debt for those who are unable to maintain significant employment due to a disabling medical condition, whether physical or psychological.

The Biden administration recently updated the TPD discharge application to reflect new regulations that went into effect last summer. The reforms expand the types of medical providers who can certify that a borrower meets the TPD standard, and broadens the categories of people who can qualify for automatic relief based on receiving Social Security disability benefits.

The TPD discharge program will likely go through an application processing pause similar to PSLF later this year, although the administration has not yet provided a specific timeline.

Applying For Student Loan Forgiveness Through Borrower Defense To Repayment

The Education Department has approved upwards of $22 billion in student loan forgiveness for more than a million borrowers who were subject to certain types of school misconduct. A portion of that relief was approved through the Borrower Defense to Repayment program, with allows borrowers to request a discharge if their school misled them about core elements of their degree or certificate program.

The Borrower Defense program typically requires a long application detailing how the school engaged in misrepresentations. The Biden administration updated regulations governing the program last summer, providing additional avenues for relief and removing some previous restrictions (such as a statute of limitations) that could have blocked some borrowers from receiving any loan forgiveness under the program.

But a legal challenge has resulted in those new regulations being blocked. In a ruling earlier this month, a federal appeals court suggested that these new, more borrower-favorable rules are likely to ultimately get struck down. That puts the Education Department in a bind — officials cannot currently use the new regulations when evaluating Borrower Defense applications because of the court injunction, but they don’t necessarily want to deny people under the older set of rules while the legal process plays out (unless they have to under other court orders).

Consequently, many applications for student loan forgiveness under Borrower Defense are effectively stuck in a limbo status. Borrowers can apply, but they may not get a decision for quite some time.

“The Department will not adjudicate any borrower defense applications under the latest rule unless and until the effective date is reinstated,” says the department. “While this injunction is in effect, borrowers may still apply online for borrower defense relief. The Department will continue to adjudicate borrower defense applications using an earlier version of the regulations where required under a court settlement.”

Applying For Forthcoming Biden Student Loan Forgiveness Plan

Earlier this month, President Biden announced that a new student loan forgiveness plan is coming. The new initiative, billed as a replacement for the one that the Supreme Court struck down last year, is designed to provide relief to several groups of borrowers based on their circumstances.

According to draft regulations, many borrowers could receive loan forgiveness automatically under the new program, without needing to submit an application. This includes those who have experienced significant compounded interest, borrowers who first entered repayment 20 or 25 years ago, and people who would be eligible for loan forgiveness under other programs but haven’t applied or enrolled.

Other borrowers, such as those experiencing financial hardship, will likely need to submit an application for loan forgiveness. However, that application is not yet available. The new program must first undergo several more steps, including completing a public comment period followed by the adoption of the final version of the rules. Officials have indicated that the program, and any associated loan forgiveness application, could launch by this fall, although it will almost certainly face legal challenges.

Read the full article here