With $111 billion in assets and $6 billion in profits, shadowy stablecoin merchant Tether has emerged as crypto’s most profitable company. Now it’s restructuring, moving into bitcoin mining, AI and education.

By Nina Bambysheva, Forbes Staff

While much of the crypto world crashed and burned during the recent market downturn, reeling from the collapse of FTX and other giants, Tether has thrived.

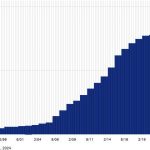

The market capitalization of its stablecoin, USDT, ballooned to $111 billion—triple that of its nearest rival, USDC, issued by Boston-based Circle. Thanks to higher interest rates on U.S. Treasurys, which form the bulk of the reserves backing its digital stablecoins, Tether is in an enviable position because its source of capital is effectively free. Unlike traditional banks, customers who deposit hard currency with Tether in exchange for the tokens earn no interest.

For the first quarter of 2024 alone, Tether reported unaudited company-wide “financial results” of $4.5 billion and a net equity of $11.4 billion. In 2023 it reported a net profit of $6.2 billion, likely making it the most profitable company in crypto today. Coinbase, the largest U.S. crypto exchange, earned $95 million on $3.1 billion in revenue in all of 2023 and for the first quarter of 2024 it had net income of $1.2 billion thanks largely to the rise in crypto prices. Approximately 20% of Coinbase’s 2023 profits were generated from the interest it received on the reserves backing stablecoin USDC thanks to a partnership with Circle.

Flush with capital, Tether is now looking beyond stablecoins for growth. Last month, the company, headquartered in the British Virgin Islands, announced a strategic restructuring, branching into three new divisions beyond stablecoins, bitcoin mining, artificial intelligence, and education.

“There is this concept of removing intermediaries in crypto that can be applied to many other things,” says Tether’s new chief executive Paolo Ardoino, who had served as its chief technology officer and spokesperson since 2017.

Tether’s planned expansion isn’t just a matter of prudent diversification–it’s philosophical. “We feel like 90% of technologies, if not more, are built for the best case scenario but no one is building the tech for the worst case scenario,” says Ardoino, 40. “If there is a catastrophe, I’m not saying that there has to be a huge war, but anything can happen, and we are not prepared for that.”

Crypto historians will recall that bitcoin was created by Satoshi Nakamoto in response to the 2008 financial crisis, a time when there was widespread doubt over the stability and trustworthiness of existing global financial systems. Ardoino believes Tether will play a big role in creating what he describes as sovereign technologies that can empower people.

Says Ardoino “It’s good to have resilient money, but if you only have resilient money and everything else is centralized, it can be destroyed quickly. One of our mottos is ‘build for the apocalypse’.”

Paolo Ardoino was raised in northern Italy on a family farm. He began coding at the age of eight and went on to study computer science and math at the University of Genoa. Upon his graduation in 2008, Ardoino became a researcher for a military project with the electronics and information technology company Selex Communications, where he focused on high-availability resilient networks and cryptography.

Looking for opportunities outside of Italy, he moved to London around 2013 and soon after founded Fincluster, a startup that built cloud-based financial applications for advisors, fund managers and institutions throughout London, Milan, and Lugano. In October 2014, one of his customers introduced him to Giancarlo Devasini, the CFO of Tether and its sister crypto exchange Bitfinex. Devansini asked Ardoino to help scale Bitfinex’s platform, which was already gaining popularity.

Ardoino was soon tasked with leading technology at both companies and since Devasini and CEO Jean-Louis van der Velde shunned the spotlight, Ardoino became Tether’s public face. All three, as well as general counsel Stuart Hoegner, would go on to become billionaires, according to Forbes’ billionaires ranking.

In December, Ardoino officially took the reins at Tether while retaining his CTO duties at Bitfinex. He also leads strategy at Holepunch, a technology platform that allows developers to create apps with no servers, launched by Tether, Bitfinex and infrastructure platform Hypercore.

Tether’s ownership structure hasn’t changed according to Ardoino. CFO Devasini is still the company’s largest shareholder and former CEO van der Velde is still involved as an advisor. That hasn’t stopped Ardoino from charting Tether’s new course. Last month, the company announced its restructuring into four divisions to reflect its broadening focus:

- Finance, which manages USDT and oversees the upcoming digital asset tokenization platform;

- Data, responsible for strategic investments in emerging technologies, including AI and peer-to-peer platforms;

- Power, focused on bitcoin mining and energy-related ventures;

- Edu, to support education and leadership initiatives.

Tether has already made significant strides in each arena. In the last year, the stablecoin giant participated in a $1 billion investment in a bitcoin mining operation in El Salvador, dubbed “Volcano Energy”, even though the operations would be powered by solar and wind energy. It also established its own bitcoin mine in Uruguay. Last September Tether revealed that it spent $420 million on 10,000 Nvidia’s H100 graphics processing unit (GPUs), which are typically used by artificial intelligence companies looking to crunch huge amounts of data, on behalf of German-listed bitcoin miner Northern Data. In exchange for the advanced chips, Tether received a 20% stake in the company, which intends to rent the chips to AI startups. Another novel investment by Tether came in April, when it spent $200 million for a majority stake in Blackrock Neurotech, a Salt Lake City biotech that creates brain implants designed to allow people with neurological disorders or paralysis, the ability to “eat, drink, operate robotic arms and send emails just by thinking.”

The company has also doubled its lean headcount in the past year to about 100 employees, according to Ardoino, who interviews each candidate personally. “I don’t want yes men,” says Ardoino. “I want people to tell me what they think about Tether, what we are doing right and wrong.”

In terms of bitcoin mining, Ardoino’s goal is a 5% market share, which would rank it among the top miners globally. “If you think of bitcoin as the ultimate form of money, you know, built for the apocalypse, you don’t want the majority of bitcoin mining being concentrated in one country. So the way to do it is to invest in different regions,” he explains. “We started from South America and we plan to expand in different areas globally to make sure that bitcoin mining can continue to be decentralized.”

“In terms of competing in bitcoin mining, it’s really about the investment that you can make. They’ve allocated about $500 million. You can get pretty far with that,” says Kevin Dede, an analyst at H.C. Wainwright. Adam Sullivan, CEO of publicly traded miner Core Scientific, adds, “They’re the biggest investor in bitcoin mining right now. It is a natural fit for them because that’s really what drives their business.” Sullivan is referring to the fact that bitcoin’s recent surge in price has boosted Tether’s profits given its large holdings of the digital asset. Mining bitcoin should amplify profits if bitcoin prices continue to rise.

But while Tether has made strides in bitcoin mining, its move into AI will be more challenging. Besides deals like Northern Data, Tether seeks to establish in-house expertise in building large-scale models and integrating AI features into its existing products. Job postings on its website list positions such as AI engineer and head of AI research and development. “I think AI can be of much more use and a bit less subject to the political biases of a small elite that at this moment is running the biggest AI projects in the world,” says Ardoino referring to the small group of firms including Microsoft, OpenAI and Google now driving most of AI development. “We believe AI should be disintermediated from middlemen, just as money should be.”

Rob Toews, partner at Radical Ventures, is doubtful about Tether’s so-called move into AI. “Getting hands on GPUs and renting them out to AI companies is a strategy that is easier to get into, but it’s really hard for me to imagine Tether becoming a credible competitor in the world of building multimodal AI models.”

Through its education arm, Tether will offer courses and masterclass programs encompassing blockchain tech as well as artificial intelligence, coding and design. It has already launched initiatives with the Academy of Digital Industry in Georgia and Bitkub, Thailand’s largest local exchange. “Education stands as the cornerstone of this journey, serving as a linchpin for fostering economic prosperity and sustainable development,” says Ardoino.

Given crypto’s troubled history and the fact that Tether has yet to produce financial statements that have been audited by certified public accountants, it’s reasonable to be concerned about the source of the capital for the company’s new investments. According to the company’s financial attestations, much of its $4.52 billion profit in the first quarter stemmed from gains in the firm’s bitcoin and gold positions. Ardoino insists Tether’s investments come from its profits, not its customer reserves.

“If people think they’re starting to tap into their reserves to invest in that stuff, Tether could go down fairly quickly,” says Austin Campbell, an adjunct professor at Columbia Business School and a consultant for blockchain firms. “I’ve always said the problem with Tether is not what they hold now. It’s what they might hold in the future because they’re not restricted.”

Campbell also warns that Tether’s stablecoin dominance is far from guaranteed long term: “As stablecoin regimes come out, as regulation gets formalized, as these structures are put into place, Tether is going to have to start either complying with them locally or leave those jurisdictions.”

Tether’s dominance is already being challenged. Even though USDT is still a leader in the stablecoin market with a 69% share, according to data from DefiLlama, it lags in transactional volume. Circle’s USDC saw 178.6 million transactions in April 2024, overtaking USDT’s 173.9 million monthly transactions, according to analytics by payments giant Visa and enterprise blockchain data platform Allium Labs.

Additionally, a new version of the bipartisan stablecoin bill, introduced by U.S. Senators Cynthia Lummis (R-Wyo.) and Kirsten Gillibrand (D-N.Y.) in April, which would limit institutions without a banking license to a maximum stablecoin issuance of $10 billion, could spur competition from traditional banks, according to a recent report by S&P Global Ratings.

Says Ardoino, “We believe that all these investments are critical for Tether…things that we believe can be life-changing for the emerging markets, developing countries. We want to be a leader in the evolution of humanity.”

MORE FROM FORBES

Read the full article here