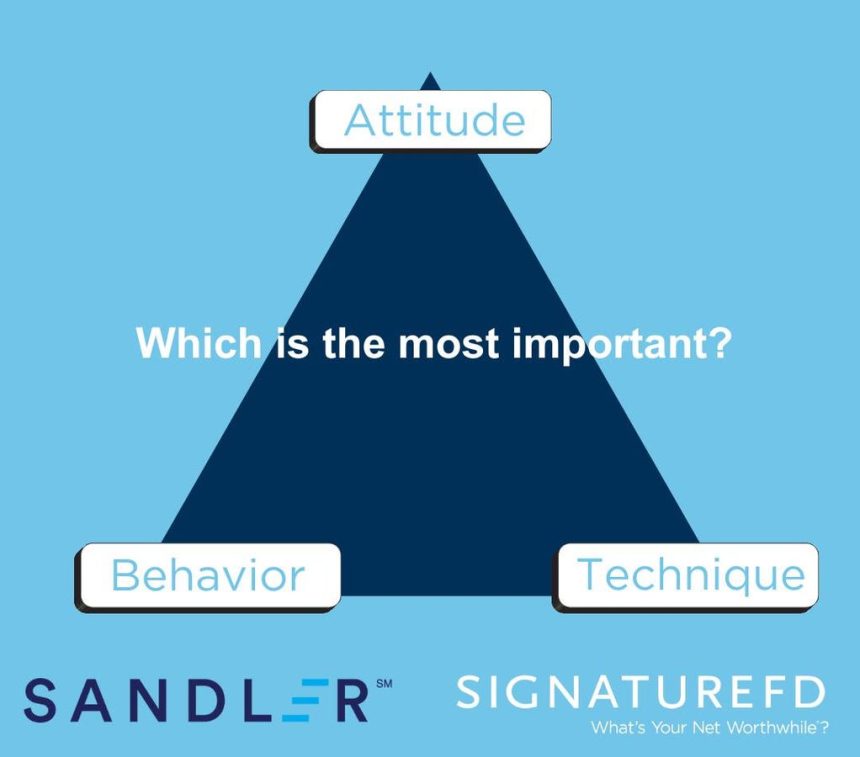

Behavior, attitude, technique. If you think about these three components in any pursuit, which is the most important?

For example, let’s say you resolve to get more physically active. What is the order of priority when considering your behavior, your attitude, and your technique?

Most of us respond initially with attitude. I mean, surely having the right disposition, inspiration, and motivation must be the starting point, right?

Or spend 30 seconds on social media, and you’ll be flooded with hundreds of self-styled fitness gurus who insist that it is their top three, five, seven, or ten specific exercises and techniques that will help you accomplish your health goals, whatever they may be.

Yet, all the right attitude and technique in the world won’t get you one step closer to your physical fitness goals if you don’t get your butt off the couch and do something. So, while we love to suggest “there are no wrong answers,” the only right answer here is that there is no path to success in any endeavor without action—behavior.

This is no less true in our financial pursuits, and the irony here is that most of the commentary in the realm of personal finance and wealth management is related to the attitude (or philosophy) and, especially, technique.

Think for a moment about investing. The overwhelming majority of content and commentary you read or hear on the topic is about philosophy and technique: active vs. passive, individual stocks vs. funds vs. ETFs, traditional vs. alternative, strategic vs. tactical, puts vs. shorts, and more get-rich-quick trading techniques than one could ever apply.

How about retirement? Dollar-cost-averaging vs. time-in-the-market on the accumulation side—and 3% vs. 4% vs. 5% withdrawal rates on the distribution side. 401(k) vs. IRA vs. Roth vs. annuities vs. over-funded life insurance. Sustainable withdrawal rates vs. “die with zero.”

Don’t even get me started on life insurance. Term vs. whole vs. variable vs. universal vs. private placement.

Precisely where and how you invest for education is a hotly debated topic. Whether or not a revocable living trust is an appropriate estate planning vehicle all or any of the time will draw passionate supporters on both sides—and introduce several other alternative techniques.

But…

- Do you have a will that has been updated in the past five years?

- Are you saving for education if you have minor children?

- Do you have enough catastrophic life insurance?

- Have you paid off all revolving credit card debt?

- Are you maxing out the match in your company’s retirement plan?

- Are you saving at least 10% of your income for retirement?

These behaviors help lead to financial success, and if the answer to ANY of the above is “no,” then you need not worry yourself—YET—with the attitudes, philosophies, and techniques.

Yes, our behavior, our action, is the catalyst for all the rest. Consistent actions—habits—shape and refine our attitudes, opinions, and philosophies. And without action, the world’s best technique is just a tool in the shed gathering rust.

But the BAT Success Triangle does have more to teach us than where to start. Once all three of these components are activated, we are well-served to find areas for improvement and refinement by analyzing where our strengths and weaknesses are.

For example, if we return to the illustration of physical fitness, I recently chose to submit myself to the wisdom buried within the largely platitudinal, often cringy, guidance of the best-selling self-help parable, The 5am Club. Although it’s a painstaking effort to get to it, the book really does offer an attitudinal disposition and an explicit technique for reshaping your morning (and nighttime) routine to give one a veritable unfair advantage by accomplishing your biggest priorities of the day before most people even get up.

But unless I go to bed earlier, set that alarm for an ungodly hour, get up without snoozing, groggily put my workout clothes on, and hit the weights, bike, or yoga mat while it’s still dark outside, I’m not part of the 5am club (or 5:30am club, as it were). To be clear, the first 14 or more days in a row were abject misery. My attitude was horrible (“Why the heck am I doing this? I didn’t even like the stupid book!”). My workouts weren’t nearly as productive as when I used my evening workout routine.

But after a couple of straight weeks of doing it, I realized, “Wow, I’m now officially an early riser.” For the first time in my life. I’ve been telling people for decades that “I’m not a morning person,” but now I’ve reset my circadian rhythms and I’m starting to own it. Similarly, I’ve examined my technique and improved it, making it even easier to get up (like simply setting my workout clothes right next to the bed, finding a few new audiobooks that give me even more motivation to start my workout, and consciously deliberating on how great it feels to have my workout complete as the sun rises).

Now, if I find the habit fading or failing, I can examine which of the three are suffering—my behavior, attitude, or technique—and find the help and solution I need to get back on track.

Similarly, once you’ve checked the behavior box for each of the basics of financial planning, you can focus on optimizing your attitude or technique—creating a virtuous cycle that vastly improves your chances of achieving financial success, however you define it.

Read the full article here