In today’s changing climate, a weather event can put someone out of their home temporarily or permanently in the blink of an eye. If it’s that risky now, what about tomorrow? How can homeowners know their risks and protect themselves and the investment in their home for the 15- or 30-year span of a mortgage?

“As the atmosphere warms, more water vapor will enter the atmosphere and lead to more intense events,” said Jay Banners a professor of geosciences at the University of Texas Austin during this session at the 2024 SXSW conference. “The temperature of the ocean is rising and we’re seeing record drought, which has been predicted by climate science. Theory and practice are all coming forward to bear on our situation today.”

Censuswide and Realtor.com surveyed more than 4,000 U.S. respondents this year and found that 90% are concerned with at least one natural disaster, with the most concern around tornadoes, hurricanes, severe winter storms, and floods.

About 70% of homeowners took some type of local climate factor into account when buying their current home. Two-thirds of homeowners say they are concerned about the threat of natural disasters to homeownership, and half say they’ve become more concerned in the last five years about the threat of natural disasters to homeownership.

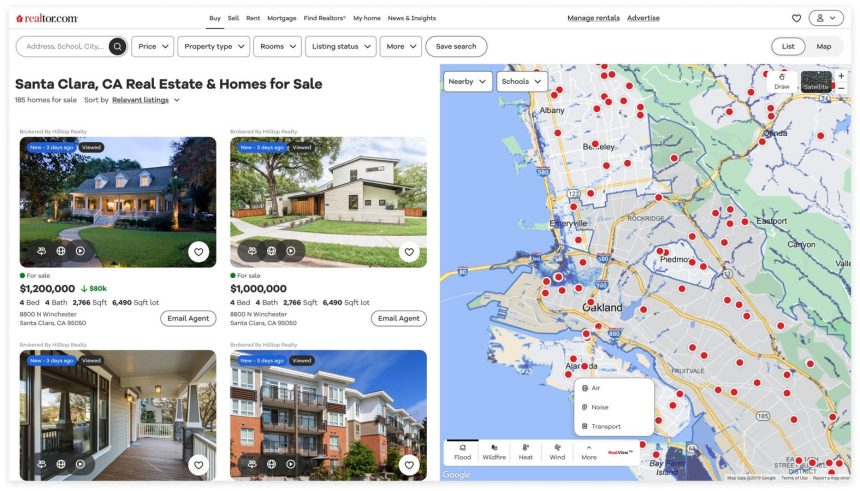

With Realtor.com’s launch of an environmental risk factor score for all listings, every homeowner and buyer can have access to climate risk information including extreme heat, wind, and air quality.

Access to this data allows both stakeholders to fully understand the climate risk associated with a property. Users can toggle between factors to see how a particular risk may affect a property now and in the future, showing current exposure to risks and the expected change for each risk in 15 and in 30 years.

I found a small condo in Fort Lauderdale, FL, on the platform and the new risk factor information reports a moderate flood factor, meaning it has a 23% risk of flooding over 30 years. While the fire risk at this property is minimal, the heat risk is extreme – a 10 out of 10. The Realtor.com environmental risk factor says that over the next 30 years, the property is projected to experience a 260% increase in the number of days with a heat index above 105 degrees.

The air factor also is low, but the wind factor is extreme since it is in a hurricane prone area. The 10 out of 10 wind risk rating for this property means that during the next 30 years, it has a 99% chance of 3-second wind gusts of more than 50 mph.

The data is fed by First Street, a leading climate technology company that connects climate risk to financial risk.

“First Street takes all that information and translates it into what will actually be the climate hazard,” said Matthew Eby the CEO at First Street. “Then we use it to understand the risks today and how they are forecast to change in 30 years. For example, 17,000 structures are burned down on average every year due to wildfires. Over the next 30 years, we expect that annual number to double. Climate change is getting hotter, wildfires will be more likely, and there will be double impacted properties.”

With the heat risk score informed by First Street, Realtor.com visitors can see the average high temperature in the typical hottest month today and 30 years into the future. Today, approximately 32.5% of homes in the U.S. will face severe or extreme risk of heat exposure. About 18% of homes in the U.S. rank as a severe or extreme risk of hurricane wind damage, risking properties valued at nearly $7.7 trillion. The air factor rates air quality and nearly 9% of homes in the U.S. this year are at severe or extreme air quality risk.

Wildfire Risks

From 2020 to 2022, more than 26,000 structures and homes were destroyed by wildfires.

“Fires are happening where they have never happened before,” said Dr. Lori Moore-Merrell, U.S. fire administrator at the U.S. Fire Administration. “Drought, low barometric pressure, and no humidity in the atmosphere mean that we are seeing first ever happening a lot. We cannot control climate change, but what we can control is where we are building.”

One-third of the U.S. population currently lives in fire prone lands, where building is still allowed.

“We are not holding builders responsible to wildlife urban interface code,” Moore-Merrell said. “State jurisdiction may be adopted but not enforced. It comes down to recognition of the issue and then people to make the change.”

Certainly the data being more transparent and available to the public will change that. Plus, there are preventative measures to retrofit a structure, such as roofing materials, screens on vents, windows, not putting a wood fence around the home, not using mulch, not installing a wooden outbuilding structure.

Community design plays a role as well because there is increased risk to low-density residential.

“Clustered residential development is safer, but that’s a choice regulated by zoning by city officials, with input from interested developers,” said Donald Jones, president at Jones & Associates Economics. “Self-protective measures against wildfire damage by one homeowner yield benefits to neighboring homeowners, with the result that individual homeowners under invest in such measures, regardless of the price break offered in insurance policies.”

New, more resilient materials may increase costs, which challenges appraisers in many circumstances and can lead them to under value the risk prevention.

James Greer is vice president at Wildfire Defense Mesh and his product claims to stop a minimum of 98% of dangerous embers that might enter vents, enclosing decks, gutters, window and door screens, weepholes, external inlets and outlets, eaves and soffits, roofs and gulley leaf guards and perimeter fences. The solution is affordable, as a home can be retrofit starting at just $100.

Measuring The Costs

Realtor.com reports that 40% of U.S. homes, valued at nearly $20 trillion, are at severe or extreme risk when it comes to heat, wind, and air quality.

As presented in this SXSW session, CoreLogic analyzes U.S. properties using 22,000 data sources and about 3,700 data points per property. The organization also is doing research with the Federal Reserve Board to assess and understand risk profile to then pinpoint the financial impact of an event.

And, while the data exists and so do the prediction models, it isn’t always beneficial.

“Paralleling the garden-variety climate change denialism is reluctance of state insurance regulators, at the urging of local development authorities to allow insurance companies to use risk data derived from sophisticated climate models,” Jones said. “Partly it’s a matter of financial self-interest to local taxpayers to keep the income from property tax revenue coming in, regardless of any possible disbelief in the models and partly the American tendency to reject the same science that gives us cell phones and TikTok video clips when it tells us that stuff is more expensive than we’d like it to be.”

Jones foresees that homeowner’s insurance will need to separate from individual risk and take on more of the characteristics of catastrophe policies since all the insured experience a climate event at the same time. That approach would help prevent against risk spreading and policies that have been restricted to coastal areas subject to hurricanes.

“High-F tornadoes are coming to places unaccustomed to them, requiring modification of homeowners’ policies in those areas,” he said. “And probably the same can be said about flood policies. Areas subject to future flooding may extend beyond the floodplains identified by data of the previous century.”

In the state of Florida, the insurer of last resort, or the insurance plans designed by the state to fill gaps in private property insurance market, has doubled to charge the amount commensurate with the risk. This provides an example of the cost of homeownership going up while the value of the real estate asset goes down.

As data on new climate threats grows, insurers will have the intelligence to adapt.

“When you can provide a financial measure, the behavior starts to change,” said Rogers. “One house can triple in risk over time. When you are able to see that you can build policy and loaning regulations fit to assess risk and set insurance premiums and incentives. So, the data can help companies provide better premiums.”

However, insurance costs aren’t the only costs that will be increasing.

“Prospective buyers need to factor in cost and maintenance with rising heat for example,” said Danielle Hale, chief economist at Realtor.com. “AC becomes more of a necessity. You are more likely to see maintenance expenses. With HVAC systems, you also create more energy demand and a lot of insurance impacts. The extra costs also depend on the type of risk.”

Not only does the magnitude of the risk evolve over time, so does its geography.

“Everything is bigger in Texas, and climate change is no exception,” Banner said. “By 2070, urbanization in Texas will mean twice as many people. It will be more than 4 months where it is more than 100 degrees Fahrenheit. Demand for water will go up. Drought will be the new climate regime.”

Programs like Project CRESSLE, Community Resilience integrated into an Earth System Science Learning Ecosystem, are looking at the changes in human behavior by working with the National Science Foundation on community-based participatory research.

Protecting The Assets

First Street’s Riskfactor.com also provides information to understand personal property risk and recommendations to improve the property and reduce risk, including links to shop for those solutions on Amazon.com.

“The good news is that for every $1 you invest in resiliency it equates to about $6 when a climate disaster occurs and causes damage on the house,” Rogers said. “The business case makes sense, because we no longer focus on climate change, we focus on a business case.”

He adds that in the last year insurance premiums have gone up an average of 23%, so CoreLogic is working with insurers to put in incentives to lower premiums.

A homeowner browsing the Realtor.com risk factor data also has access to layers and layers of information educating them on the risk and how to prevent or how to protect the property, such as a look at comparable insurance quotes, plus quick and easy tips for home remodeling upgrades to make it more resilient.

The Pacific Northwest National Laboratory has multiple research publications and tools developed on behalf of the U.S. Department of Energy that look at individual disasters alongside specific building characteristics that enhance resilience.

“If you are in a hurricane prone area, it is also usually hot in the summer. Roof overhangs are great to offset thermal gains indoors but bad for hurricanes- since they can cause a roof to blow off during high winds,” said Chrissi Antonopoulos, a senior building scientist at the laboratory emphasizing the importance of putting simple information in everyone’s hands. “We don’t need to be architects and engineers to understand how to create climate resilient housing; what we need is some practical guidance and education that is easy to access.”

The Building America Solution Center Disaster Resistance tool is designed for builders, remodelers, contractors, and homeowners to learn about building, renovating, and restoring homes to be more resistant to natural disasters including hurricanes, high winds, tornadoes, earthquakes, floods, wildfires, and severe winter weather.

I would say we shouldn’t stop there. Those tools need to be shared with product manufacturers, architects, city planners, urban designers, and insurers to understand the design considerations. With more stakeholders creating preventative solutions, we’ll all be rowing in the same direction and create much more change to a broken system.

Read the full article here